Answered step by step

Verified Expert Solution

Question

1 Approved Answer

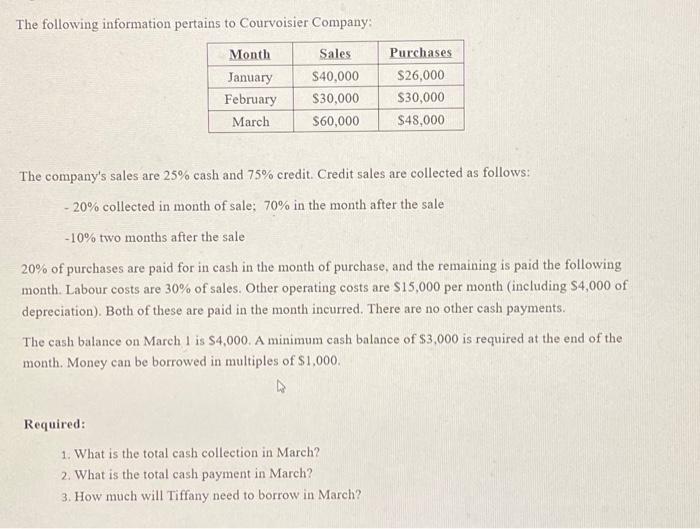

The following information pertains to Courvoisier Company: Month Sales Purchases January $40,000 $26,000 February $30,000 $30,000 March $60,000 $48,000 The company's sales are 25%

The following information pertains to Courvoisier Company: Month Sales Purchases January $40,000 $26,000 February $30,000 $30,000 March $60,000 $48,000 The company's sales are 25% cash and 75% credit. Credit sales are collected as follows: 20% collected in month of sale; 70% in the month after the sale -10% two months after the sale 20% of purchases are paid for in cash in the month of purchase, and the remaining is paid the following month. Labour costs are 30% of sales. Other operating costs are $15,000 per month (including $4,000 of depreciation). Both of these are paid in the month incurred. There are no other cash payments. The cash balance on March 1 is $4,000. A minimum cash balance of $3,000 is required at the end of the month. Money can be borrowed in multiples of $1,000. Required: 1. What is the total cash collection in March? 2. What is the total cash payment in March? 3. How much will Tiffany need to borrow in March?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started