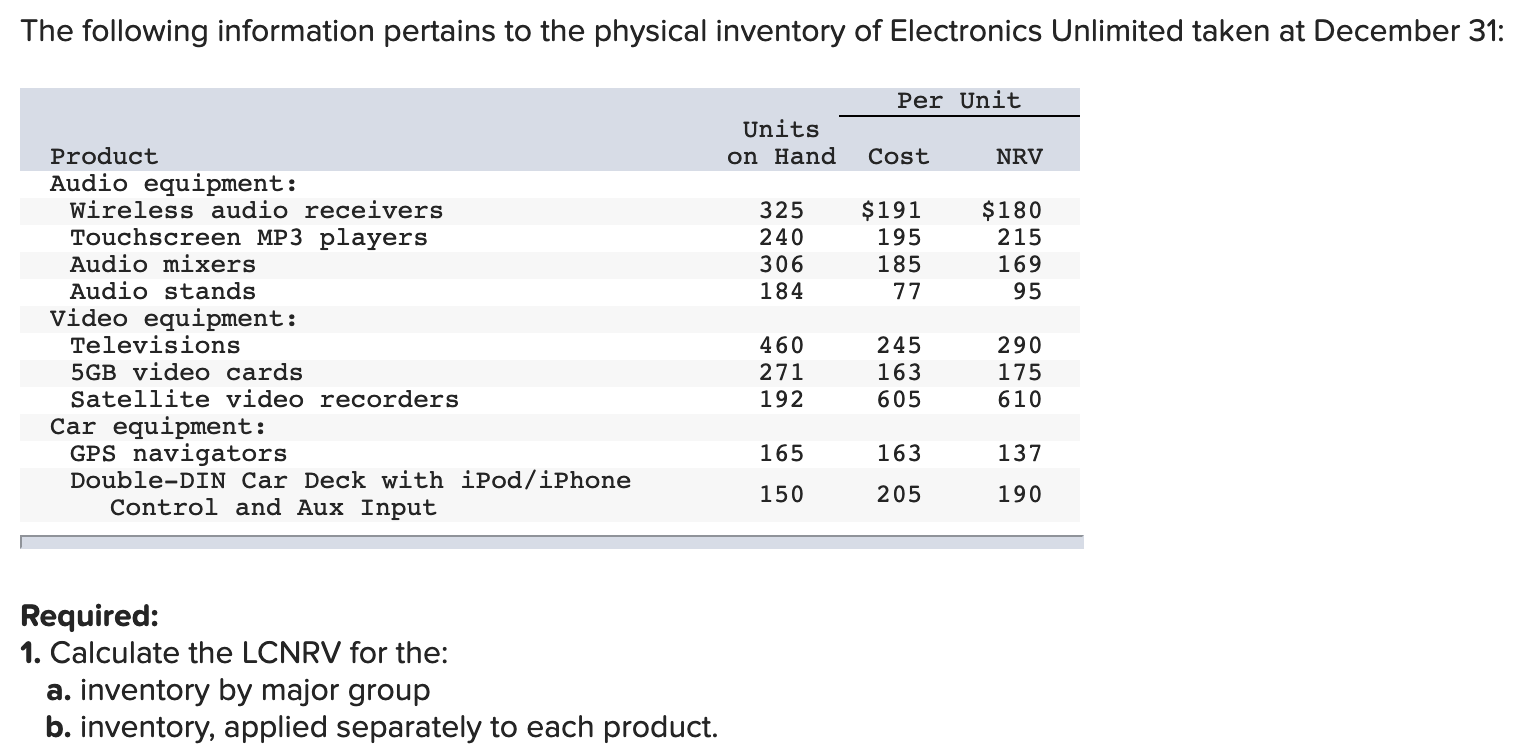

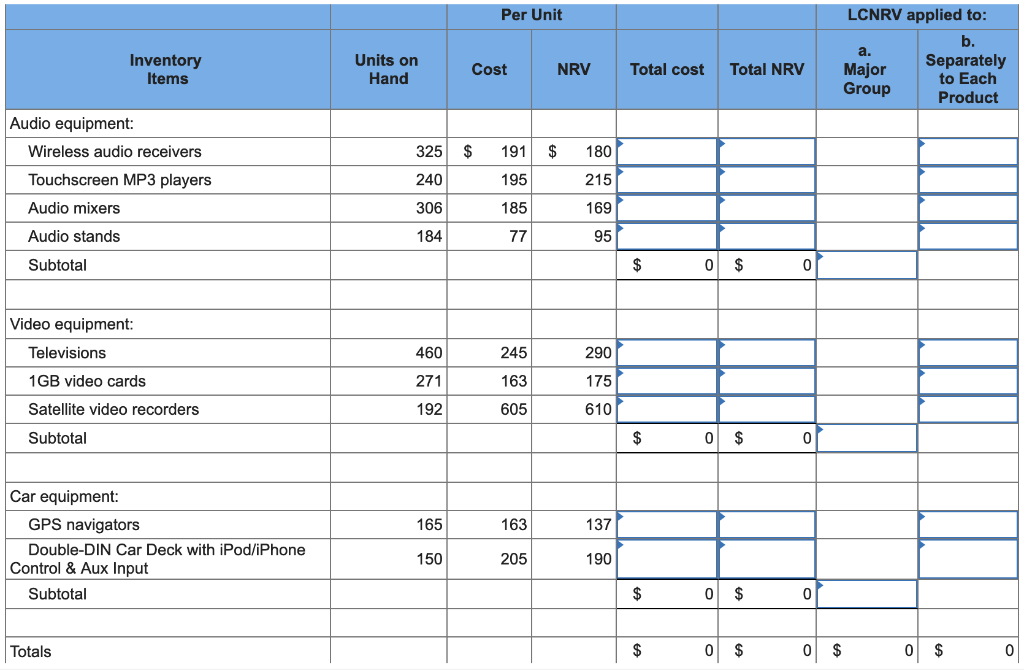

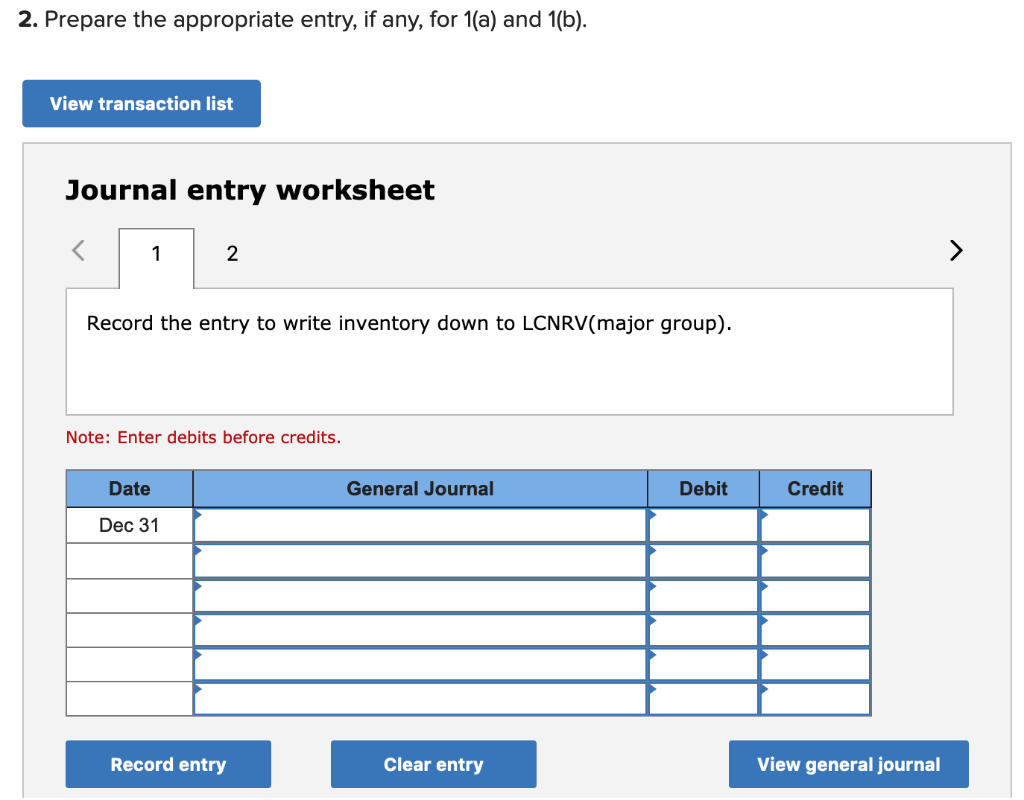

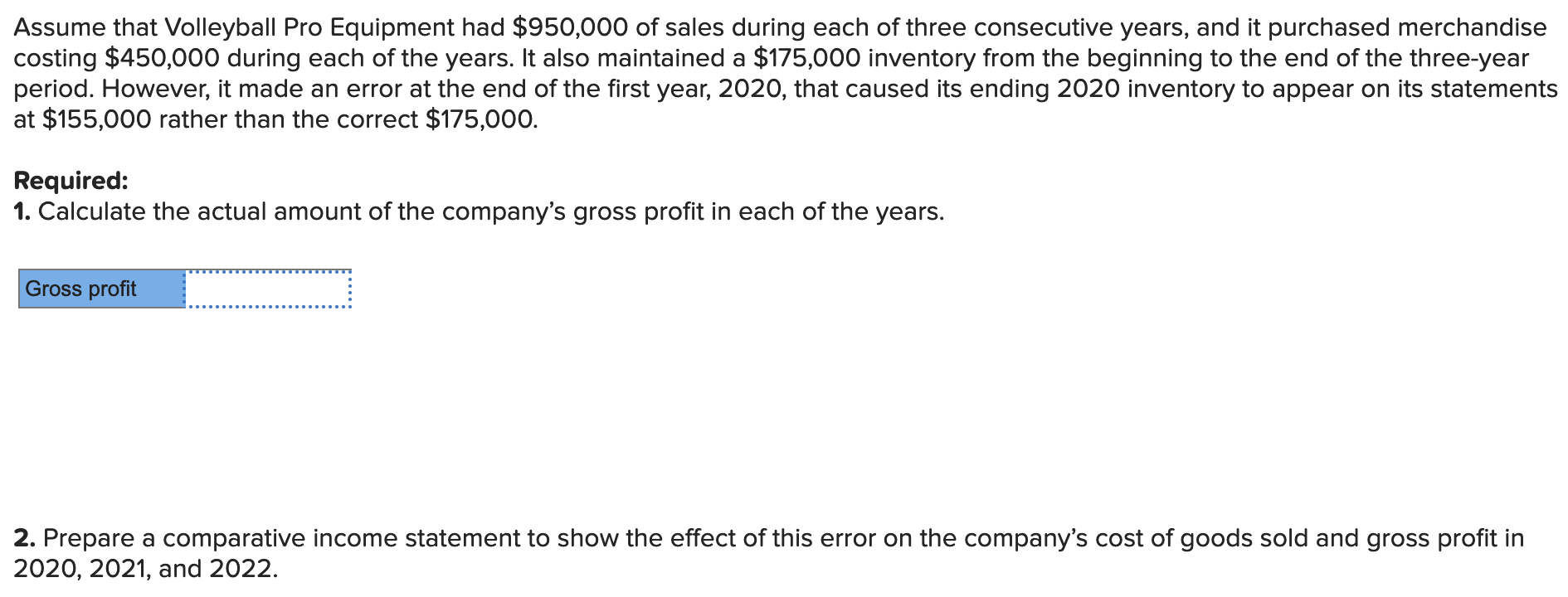

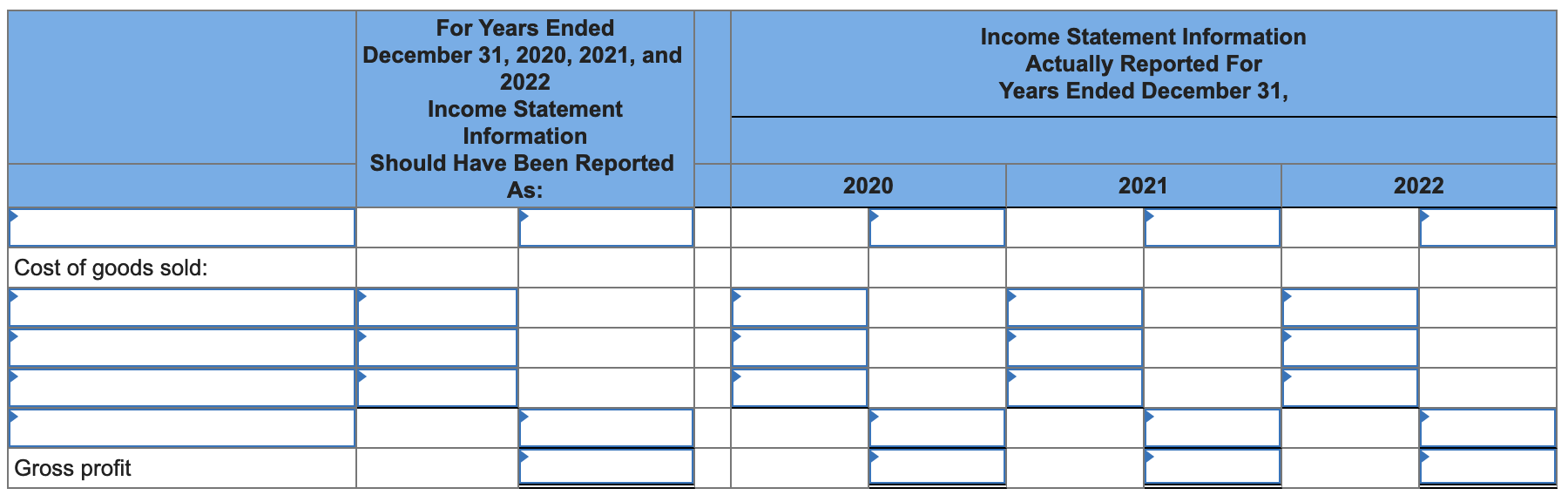

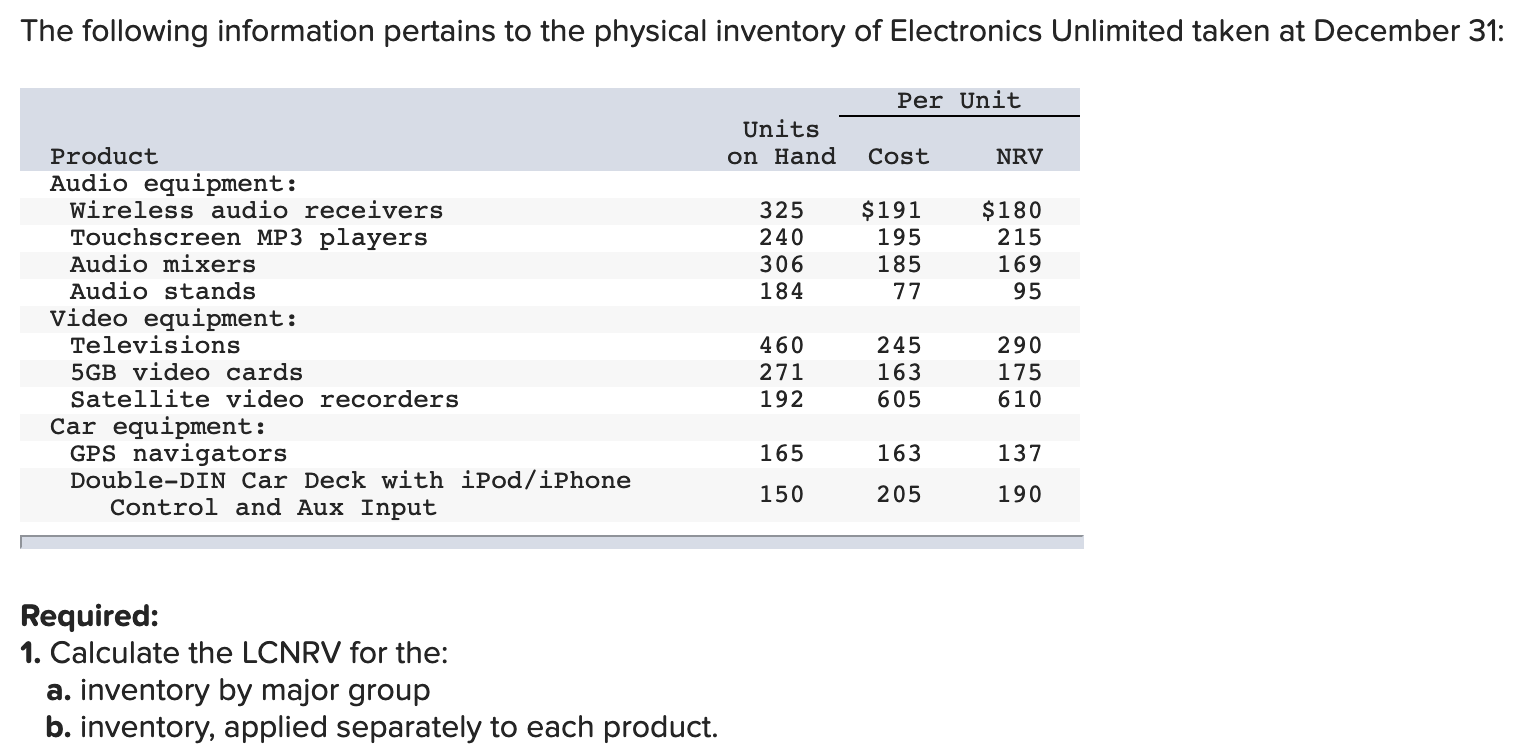

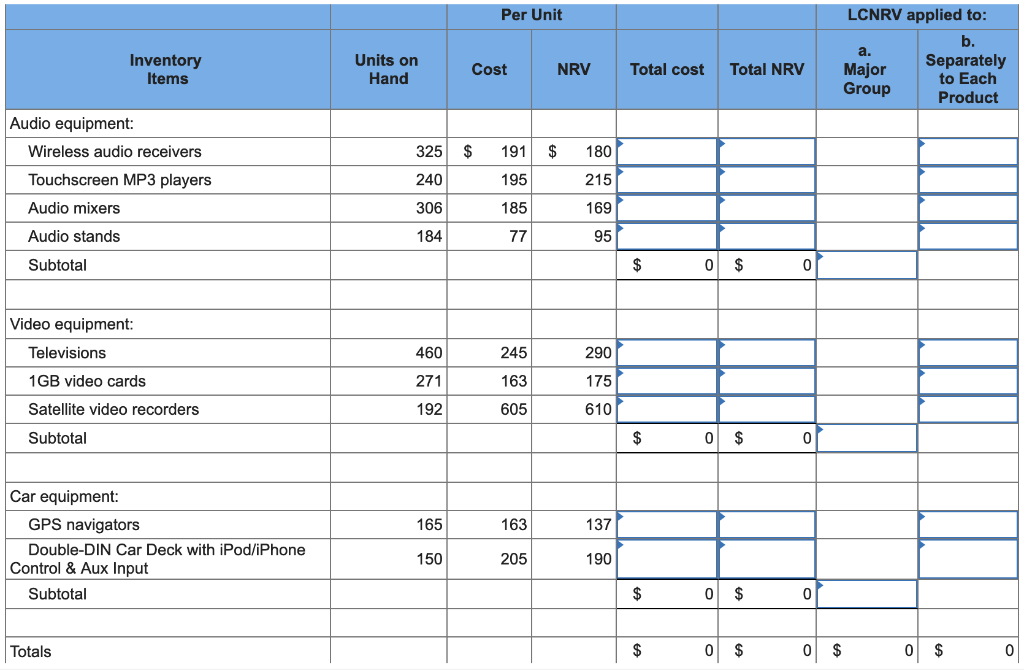

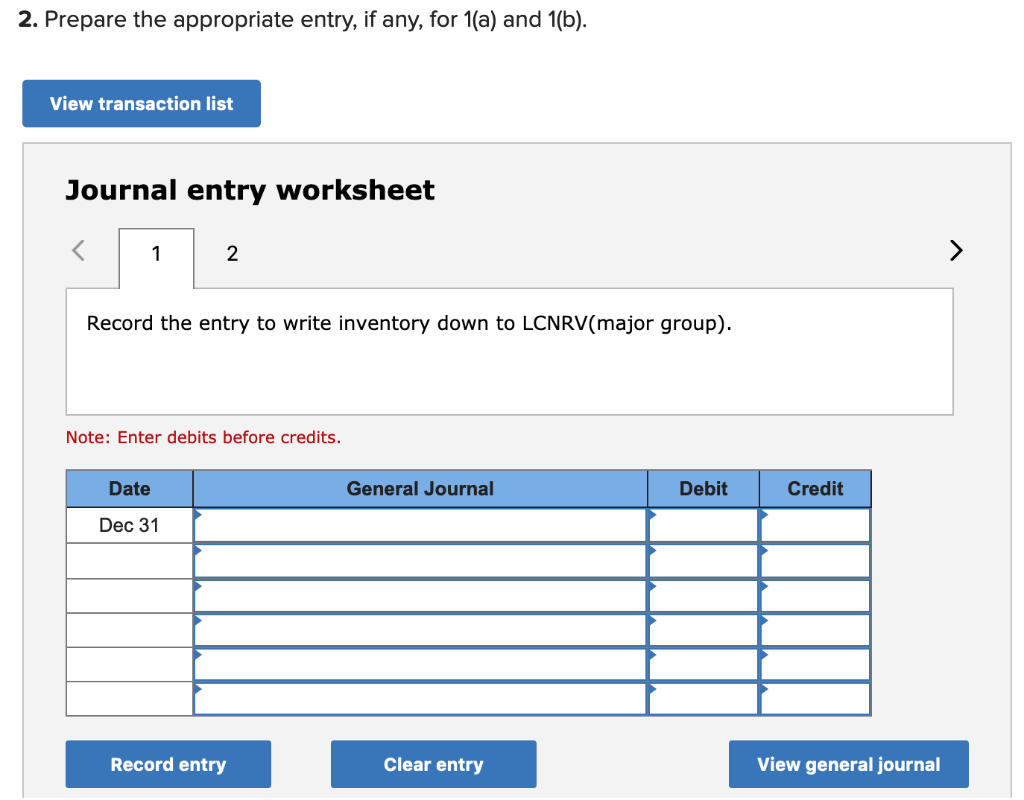

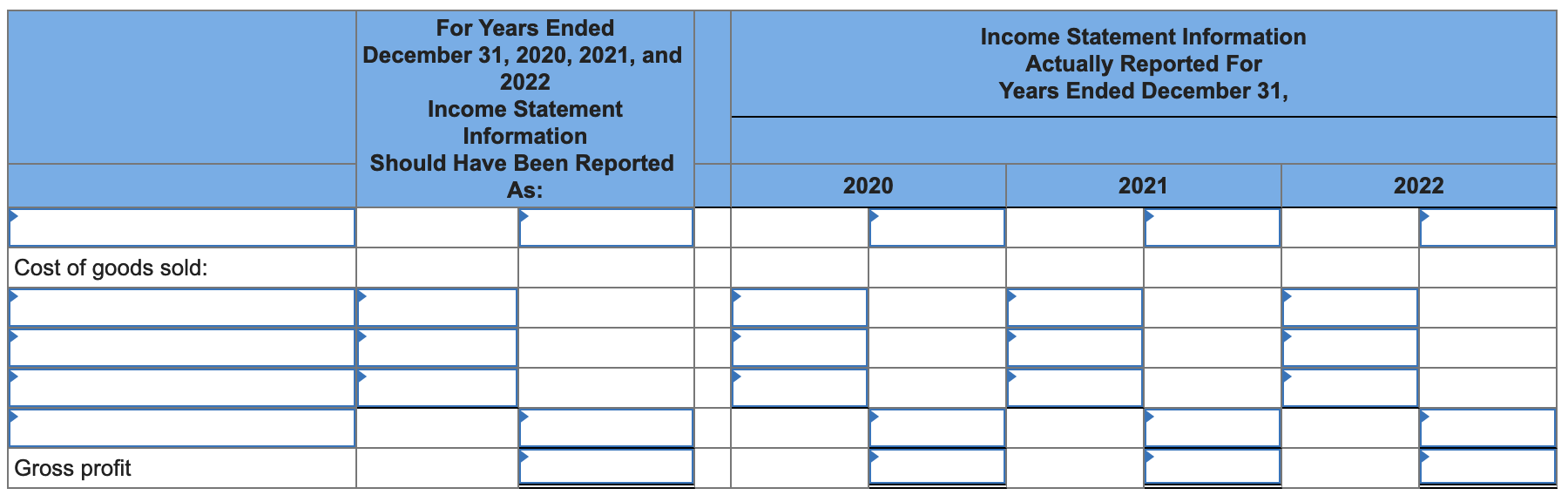

