Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is given about an Option on a stock: S(0)=$31, X=$34, rf=9%, variance (sigma squared)=20%, T=182.5 days, Dividend $1.75 in 45 days (5)

The following information is given about an Option on a stock: S(0)=$31, X=$34, rf=9%, variance (sigma squared)=20%, T=182.5 days, Dividend $1.75 in 45 days

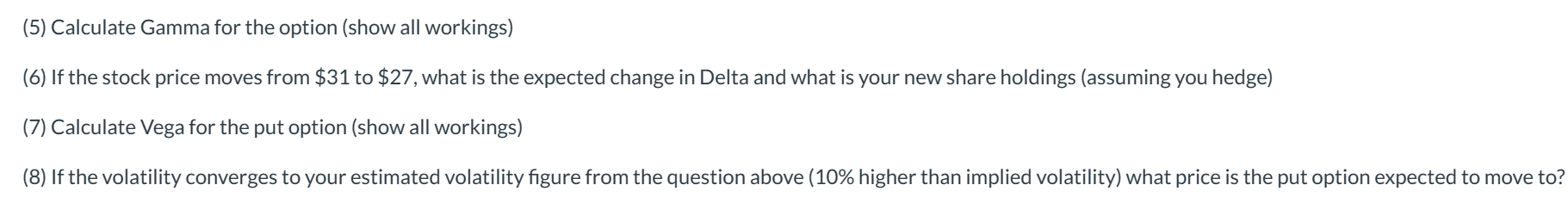

(5) Calculate Gamma for the option (show all workings) (6) If the stock price moves from $31 to $27, what is the expected change in Delta and what is your new share holdings (assuming you hedge) (7) Calculate Vega for the put option (show all workings) (8) If the volatility converges to your estimated volatility figure from the question above (10\% higher than implied volatility) what price is the put option expected to move to

(5) Calculate Gamma for the option (show all workings) (6) If the stock price moves from $31 to $27, what is the expected change in Delta and what is your new share holdings (assuming you hedge) (7) Calculate Vega for the put option (show all workings) (8) If the volatility converges to your estimated volatility figure from the question above (10\% higher than implied volatility) what price is the put option expected to move to Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started