Answered step by step

Verified Expert Solution

Question

1 Approved Answer

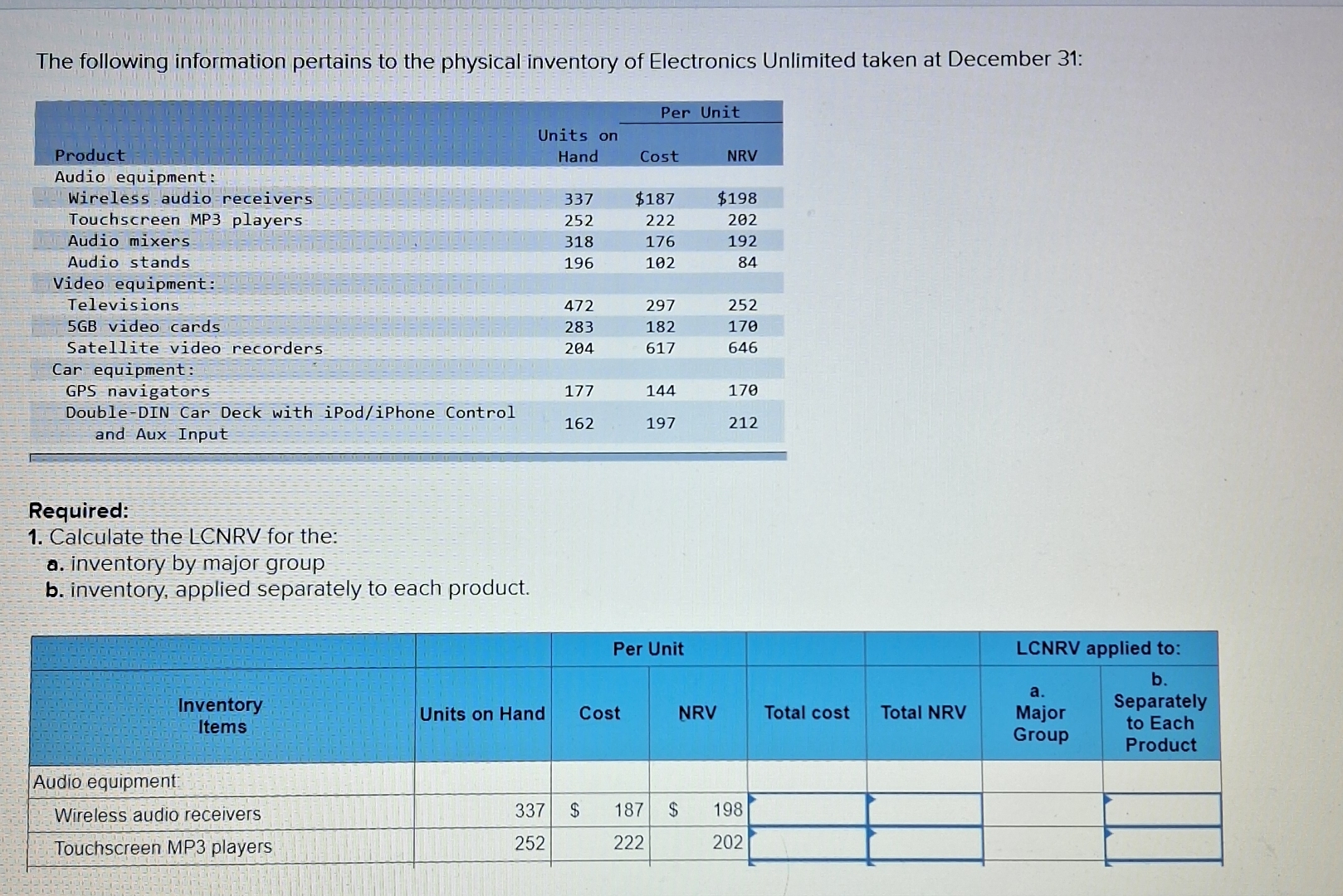

The following information pertains to the physical inventory of Electronics Unlimited taken at December 31: Per Unit Units on Product Hand Cost NRV Audio

The following information pertains to the physical inventory of Electronics Unlimited taken at December 31: Per Unit Units on Product Hand Cost NRV Audio equipment: Wireless audio receivers 337 $187 $198 Touchscreen MP3 players 252 222 202 Audio mixers 318 176 192 Audio stands Video equipment: Televisions 196 102 84 472 297 252 5GB video cards 283 182 170 Satellite video recorders 204 617 646 Car equipment: GPS navigators 177 144 170 Double-DIN Car Deck with iPod/iPhone Control 162 197 212 and Aux Input Required: 1. Calculate the LCNRV for the: a. inventory by major group b. inventory, applied separately to each product. Per Unit LCNRV applied to: a. Inventory Items Units on Hand Cost NRV b. Separately Total cost Total NRV Major Group to Each Product Audio equipment: Wireless audio receivers Touchscreen MP3 players 337 $ 187 $ 198 252 222 202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the LCNRV Lower of Cost or Net Realizable Value for the inventory by major group and se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642d952ade8c_973637.pdf

180 KBs PDF File

6642d952ade8c_973637.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started