Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is for the next 4 questions. You are evaluating the performance of an actively managed mutual fund run by Trident Funds. The

The following information is for the next questions.

You are evaluating the performance of an actively managed mutual fund run by Trident Funds. The fund has a market beta of and has earned an average annual return of over the last years. The market risk premium is and the riskfree rate is

Question

pts

If CAPM is the correct asset pricing model, calculate the abnormal returns earned by the Trident fund.

Question

pts

Now consider an alternative asset pricing model the FamaFrench Factor model that allows for multiple factors: the market risk factor, a size factor, and a booktomarket factor. In addition to the market premium above, the size premium is and the booktomarket premium is Using this new model, you estimate the following betas for the Trident fund:

Using the FamaFrench factor model, what is the expected return for the Trident fund?

Question

pts

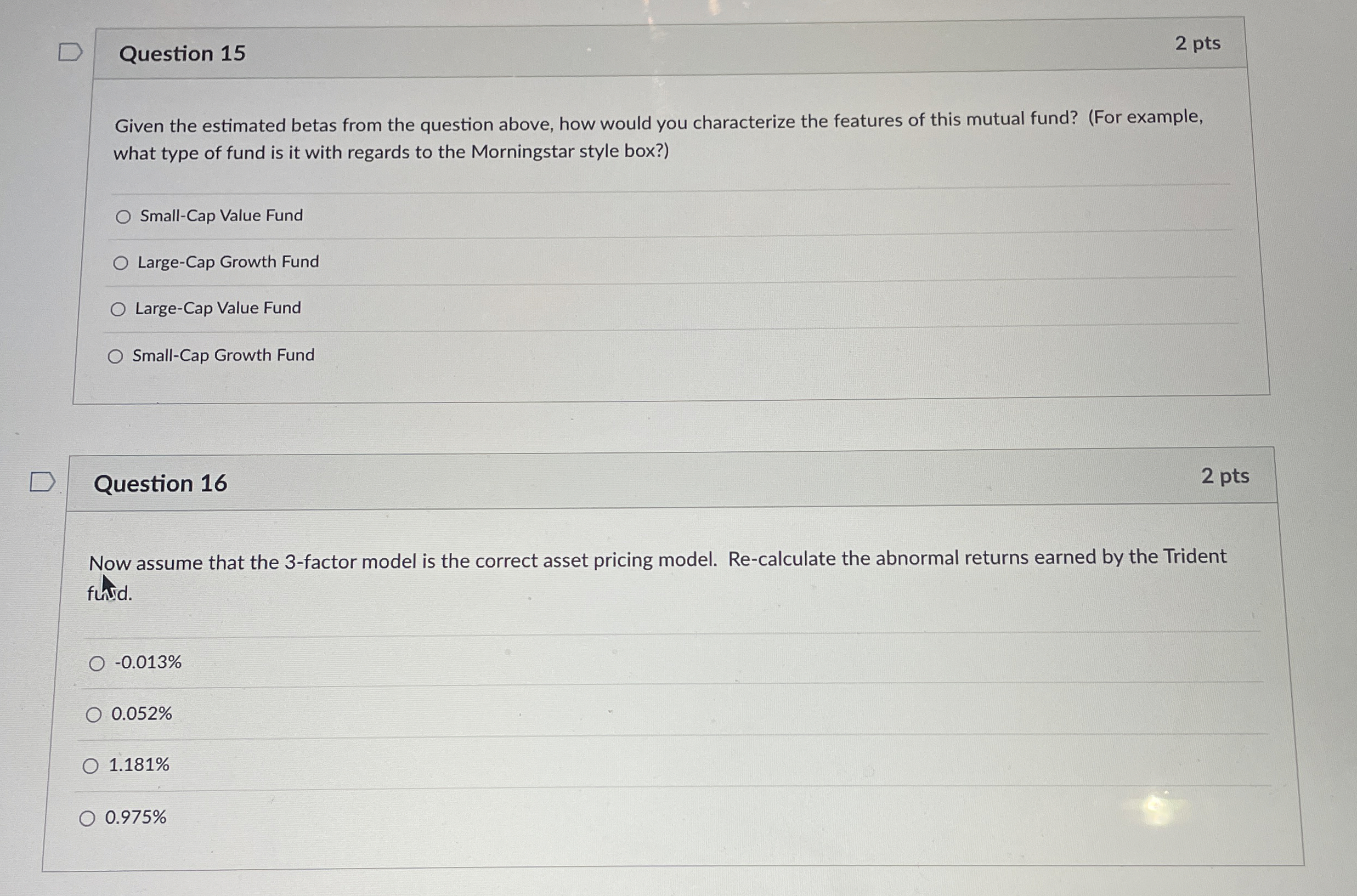

Given the estimated betas from the question above, how would you characterize the features of this mutual fund? For example, what type of fund is it with regards to the Morningstar style box?

SmallCap Value Fund

LargeCap Growth Fund

LargeCap Value Fund

SmallCap Growth Fund

Question

pts

Now assume that the factor model is the correct asset pricing model. Recalculate the abnormal returns earned by the Trident fund.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started