Answered step by step

Verified Expert Solution

Question

1 Approved Answer

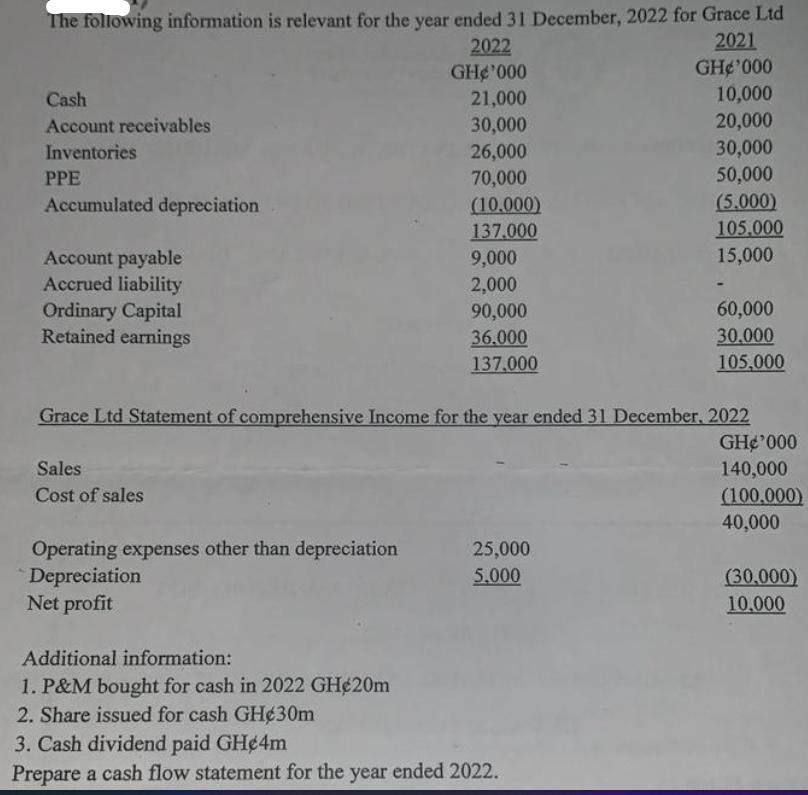

The following information is relevant for the year ended 31 December, 2022 for Grace Ltd 2022 2021 GH'000 GH'000 Cash 21,000 10,000 Account receivables

The following information is relevant for the year ended 31 December, 2022 for Grace Ltd 2022 2021 GH'000 GH'000 Cash 21,000 10,000 Account receivables 30,000 20,000 Inventories 26,000 30,000 PPE 70,000 50,000 Accumulated depreciation (10.000) (5.000) 137.000 105.000 Account payable 9,000 15,000 Accrued liability 2,000 Ordinary Capital 90,000 60,000 Retained earnings 36.000 30.000 137,000 105,000 Grace Ltd Statement of comprehensive Income for the year ended 31 December, 2022 GH'000 Sales 140,000 Cost of sales (100,000) 40,000 Operating expenses other than depreciation 25,000 Depreciation 5.000 (30,000) 10,000 Net profit Additional information: 1. P&M bought for cash in 2022 GH20m 2. Share issued for cash GH30m 3. Cash dividend paid GH4m Prepare a cash flow statement for the year ended 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To prepare the cash flow statement for Grace Ltd for the year ended 31 December 2022 we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started