Answered step by step

Verified Expert Solution

Question

1 Approved Answer

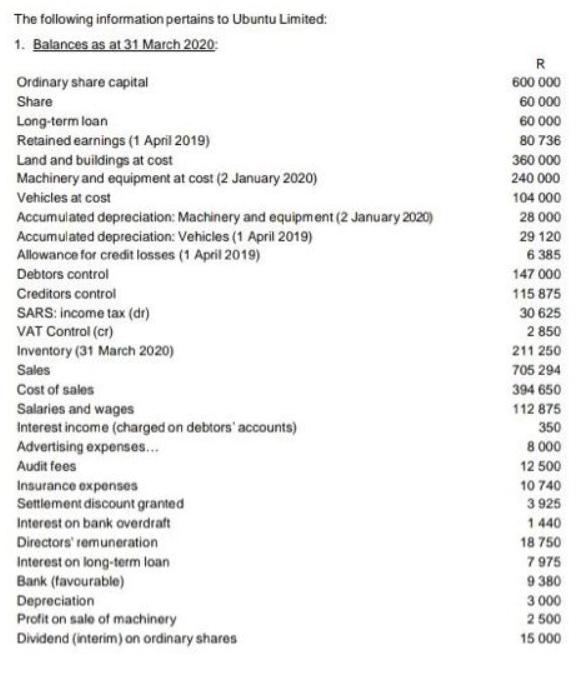

The following information pertains to Ubuntu Limited: 1. Balances as at 31 March 2020: R Ordinary share capital 600 000 Share 60 000 Long-term

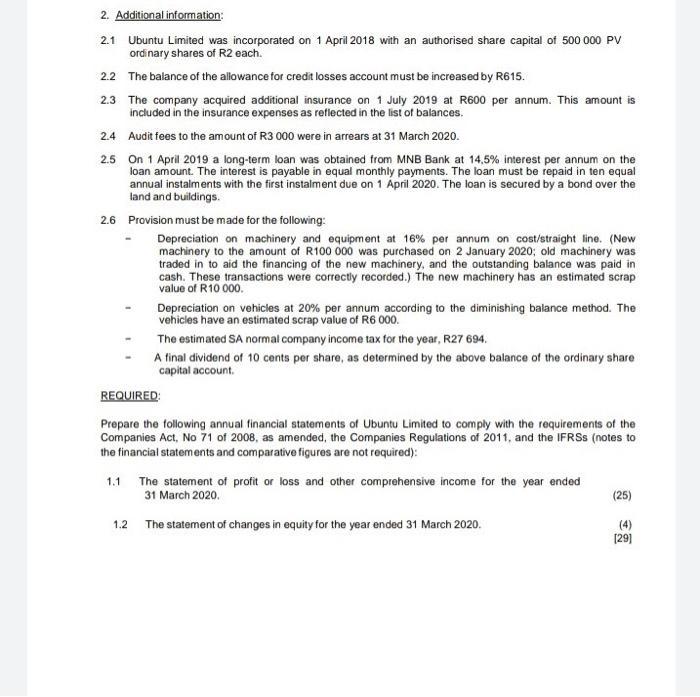

The following information pertains to Ubuntu Limited: 1. Balances as at 31 March 2020: R Ordinary share capital 600 000 Share 60 000 Long-term loan Retained earnings (1 April 2019) 60 000 80 736 Land and buildings at cost Machinery and equipment at cost (2 January 2020) 360 000 240 000 Vehicles at cost 104 000 Accumulated depreciation: Machinery and equipment (2 January 2020) Accumulated depreciation: Vehicles (1 April 2019) Allowance for credit losses (1 April 2019) 28 000 29 120 6 385 Debtors control 147 000 Creditors control 115 875 SARS: income tax (dr) VAT Control (cr) Inventory (31 March 2020) 30 625 2 850 211 250 Sales 705 294 Cost of sales 394 650 Salaries and wages Interest income (charged on debtors' accounts) Advertising expenses. Audit fees 112 875 350 8 000 12 500 Insurance expenses Settlement discount granted 10 740 3 925 Interest on bank overdraft Directors' remuneration 1 440 18 750 7 975 Interest on long-term loan Bank (favourable) 9 380 Depreciation Profit on sale of machinery Dividend (interim) on ordinary shares 3 000 2 500 15 000 2. Additional information: 2.1 Ubuntu Limited was incorporated on 1 April 2018 with an authorised share capital of 500 000 PV ordinary shares of R2 each. 2.2 The balance of the allowance for credit losses account must be increased by R615. 2.3 The company acquired additional insurance on 1 July 2019 at R600 per annum. This amount is included in the insurance expenses as reflected in the list of balances. 2.4 Audit fees to the amount of R3 000 were in arrears at 31 March 2020. 2.5 On 1 April 2019 a long-term loan was obtained from MNB Bank at 14,5% interest per annum on the loan amount. The interest is payable in equal monthly payments. The loan must be repaid in ten equal annual instalments with the first instalment due on 1 pril 2020. The loan is secured by a bond over the land and buildings. 2.6 Provision must be made for the following: Depreciation on machinery and equipment at 16% per annum on cost/straight line. (New machinery to the amount of R100 000 was purchased on 2 January 2020; old machinery was traded in to aid the financing of the new machinery, and the outstanding balance was paid in cash. These transactions were correctly recorded.) The new machinery has an estimated scrap value of R10 000. Depreciation on vehicles at 20% per annum according to the diminishing balance method. The vehicles have an estimated scrap value of R6 000. The estimated SA normal company income tax for the year, R27 694. A final dividend of 10 cents per share, as determined by the above balance of the ordinary share capital account. REQUIRED: Prepare the following annual financial statements of Ubuntu Limited to comply with the requirements of the Companies Act, No 71 of 2008, as amended, the Companies Regulations of 2011, and the IFRSS (notes to the financial statements and comparative figures are not required): 1.1 The statement of profit or loss and other comprehensive income for the year ended 31 March 2020. (25) 1.2 The statement of changes in equity for the year ended 31 March 2020. (4) [29]

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

11 Profit and loss for the year ended 31 March 2020 Revenue Sales 705294 Cost of sales 394650 Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started