Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is relevant for Mr T. Toof tax calculation for the year ended 28 February 2022: i. he received interest on his

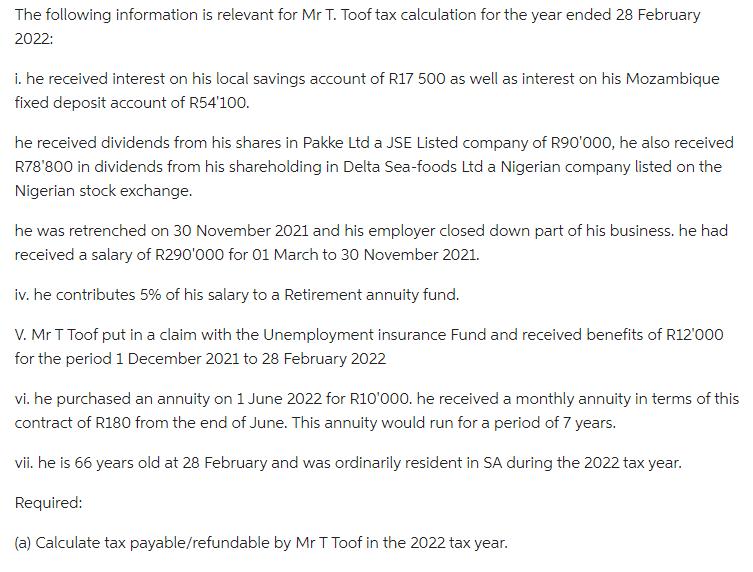

The following information is relevant for Mr T. Toof tax calculation for the year ended 28 February 2022: i. he received interest on his local savings account of R17 500 as well as interest on his Mozambique fixed deposit account of R54'100. he received dividends from his shares in Pakke Ltd a JSE Listed company of R90'000, he also received R78'800 in dividends from his shareholding in Delta Sea-foods Ltd a Nigerian company listed on the Nigerian stock exchange. he was retrenched on 30 November 2021 and his employer closed down part of his business. he had received a salary of R290'000 for 01 March to 30 November 2021. iv. he contributes 5% of his salary to a Retirement annuity fund. V. Mr T Toof put in a claim with the Unemployment insurance Fund and received benefits of R12'000 for the period 1 December 2021 to 28 February 2022 vi. he purchased an annuity on 1 June 2022 for R10'000. he received a monthly annuity in terms of this contract of R180 from the end of June. This annuity would run for a period of 7 years. vii. he is 66 years old at 28 February and was ordinarily resident in SA during the 2022 tax year. Required: (a) Calculate tax payable/refundable by Mr T Toof in the 2022 tax year.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started