The following information pertains to Zhifang who is a UK resident for the tax year 2020/21:

- Zhifang was paid an annual salary of 52,000 by her employer, a private equity firm that invests in renewable energy companies within emerging markets. Her employer had also deducted income tax of 10,250 from Zhifangs salary under the PAYE system.

- Zhifang received two bonus payments from her employer in recognition of her outstanding performance as follows:

- First bonus payment amounted to 1,900 paid on 30 September 2020.

- Second bonus payment of 2,100 was paid on 31 March 2021.

- Zhifang was provided with a diesel-powered car with a list price of 32,000. Zhifangs employer had however paid 30,000 for the car after obtaining a discount from the car dealership because of their continued custom. Zhifang also contributed 4,000 towards the cost of this car. The car had an official carbon dioxide emission rate of 120g/km. Zhifang used the car both for private and work use and all fuel was provided by her employer.

- Zhifang was provided with accommodation by her employer since the beginning of her employment on 1 January 2017. Her employer had initially acquired this house on 1 November 2015 for 190,000. The market value of this property was estimated at 200,000 following a valuation conducted on 1 January 2017. The annual value of the property is 5,000.

- Zhifang has a home theatre system provided by her employer for private enjoyment. This equipment had cost her employer 5,000 when it was acquired on 1 January 2017.

- Zhifangs employer also paid 500 to a local golf club so that she can enjoy her weekends when she is off work.

- Zhifang also took three loans from her employer that were in existence during the entire tax year, as follows:

- An interest-free loan of 20,000 which Zhifang used to purchase a vintage car.

- A Loan of 3,000 to buy an annual ticket for Manchester United home games, taken at an interest rate of 1.5% p.a.

- An interest-free loan of 3,000 to purchase an equipment she needed for her job.

- Zhifang earned annual rental income of 4,800 from a property located in Liverpool, out of which she spent 700 to repair a section of the propertys roof that had been damaged by strong winds. Zhifang also paid 150 with respect to insurance for this property during the year.

Additional information:

- Zhifang is a very philanthropic person and she donated 3,000 to a charity through her employers gift aid scheme on 31 January 2021.

- Zhifang received a premium bond prize of 270 on 1 April 2021.

- Zhifang received net interest of 2,000 from her savings account with a local bank, and gross dividends of 1,000. Both amounts were deposited into her bank account on 3 April 2021.

Required: Calculate the income tax payable by Zhifang for the tax year 2020/21 (Assume an official rate of interest of 2.25%).

[TOTAL: 20 MARKS]

