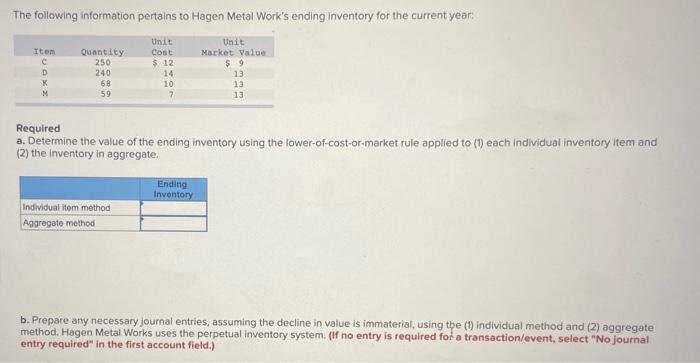

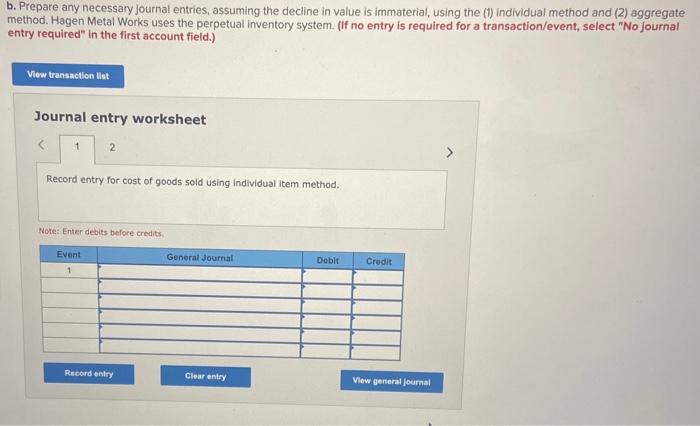

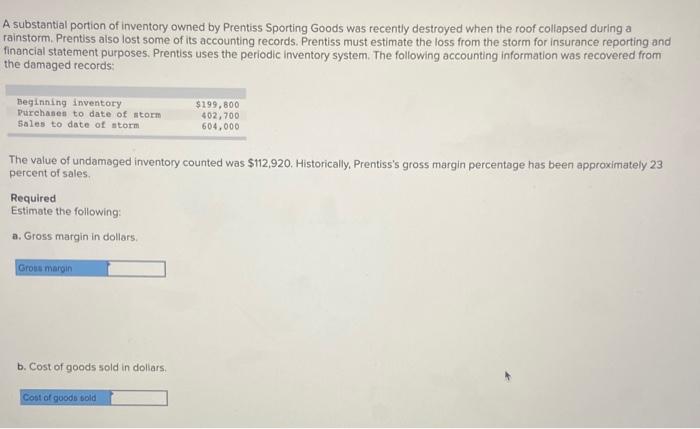

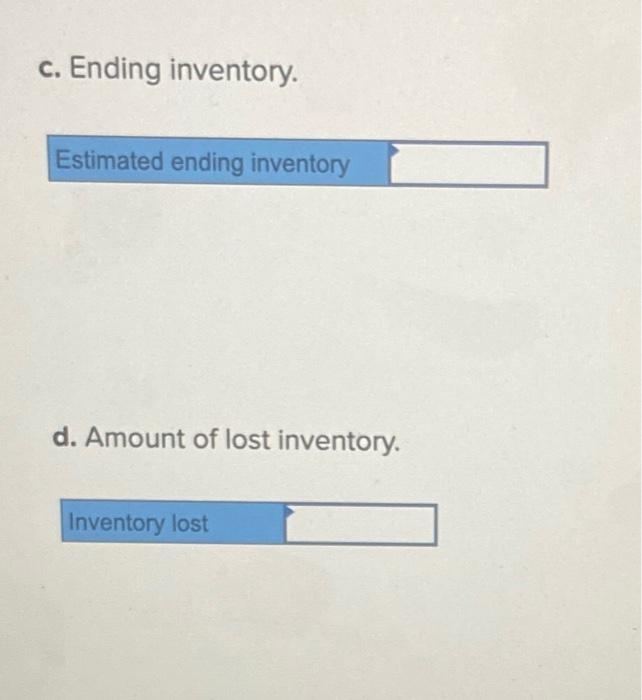

The following information pertains to Hagen Metal Work's ending inventory for the current year: Item c D M Quantity 250 240 68 59 Unit Cost $. 12 14 10 7 Unit Market Value $9 13 13 13 Required a. Determine the value of the ending inventory using the lower-of-cost-or-market rule applied to (1) each individual inventory Item and (2) the inventory in aggregate. Ending Inventory Individual item method Aggregate method b. Prepare any necessary Journal entries, assuming the decline in value is immaterial, using the (1) Individual method and (2) aggregate method. Hagen Metal Works uses the perpetual inventory system. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Prepare any necessary journal entries, assuming the decline in value is immaterial, using the (1) individual method and (2) aggregate method. Hagen Metal Works uses the perpetual inventory system. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record entry for cost of goods sold using individual item method. Note: Enter debits before credits Event General Journal Dobit Credit 1 Record entry Clear entry View general journal A substantial portion of inventory owned by Prentiss Sporting Goods was recently destroyed when the roof collapsed during a rainstorm. Prentiss also lost some of its accounting records. Prentiss must estimate the loss from the storm for insurance reporting and financial statement purposes. Prentiss uses the periodic Inventory system. The following accounting information was recovered from the damaged records Beginning inventory Purchases to date of storm Sales to date of storm $199,800 402,700 604,000 The value of undamaged inventory counted was $112,920. Historically, Prentiss's gross margin percentage has been approximately 23 percent of sales Required Estimate the following: a. Gross margin in dollars Grous margin b. Cost of goods sold in dollars. Cost of goods sold c. Ending inventory. Estimated ending inventory d. Amount of lost inventory. Inventory lost