Answered step by step

Verified Expert Solution

Question

1 Approved Answer

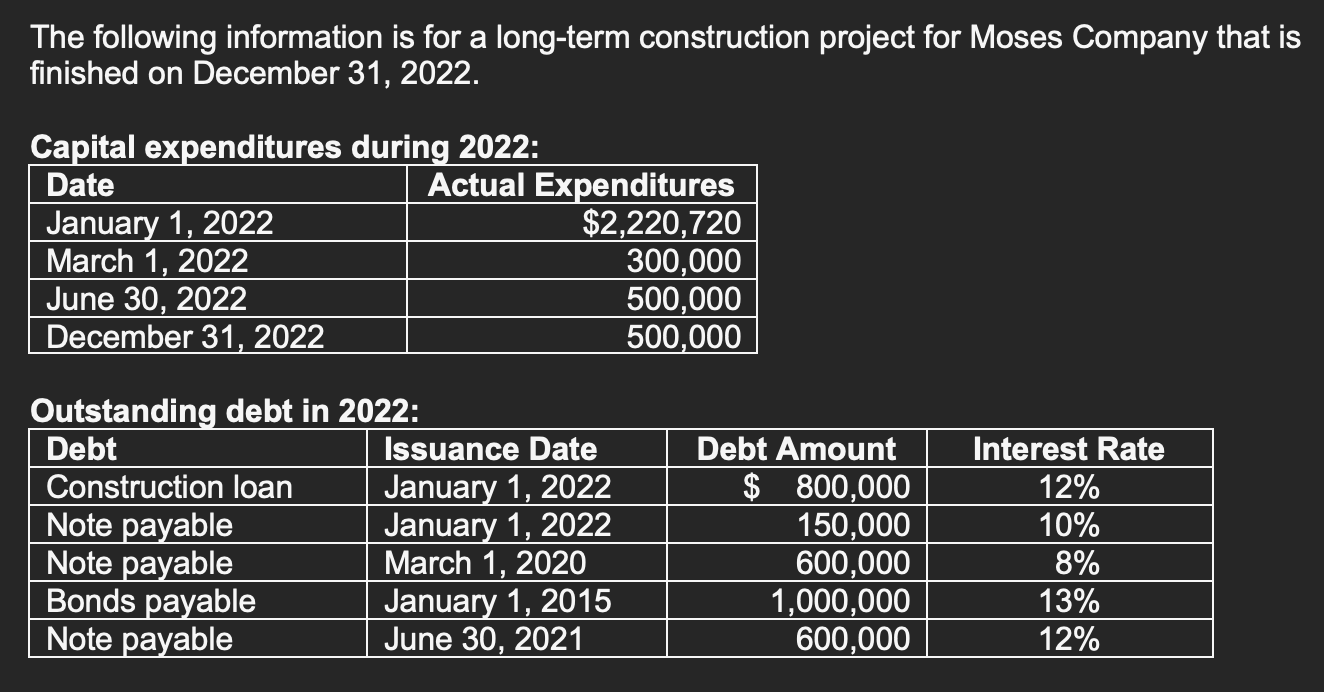

The following information is for a long-term construction project for Moses Company that is finished on December 31, 2022. Capital expenditures during 2022: Date

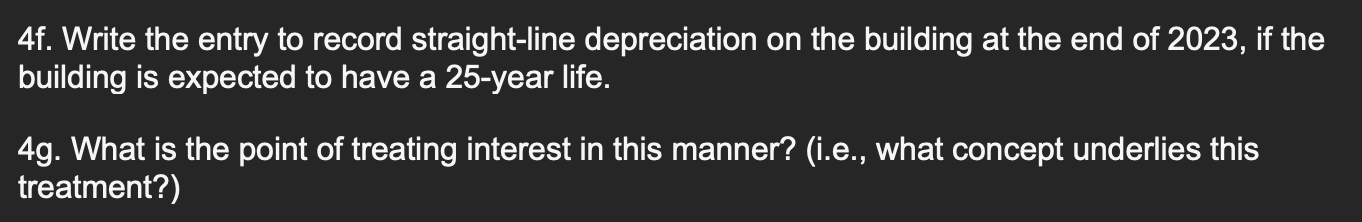

The following information is for a long-term construction project for Moses Company that is finished on December 31, 2022. Capital expenditures during 2022: Date January 1, 2022 March 1, 2022 June 30, 2022 December 31, 2022 Outstanding debt in 2022: Actual Expenditures $2,220,720 300,000 500,000 500,000 Debt Issuance Date Debt Amount Interest Rate Construction loan January 1, 2022 $ 800,000 12% Note payable January 1, 2022 150,000 10% Note payable Bonds payable Note payable March 1, 2020 January 1, 2015 June 30, 2021 600,000 8% 1,000,000 13% 600,000 12% 4f. Write the entry to record straight-line depreciation on the building at the end of 2023, if the building is expected to have a 25-year life. 4g. What is the point of treating interest in this manner? (i.e., what concept underlies this treatment?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started