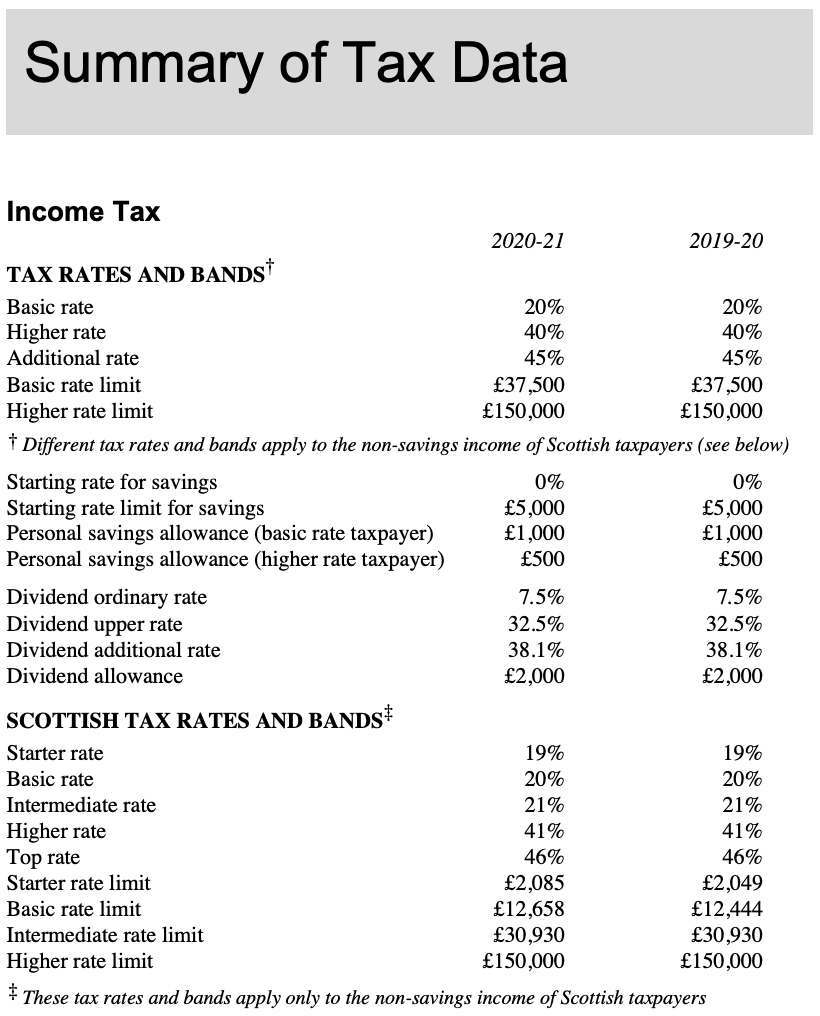

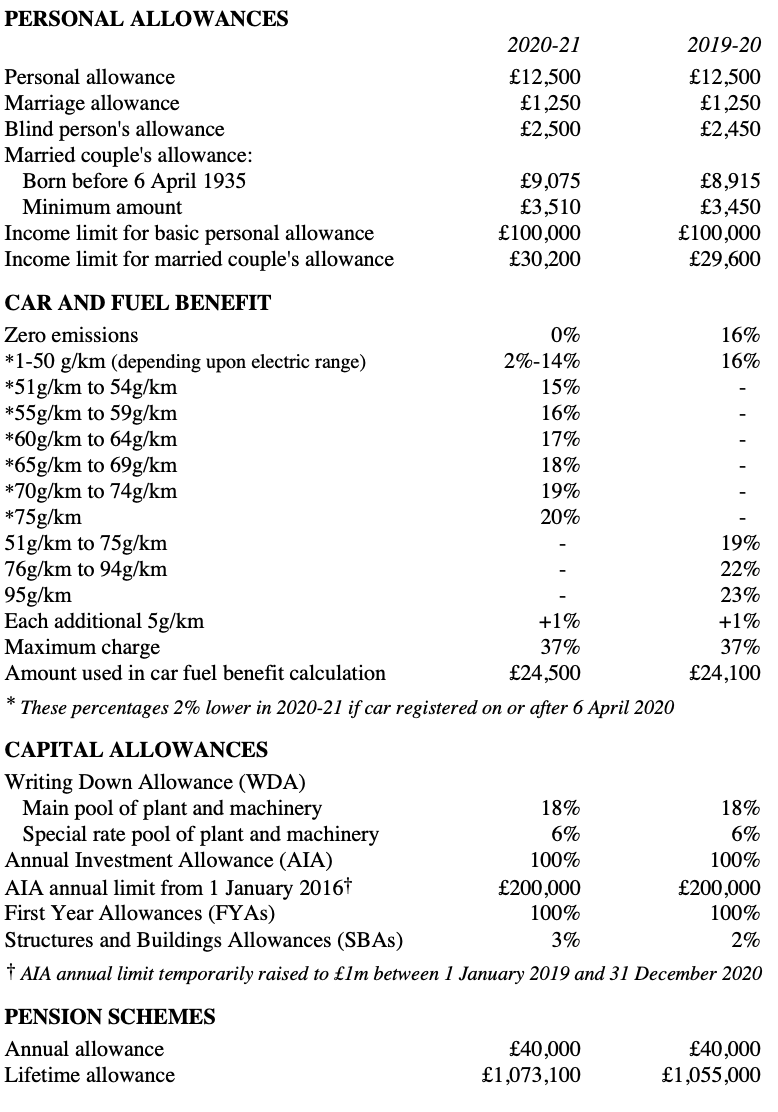

