Answered step by step

Verified Expert Solution

Question

1 Approved Answer

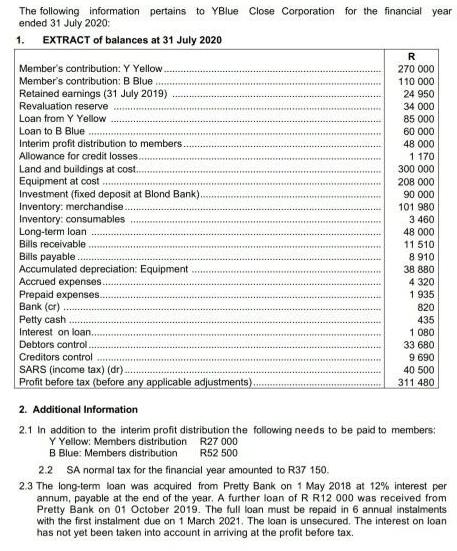

The following information ended 31 July 2020: pertains to YBlue Close Corporation for the financial year EXTRACT of balances at 31 July 2020 R

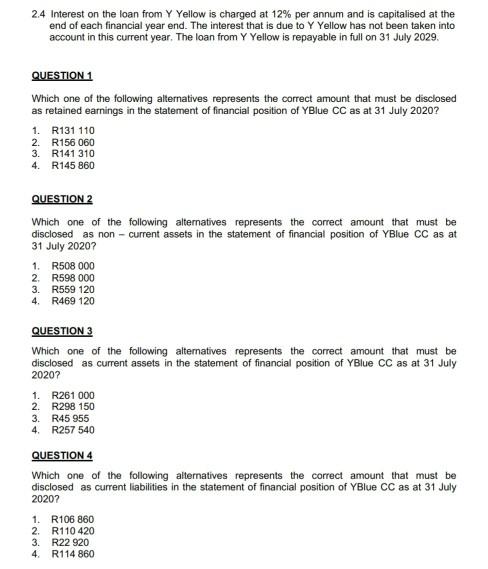

The following information ended 31 July 2020: pertains to YBlue Close Corporation for the financial year EXTRACT of balances at 31 July 2020 R Member's contribution: Y Yellow.. 270 000 110 000 24 950 34 000 Member's contribution: B Blue Retained earnings (31 July 2019) Revaluation reserve Loan from Y Yellow 85 000 60 000 Loan to B Blue Interim profit distribution to members. Allowance for credit losses. Land and buildings at cost.. Equipment at cost . Investment (fixed deposit at Blond Bank) Inventory: merchandise. Inventory: consumables Long-term loan Bills receivable Bills payable Accumulated depreciation: Equipment Accrued expenses. 48 000 1 170 300 000 208 000 90 000 101 980 3 460 48 000 11 510 8 910 38 880 4 320 1 935 Prepaid expenses. Bank (cr) Petty cash Interest on loan. Debtors control. 820 435 1 080 33 680 9 690 Creditors control SARS (income tax) (dr). Profit before tax (before any applicable adjustments). 40 500 311 480 2. Additional Information 2.1 In addition to the interim profit distribution the following needs to be paid to members: Y Yellow: Members distribution R27 000 B Blue: Members distribution SA normal tax for the financial year amounted to R37 150. 2.3 The long-term loan was acquired from Pretty Bank on 1 May 2018 at 12% interest per annum, payable at the end of the year. A further loan of R R12 000 was received from Pretty Bank on 01 October 2019. The full loan must be repaid in 6 annual instalments with the first instalment due on 1 March 2021. The loan is unsecured. The interest on loan has not yet been taken into account in arriving at the profit before tax. R52 500 2.2 2.4 Interest on the loan from Y Yellow is charged at 12% per annum and is capitalised at the end of each financial year end. The interest that is due to Y Yellow has not been taken into account in this current year. The loan from Y Yellow is repayable in full on 31 July 2029. QUESTION 1 Which one of the following alternatives represents the correct amount that must be disclosed as retained earnings in the statement of financial position of YBlue CC as at 31 July 2020? 1. R131 110 2. R156 060 3. R141 310 4. R145 860 QUESTION 2 Which one of the following alternatives represents the correct amount that must be disclosed as non current assets in the statement of financial position of YBlue CC as at 31 July 2020? 1. R508 000 2. R598 000 3. R559 120 4. R469 120 QUESTION 3 Which one of the following alternatives represents the correct amount that must be disclosed as cumrent assets in the statement of financial position of YBlue CC as at 31 July 2020? 1. R261 000 2. R298 150 3. R45 955 4. R257 540 QUESTION 4 Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of YBlue CC as at 31 July 2020? 1. R106 860 2. R110 420 3. R22 920 4. R114 860

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Retained Earnings Profit before tax and adjustment 311480 Less Tax 37150 Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started