Answered step by step

Verified Expert Solution

Question

1 Approved Answer

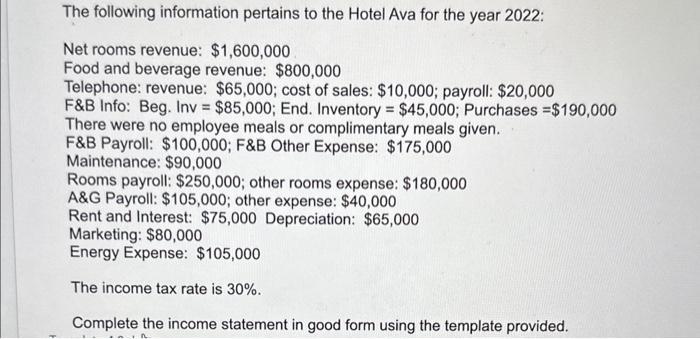

The following information pertains to the Hotel Ava for the year 2022: Net rooms revenue: $1,600,000 Food and beverage revenue: $800,000 Telephone: revenue: $65,000;

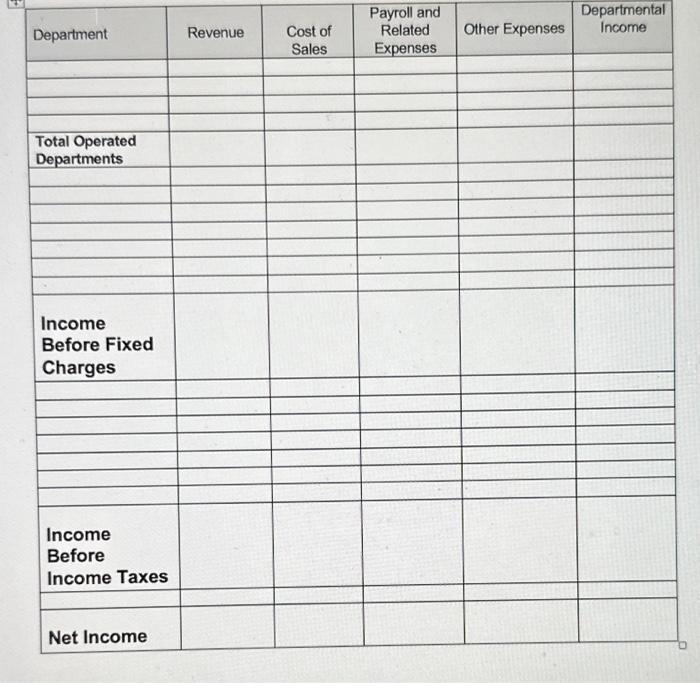

The following information pertains to the Hotel Ava for the year 2022: Net rooms revenue: $1,600,000 Food and beverage revenue: $800,000 Telephone: revenue: $65,000; cost of sales: $10,000; payroll: $20,000 F&B Info: Beg. Inv= $85,000; End. Inventory = $45,000; Purchases $190,000 There were no employee meals or complimentary meals given. F&B Payroll: $100,000; F&B Other Expense: $175,000 Maintenance: $90,000 Rooms payroll: $250,000; other rooms expense: $180,000 A&G Payroll: $105,000; other expense: $40,000 Rent and Interest: $75,000 Depreciation: $65,000 Marketing: $80,000 Energy Expense: $105,000 The income tax rate is 30%. Complete the income statement in good form using the template provided. Department Total Operated Departments Income Before Fixed Charges Income Before Income Taxes Net Income Revenue Cost of Sales Payroll and Related Expenses Other Expenses Departmental Income

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started