Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is gathered by JD s accountant in preparation of its three months master budget for March, April, and May. Actual total Sales

The following information is gathered by JDs accountant in preparation of its three months master budget for March, April, and May.

Actual total Sales in January and February are as follows:

January February

Cash Sales: $ $

Credit Sales: $ $

Total Sales: $ $

Total sales are predicted to increase by each month in March, April, and May. The increase percentage applies to both cash and credit sales.

According to the past collection history, they collect credit sales in the following pattern:

Month of Sales

Month following Sales

Two months following Sales

Inventory policy and inventory purchase payments are as follows:

Cost of Goods Sold:

Desired Ending Inventory:

All purchases of inventory are on credit and the payment of these credit purchases are made in the following pattern:

Month of purchases:

Month following purchase:

Balance Sheet:

Assets:

Current Assets:

Cash

Accounts Receivable:

Inventory:

Prepaid Insurance

Property Plant & Equipment:

Land

Equipment

Accumulated depreciation

TOTAL ASSETS:

Liabilities and Owners Equity:

Accounts Payable

Commissions Payable

Bank Line of Credit

Common Stock

Retained Earnings

TOTAL LIABILITIES AND OWNERS' EQUITY:

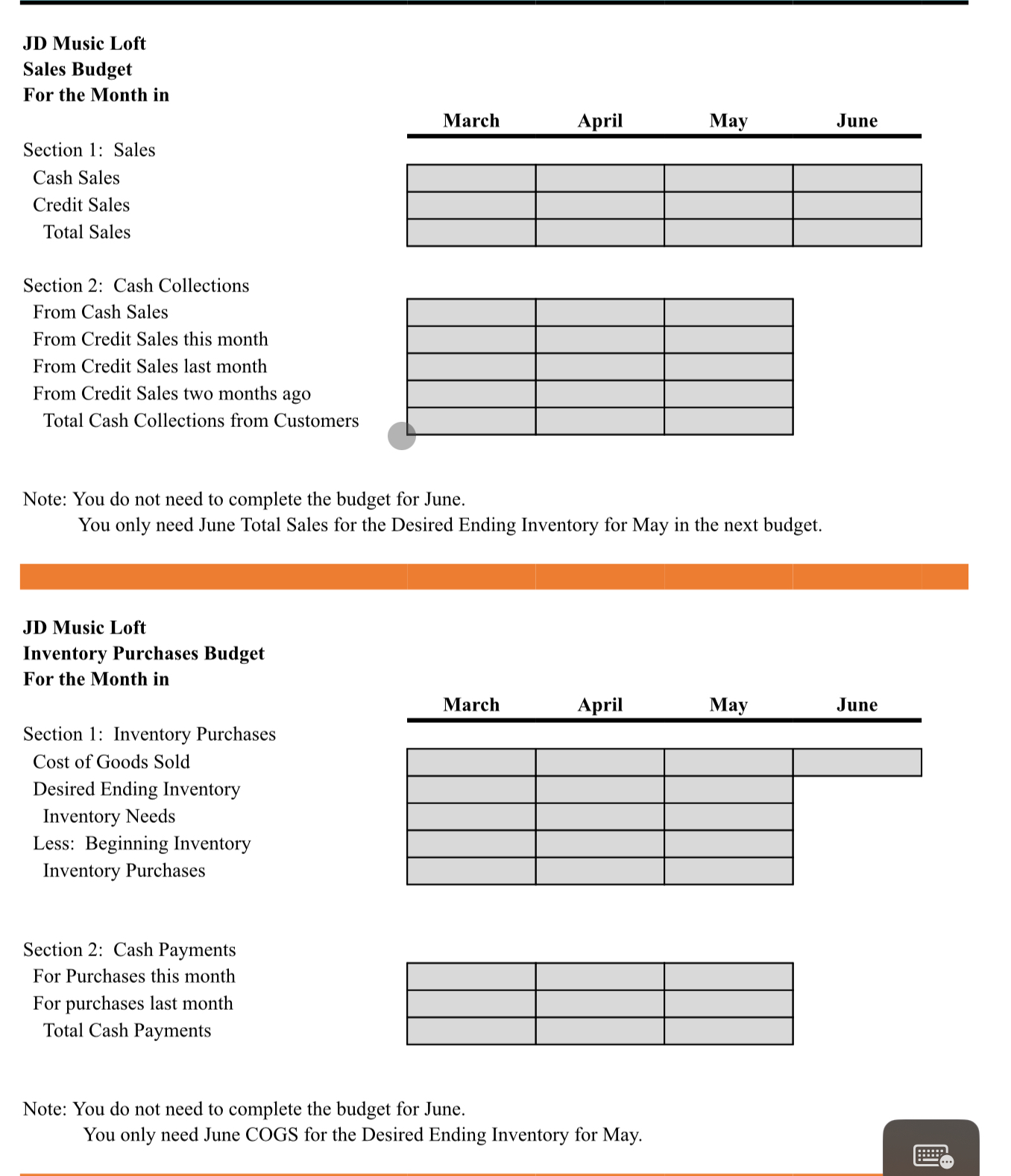

PREPARE A SALES BUDGET

PREPARE AN INVENTORY PURCHASES BUDGET

Sales Budget

For the Month in

Section : Sales

Cash Sales

Credit Sales

Total Sales

Section : Cash Collections

From Cash Sales

From Credit Sales this month

From Credit Sales last month

From Credit Sales two months ago

Total Cash Collections from Customers

Note: You do not need to complete the budget for June.

You only need June Total Sales for the Desired Ending Inventory for May in the next budget.

JD Music Loft

Inventory Purchases Budget

For the Month in

Section : Inventory Purchases

Cost of Goods Sold

Desired Ending Inventory

Inventory Needs

Less: Beginning Inventory

Inventory Purchases

Section : Cash Payments

For Purchases this month

For purchases last month

Total Cash Payments

Note: You do not need to complete the budget for June.

You only need June COGS for the Desired Ending Inventory for May.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started