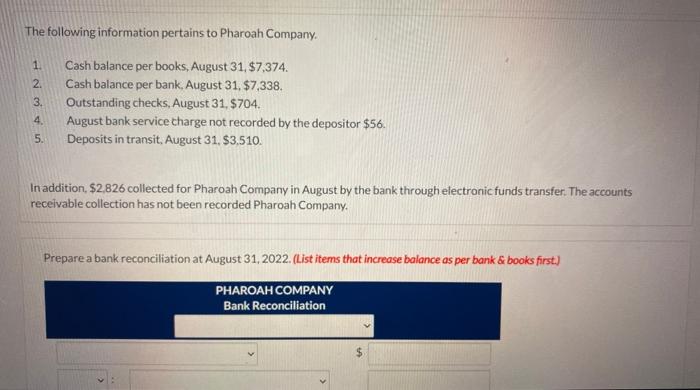

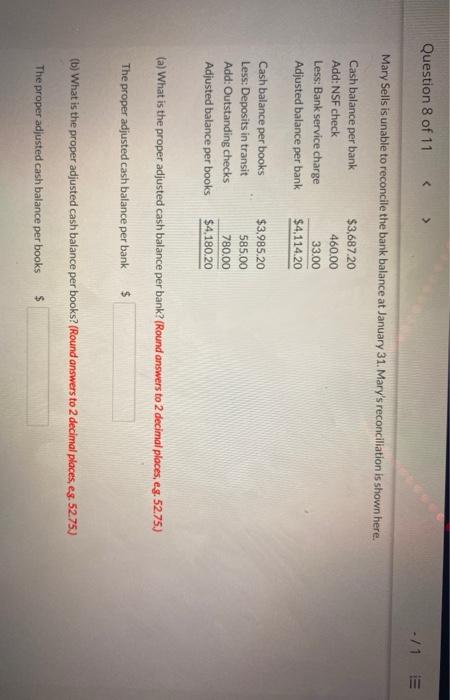

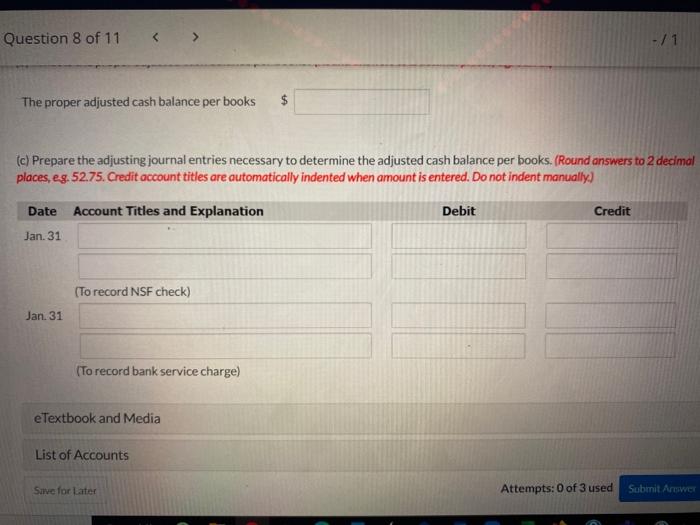

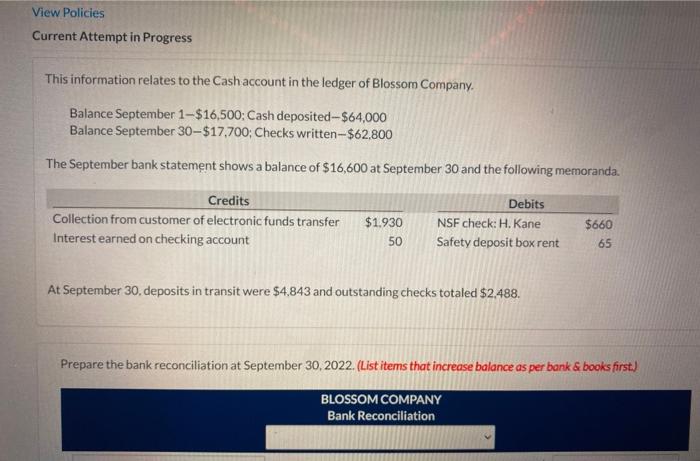

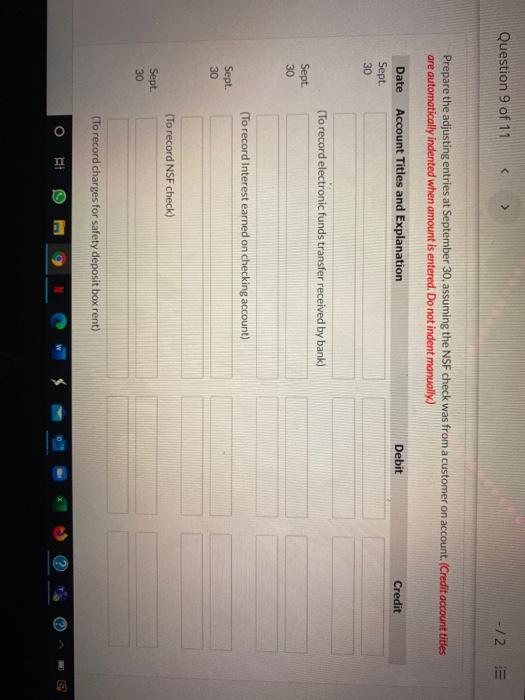

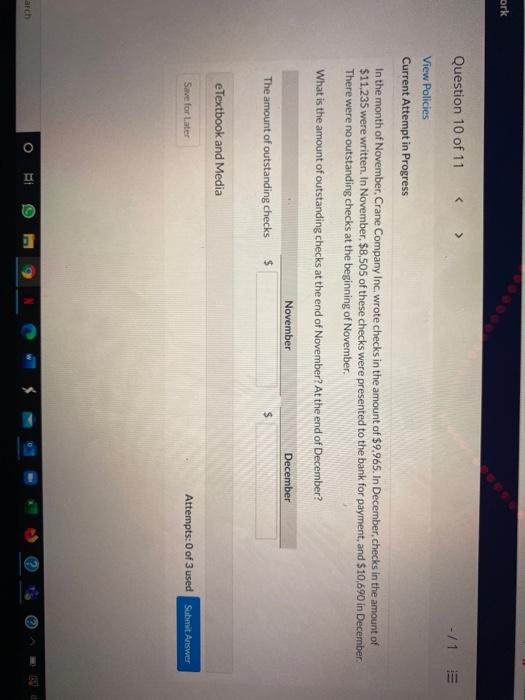

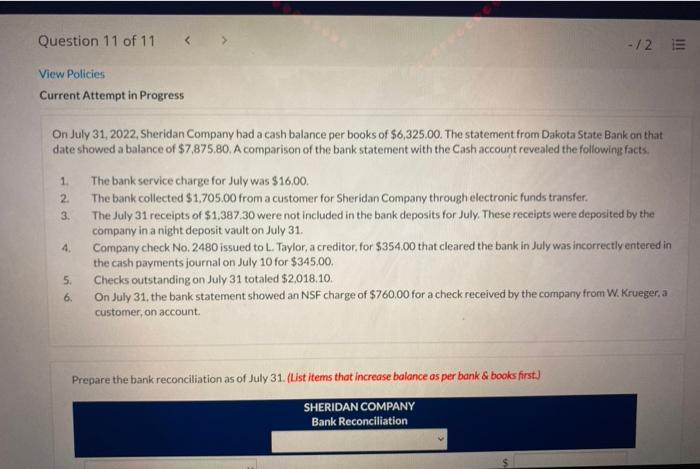

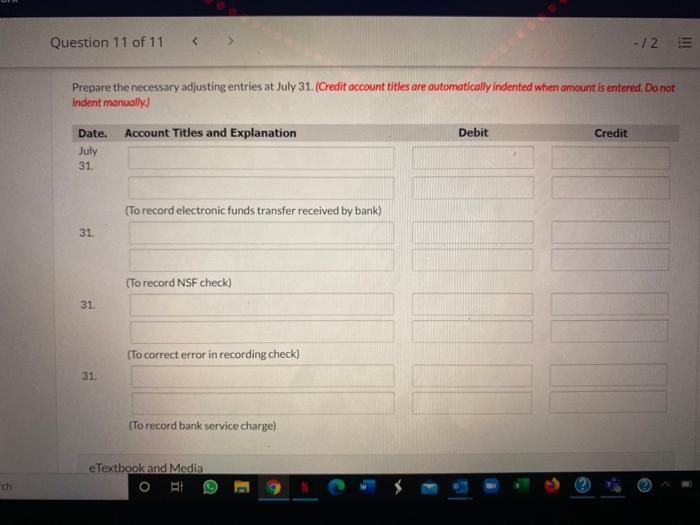

The following information pertains to Pharoah Company. 1. 2. 3. Cash balance per books, August 31, $7,374. Cash balance per bank, August 31, $7,338. Outstanding checks, August 31, $704. August bank service charge not recorded by the depositor $56. Deposits in transit, August 31. $3,510. 4. 5. In addition, $2,826 collected for Pharoah Company in August by the bank through electronic funds transfer. The accounts receivable collection has not been recorded Pharoah Company. Prepare a bank reconciliation at August 31, 2022. (List items that increase balance as per bank & books first.) PHAROAH COMPANY Bank Reconciliation Question 8 of 11 ./1 Mary Sells is unable to reconcile the bank balance at January 31. Mary's reconciliation is shown here. Cash balance per bank Add: NSF check Less: Bank service charge Adjusted balance per bank $3,687.20 460.00 33.00 $4.114.20 Cash balance per books Less: Deposits in transit Add: Outstanding checks Adjusted balance per books $3.985.20 585.00 780.00 $4,180.20 (a) What is the proper adjusted cash balance per bank? (Round answers to 2 decimal places, eg. 52.75.) The proper adjusted cash balance per bank $ (b) What is the proper adjusted cash balance per books? (Round answers to 2 decimal places, es. 52.75) The proper adjusted cash balance per books $ Question 8 of 11 -11 The proper adjusted cash balance per books $ (c) Prepare the adjusting journal entries necessary to determine the adjusted cash balance per books. (Round answers to 2 decimal places, eg. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 (To record NSF check) Jan. 31 (To record bank service charge) eTextbook and Media List of Accounts Sirve for Later Attempts: 0 of 3 used Submit Artiwer View Policies Current Attempt in Progress This information relates to the Cash account in the ledger of Blossom Company Balance September 1-$16,500: Cash deposited-$64,000 Balance September 30-$17,700; Checks written-$62,800 The September bank statement shows a balance of $16,600 at September 30 and the following memoranda. Credits Debits Collection from customer of electronic funds transfer $1.930 NSF check: H. Kane $660 Interest earned on checking account 50 Safety deposit box rent 65 At September 30, deposits in transit were $4.843 and outstanding checks totaled $2,488. Prepare the bank reconciliation at September 30, 2022. (List items that increase balance as per bank & books first.) BLOSSOM COMPANY Bank Reconciliation Question 9 of 11