Answered step by step

Verified Expert Solution

Question

1 Approved Answer

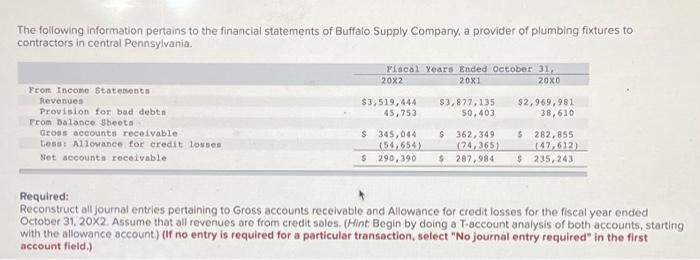

The following information pertains to the financial statements of Buffalo Supply Company, a provider of plumbing fixtures to contractors in central Pennsylvania. From Income Statements

The following information pertains to the financial statements of Buffalo Supply Company, a provider of plumbing fixtures to contractors in central Pennsylvania. From Income Statements Revenues Provision for bad debts From Balance Sheets Gross accounts receivable. Less: Allowance for credit losses Net accounts receivable Fiscal Years Ended October 31, 20X2 20x1 20X0 $3,519,444 45,753 $ $3,877,135 $2,969,981 50,403 38,610 345,044 (54,654) $ 362,349 $ 282,855 (74,365) (47,612) $ 290,390 $ 287,984 $ 235,243 Required: Reconstruct all journal entries pertaining to Gross accounts receivable and Allowance for credit losses for the fiscal year ended October 31, 20X2. Assume that all revenues are from credit sales. (Hint. Begin by doing a T-account analysis of both accounts, starting with the allowance account.) (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started