Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is provided for two companies. Company A prefers Floating rate debt whereas company B prefers fixed rate debt. Company A Company B

- The following information is provided for two companies. Company A prefers Floating rate debt whereas company B prefers fixed rate debt.

Company A | Company B | |||

Prefers to borrow | Floating | Fixed | ||

Fixed-rate cost of borrowing | 7.250% | 10.750% | ||

Floating-rate cost of borrowing: | Libor + 0.5% | Libor + 1.5% |

- Assuming that a swap makes sense for both counterparties, what is the total potential gain from swapping i.e. what is the quality spread differential (QSD)? (1 mark)

- Company A and Company B agree to share the cost savings equally. Design a swap to satisfy both counterparties. Assume that there is no swap bank. You can use a diagram if you wish to answer this question. (3 marks)

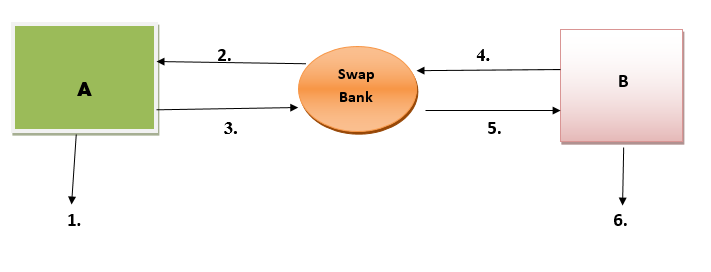

- The following information is provided for two companies (A and B) who decide to undertake an interest rate swap. The two companies decide to use a Swap bank and all parties agree to share equally in the QSD. Finally, company A prefers fixed rate borrowing whereas company B prefers floating rate borrowing.For the diagram given below, fill in the relevant information for (1) through to (6) i.e. what is the debt (floating or fixed) and the amount which should be listed next to each category (1) through to (6). (3 marks)

Firm A Firm B

Fixed Rate cost of borrowing 10% 11%

Floating Rate cost of borrowing Libor Libor +2%

A 1. 2. 3. Swap Bank 4. 5. B 6.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Com x 8 Com Y Difference Total swap gam Com X Check ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started