Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following sealed-bid private-values auction setting: N 2 bidders simultaneously submit a bid, b,, for an object after getting their own valuation for

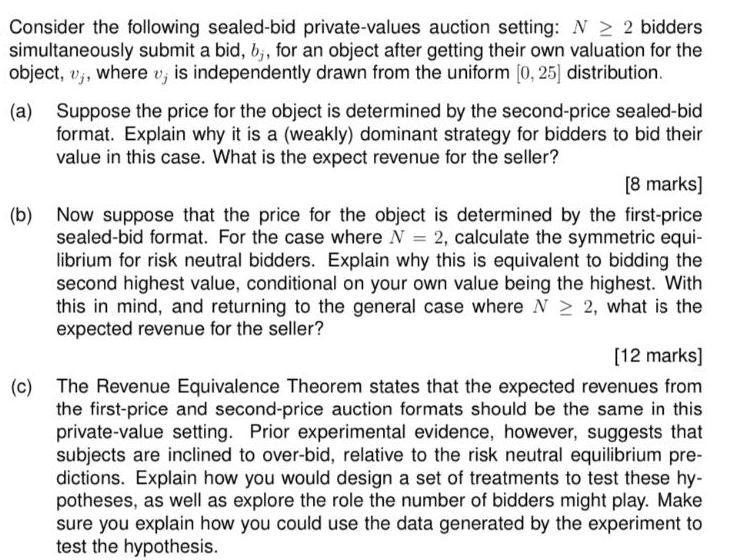

Consider the following sealed-bid private-values auction setting: N 2 bidders simultaneously submit a bid, b,, for an object after getting their own valuation for the object, v,, where u, is independently drawn from the uniform [0, 25] distribution. (a) Suppose the price for the object is determined by the second-price sealed-bid format. Explain why it is a (weakly) dominant strategy for bidders to bid their value in this case. What is the expect revenue for the seller? [8 marks] (b) Now suppose that the price for the object is determined by the first-price sealed-bid format. For the case where N = 2, calculate the symmetric equi- librium for risk neutral bidders. Explain why this is equivalent to bidding the second highest value, conditional on your own value being the highest. With this in mind, and returning to the general case where N 2, what is the expected revenue for the seller? [12 marks] (c) The Revenue Equivalence Theorem states that the expected revenues from the first-price and second-price auction formats should be the same in this private-value setting. Prior experimental evidence, however, suggests that subjects are inclined to over-bid, relative to the risk neutral equilibrium pre- dictions. Explain how you would design a set of treatments to test these hy- potheses, as well as explore the role the number of bidders might play. Make sure you explain how you could use the data generated by the experiment to test the hypothesis.

Step by Step Solution

★★★★★

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started