Answered step by step

Verified Expert Solution

Question

1 Approved Answer

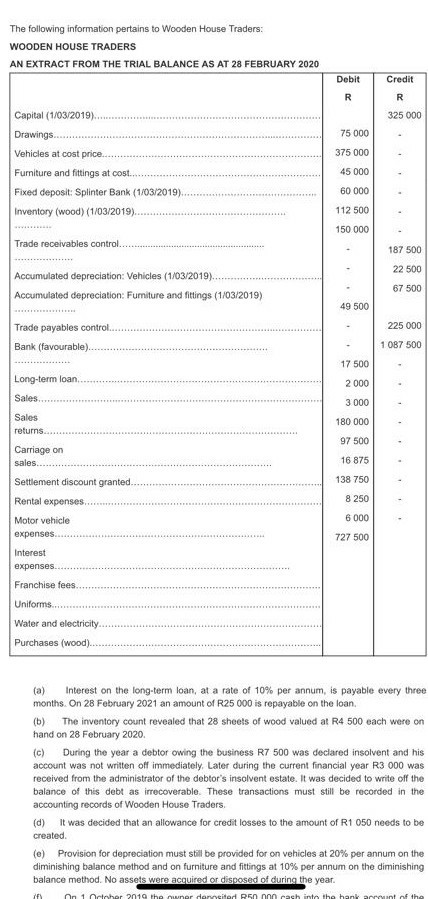

The following information pertains to Wooden House Traders: WOODEN HOUSE TRADERS AN EXTRACT FROM THE TRIAL BALANCE AS AT 28 FEBRUARY 2020 Debit Credit R

The following information pertains to Wooden House Traders: WOODEN HOUSE TRADERS AN EXTRACT FROM THE TRIAL BALANCE AS AT 28 FEBRUARY 2020 Debit Credit R R 325 000 75 000 375 000 Capital (1/03/2019)... Drawings...... Vehicles at cost price Furniture and fittings at cost.... Fixed deposit: Splinter Bank (1/03/2019). Inventory (wood) (1/03/2019).. 45 000 60 000 112 500 150 000 Trade receivables control. 187 500 22 500 Accumulated depreciation: Vehicles (1/03/2019)...... Accumulated depreciation: Fumiture and fittings (1/03/2019) 67 500 49 500 225 000 Trade payables control Bank (favourable). 1 087 500 17 500 2 000 Long-term loan Sales 3 000 Sales returns 180 000 97 500 Carriage on sales 16 875 Settlement discount granted. 138 750 Rental expenses... 8 250 6 000 727 500 Motor vehicle expenses Interest expenses.. Franchise fees. Uniforms... Water and electricity.. Purchases (wood). (a) Interest on the long-term loan, at a rate of 10% per annum, is payable every three months. On 28 February 2021 an amount of R25 000 is repayable on the loan. (b) The inventory count revealed that 28 sheets of wood valued at R4 500 each were on hand on 28 February 2020 (c) During the year a debtor owing the business R7 500 was declared insolvent and his account was not written off immediately. Later during the current financial year R3 000 was received from the administrator of the debtor's insolvent estate. It was decided to write off the balance of this debt as irrecoverable. These transactions must still be recorded in the accounting records of Wooden House Traders (d) It was decided that an allowance for credit losses to the amount of R1 050 needs to be created. (e) Provision for depreciation must still be provided for on vehicles at 20% per annum on the diminishing balance method and on furniture and fittings at 10% per annum on the diminishing balance method. No assets were acquired or disposed of during the year. 1) On1 October 2010 the owner derasited R50 non cash into the bank account of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started