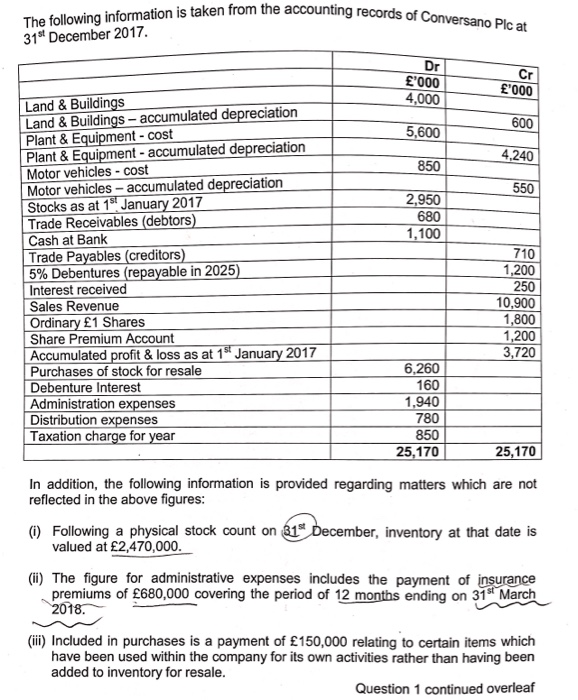

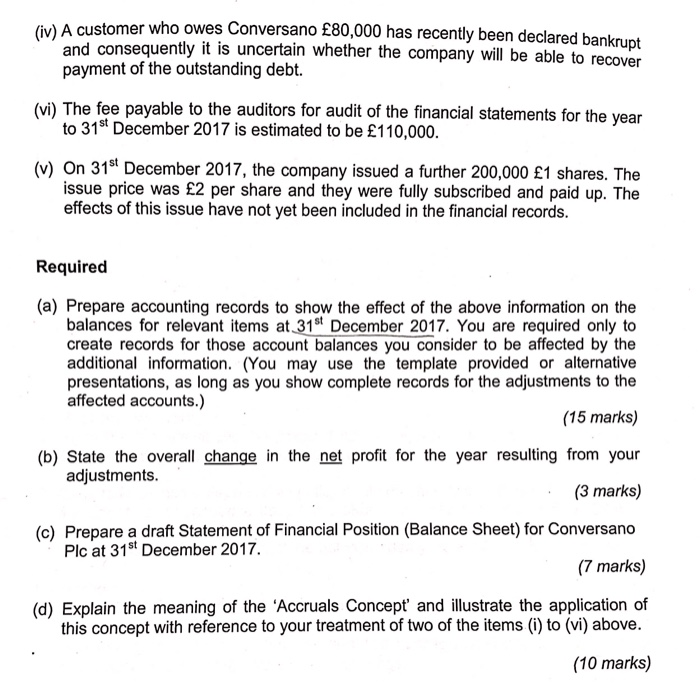

The following information is taken from the accounting records of Conversano Plc at 31st December 2017. Dr '000 4,000 Cr '000 600 5,600 4.240 850 550 2,950 680 1,100 Land & Buildings Land & Buildings - accumulated depreciation Plant & Equipment -cost Plant & Equipment - accumulated depreciation Motor vehicles - cost Motor vehicles - accumulated depreciation Stocks as at 1. January 2017 Trade Receivables (debtors) Cash at Bank Trade Payables (creditors) 5% Debentures (repayable in 2025) Interest received Sales Revenue Ordinary 1 Shares Share Premium Account Accumulated profit & loss as at 18 January 2017 Purchases of stock for resale Debenture Interest Administration expenses Distribution expenses Taxation charge for year 710 1,200 250 10,900 1,800 1,200 3,720 6,260 160 1,940 780 850 25,170 25,170 In addition, the following information is provided regarding matters which are not reflected in the above figures: (1) Following a physical stock count on 31 December, inventory at that date is valued at 2,470,000. (ii) The figure for administrative expenses includes the payment of insurance premiums of 680,000 covering the period of 12 months ending on 31 March 2018. (ii) Included in purchases is a payment of 150,000 relating to certain items which have been used within the company for its own activities rather than having been added to inventory for resale. Question 1 continued overleaf (iv) A customer who owes Conversano 80,000 has recently been declared bankrupt and consequently it is uncertain whether the company will be able to recover payment of the outstanding debt. (vi) The fee payable to the auditors for audit of the financial statements for the year to 31st December 2017 is estimated to be 110,000. (v) On 31st December 2017, the company issued a further 200,000 1 shares. The issue price was 2 per share and they were fully subscribed and paid up. The effects of this issue have not yet been included in the financial records. Required (a) Prepare accounting records to show the effect of the above information on the balances for relevant items at 31st December 2017. You are required only to create records for those account balances you consider to be affected by the additional information. (You may use the template provided or alternative presentations, as long as you show complete records for the adjustments to the affected accounts.) (15 marks) (b) State the overall change in the net profit for the year resulting from your adjustments. (3 marks) (c) Prepare a draft Statement of Financial Position (Balance Sheet) for Conversano Plc at 31st December 2017. (7 marks) (d) Explain the meaning of the 'Accruals Concept and illustrate the application of this concept with reference to your treatment of two of the items (i) to (vi) above. (10 marks)