Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information pertains to ABC Corp. Inmediately before liquidation: It was determined that there were unrecorded accounts payable of P 2 5 , 0

The following information pertains to ABC Corp. Inmediately before

liquidation:

It was determined that there were unrecorded accounts payable of

P Included in the assets of ABC Company was goodwill from a

previous business acquisition anounting to P

The following were estimated to occur during liquidation based on net

realizable values of the noncash assets:

P of accounts receivable are expected to be writtenoff. No

allowance for expected credit losses were provided by the entity.

Inventories will be sold at a loss of P

Prepaid expenses of P will be writtenoff because these are non

transferable.

Machinery and equipment will be sold at a loss of P

Land and buildings will be sold at a gain of P

Liquidation and administrative expenses of P will be incurred.

Required:

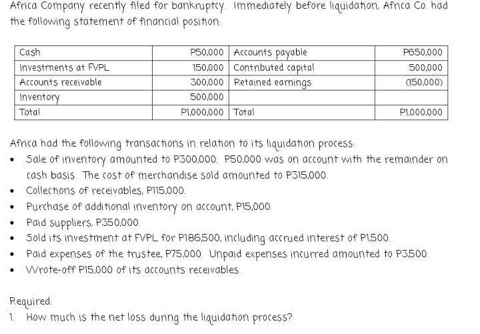

How much is the estimated estate deficit?Africa company recently flled for banknuptcy. Immediately before hquidation. Africa Co had

the following statement of financial position:

Afnca had the following transactions in relation to its liquidation process:

Sale of inventory amounted to P P was on account with the remainder on

cash basis. The cost of merchandise sold amounted to P

Collections of receivables, P

Purchase of additional inventory on account, P

Paid suppliers, P

Sold its investment at FVPL for P including accrued interest of P

Paid expenses of the trustee, P Unpaid expenses incurred amounted to P

Wroteff P of its accounts receivables

Required

How much is the net loss dunng the liquidation process?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started