The following information pertains to the physical inventory of Electronics Unlimited taken at December 31: Per Unit Units on Hand Cost NRV 325 240 306 184 $191 195 185 77 $180 215 169 95 Product Audio equipment: Wireless audio receivers Touchscreen MP3 players Audio mixers Audio stands Video equipment: Televisions 5GB video cards Satellite video recorders Car equipment: GPS navigators Double-DIN Car Deck with iPod/iPhone Control and Aux Input 460 271 192 245 163 605 290 175 610 165 163 137 150 205 190 Required: 1. Calculate the LCNRV for the: a. inventory by major group b. inventory, applied separately to each product. Per Unit Inventory Items Units on Hand LCNRV applied to: b. a. Separately Major to Each Product Cost NRV Total cost Total NRV Group Audio equipment: Wireless audio receivers Touchscreen MP3 players 325 $ 191 $ 180 240 195 215 Audio mixers 306 169 185 77 Audio stands 184 95 Subtotal $ 0 $ 0 Video equipment: Televisions 1GB video cards 460 245 290 271 163 175 Satellite video recorders 192 605 610 Subtotal $ 0 $ 0 165 163 137 Car equipment: GPS navigators Double-DIN Car Deck with iPod/iPhone Control & Aux Input Subtotal 150 205 190 $ 0 $ 0 $ Totals 0 $ 0 $ 0 $ 0 2. Prepare the appropriate entry, if any, for 1(a) and 1(b). View transaction list Journal entry worksheet Record the entry to write inventory down to LCNRV(major group). Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal Assume that Volleyball Pro Equipment had $950,000 of sales during each of three consecutive years, and it purchased merchandise costing $450,000 during each of the years. It also maintained a $175,000 inventory from the beginning to the end of the three-year period. However, it made an error at the end of the first year, 2020, that caused its ending 2020 inventory to appear on its statements at $155,000 rather than the correct $175,000. Required: 1. Calculate the actual amount of the company's gross profit in each of the years. Gross profit 2. Prepare a comparative income statement to show the effect of this error on the company's cost of goods sold and gross profit in 2020, 2021, and 2022. Income Statement Information Actually Reported For Years Ended December 31, For Years Ended December 31, 2020, 2021, and 2022 Income Statement Information Should Have Been Reported As: 2020 2021 2022 Cost of goods sold: Gross profit