Answered step by step

Verified Expert Solution

Question

1 Approved Answer

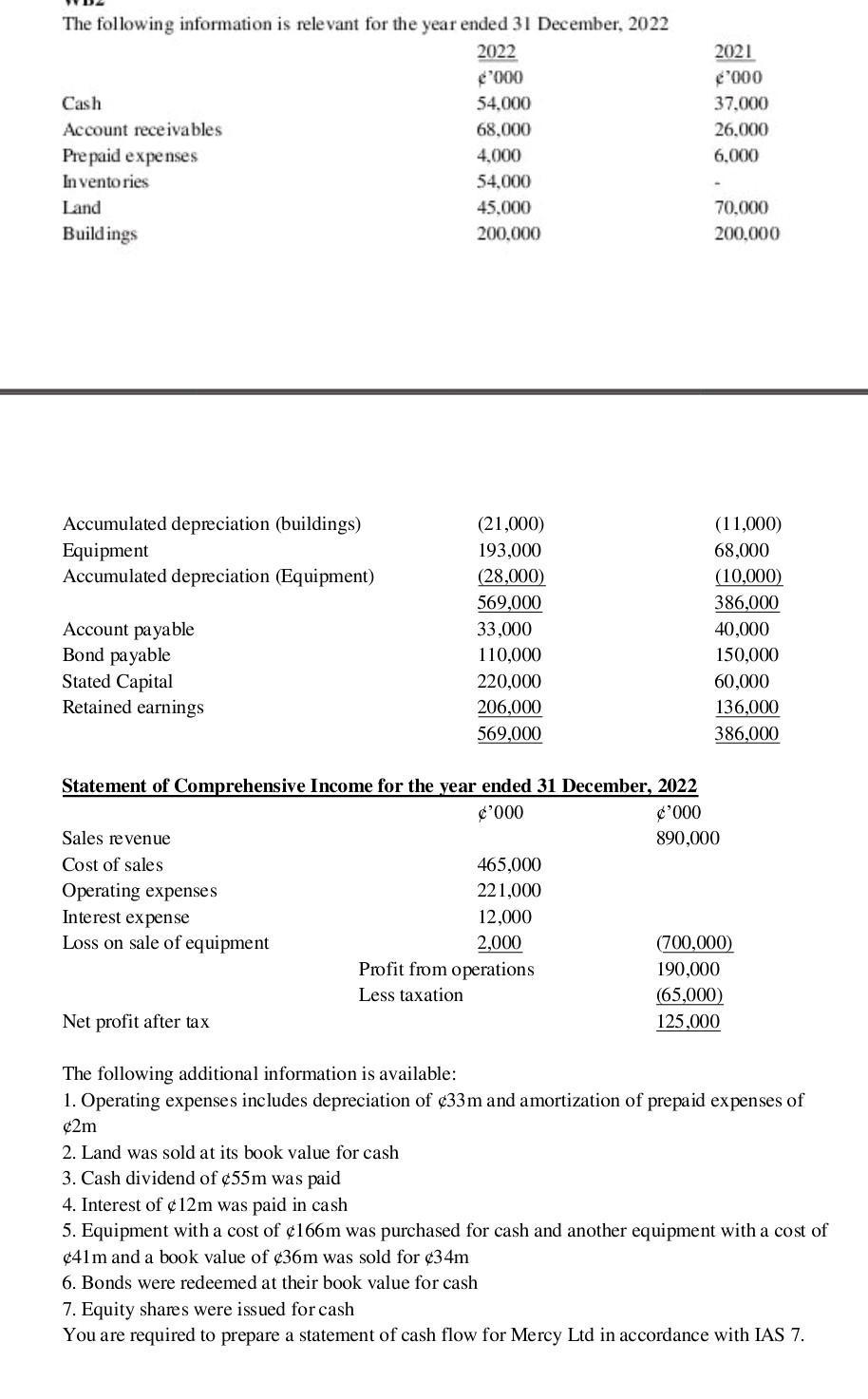

The following information is relevant for the year ended 31 December, 2022 Cash Account receivables Prepaid expenses Inventories Land Buildings 2022 2021 '000 '000

The following information is relevant for the year ended 31 December, 2022 Cash Account receivables Prepaid expenses Inventories Land Buildings 2022 2021 '000 '000 54,000 37,000 68,000 26,000 4,000 6,000 54,000 45,000 200,000 70,000 200,000 Accumulated depreciation (buildings) (21,000) (11,000) Equipment 193,000 68,000 Accumulated depreciation (Equipment) (28,000) (10,000) 569,000 386,000 Account payable 33,000 40,000 Bond payable 110,000 150,000 Stated Capital 220,000 60,000 Retained earnings 206,000 136,000 569,000 386,000 Statement of Comprehensive Income for the year ended 31 December, 2022 '000 Sales revenue '000 890,000 Cost of sales 465,000 Operating expenses 221,000 Interest expense 12.000 Loss on sale of equipment 2,000 (700,000) Profit from operations 190,000 Less taxation (65,000) Net profit after tax 125,000 The following additional information is available: 1. Operating expenses includes depreciation of 33m and amortization of prepaid expenses of 2m 2. Land was sold at its book value for cash 3. Cash dividend of e55m was paid 4. Interest of 12m was paid in cash 5. Equipment with a cost of 166m was purchased for cash and another equipment with a cost of 41m and a book value of 36m was sold for 34m 6. Bonds were redeemed at their book value for cash 7. Equity shares were issued for cash You are required to prepare a statement of cash flow for Mercy Ltd in accordance with IAS 7.

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the statement of cash flows for Mercy Ltd for the year ended December 31 2022 in accordan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started