Answered step by step

Verified Expert Solution

Question

1 Approved Answer

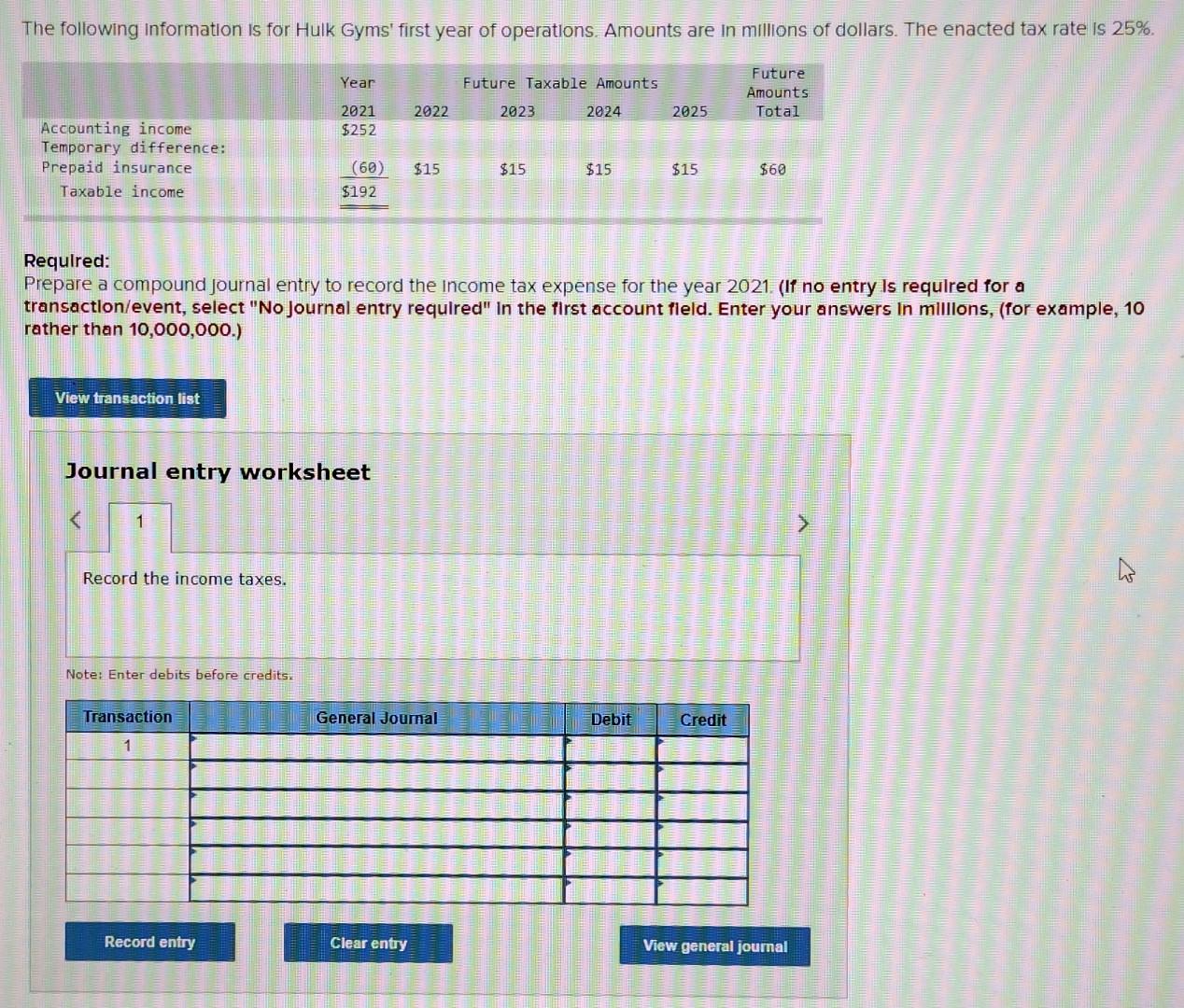

The following information is for Hulk Gyms' first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Year Future

The following information is for Hulk Gyms' first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Year Future Taxable Amounts Future Amounts Total 2022 2023 2024 2025 2021 $252 Accounting income Temporary difference: Prepaid insurance Taxable income $15 $15 $15 $15 $60 (60) $192 Requlred: Prepare a compound Journal entry to record the income tax expense for the year 2021. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your answers in millions, (for example, 10 rather than 10,000,000.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started