Question

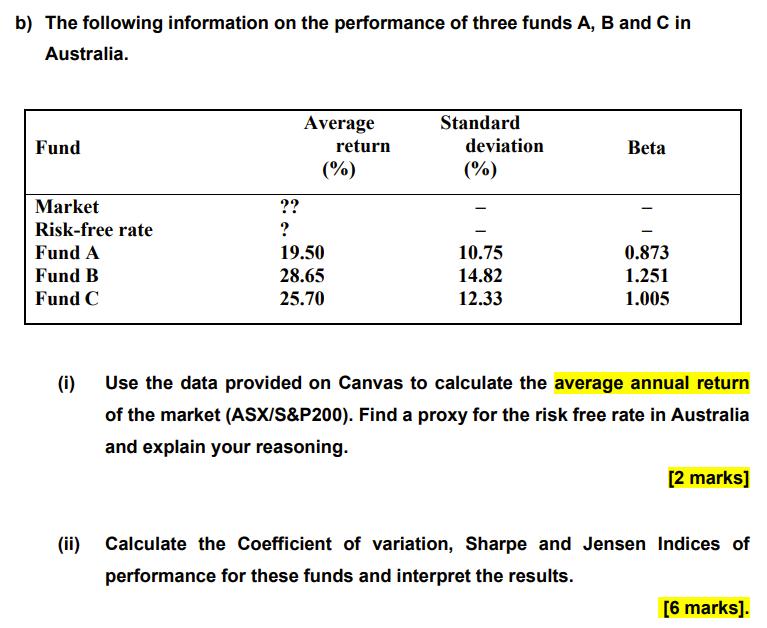

b) The following information on the performance of three funds A, B and C in Australia. Fund Market Risk-free rate Fund A Fund B

b) The following information on the performance of three funds A, B and C in Australia. Fund Market Risk-free rate Fund A Fund B Fund C (i) ?? ? Average return (%) 19.50 28.65 25.70 Standard deviation (%) 10.75 14.82 12.33 Beta 0.873 1.251 1.005 Use the data provided on Canvas to calculate the average annual return of the market (ASX/S&P200). Find a proxy for the risk free rate in Australia and explain your reasoning. [2 marks] (ii) Calculate the Coefficient of variation, Sharpe and Jensen Indices of performance for these funds and interpret the results. [6 marks].

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App