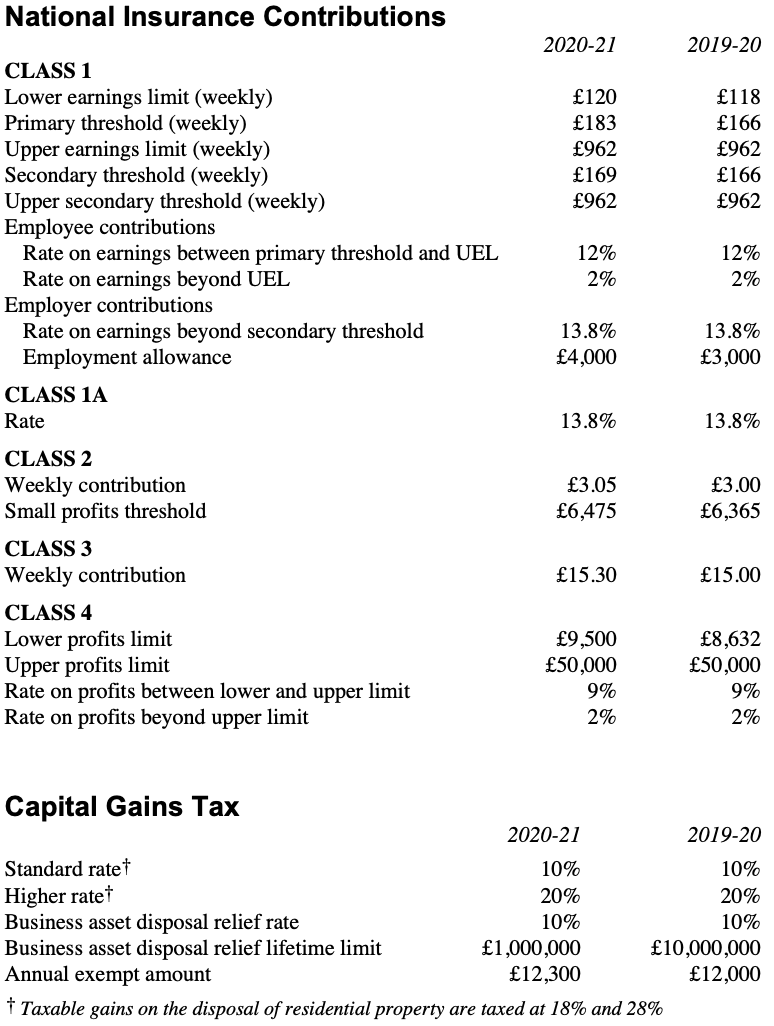

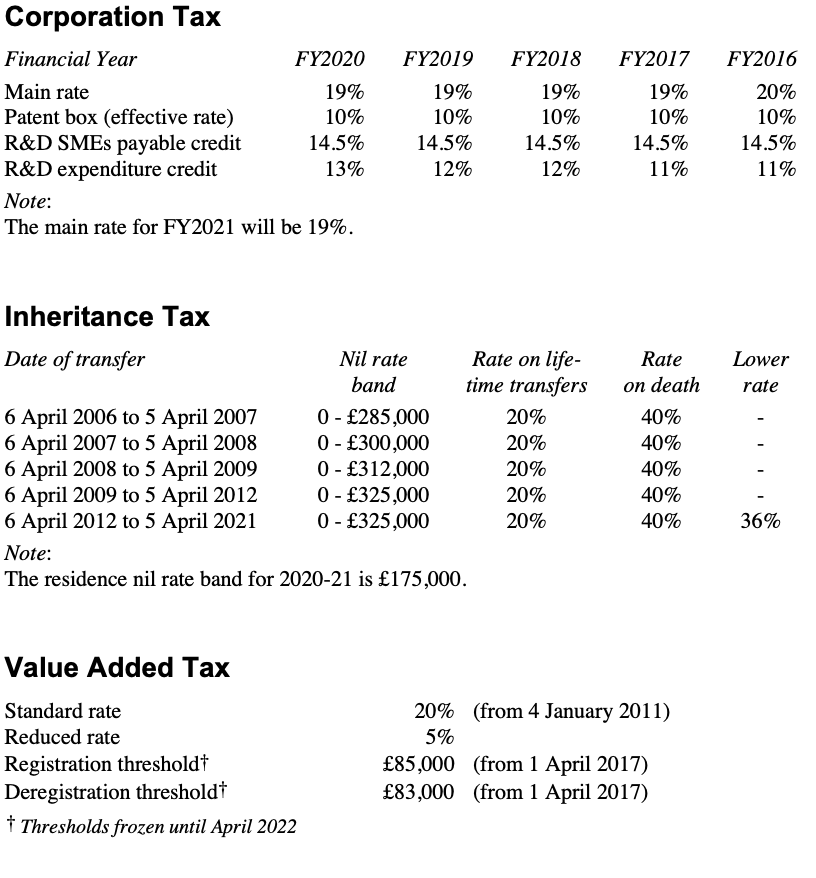

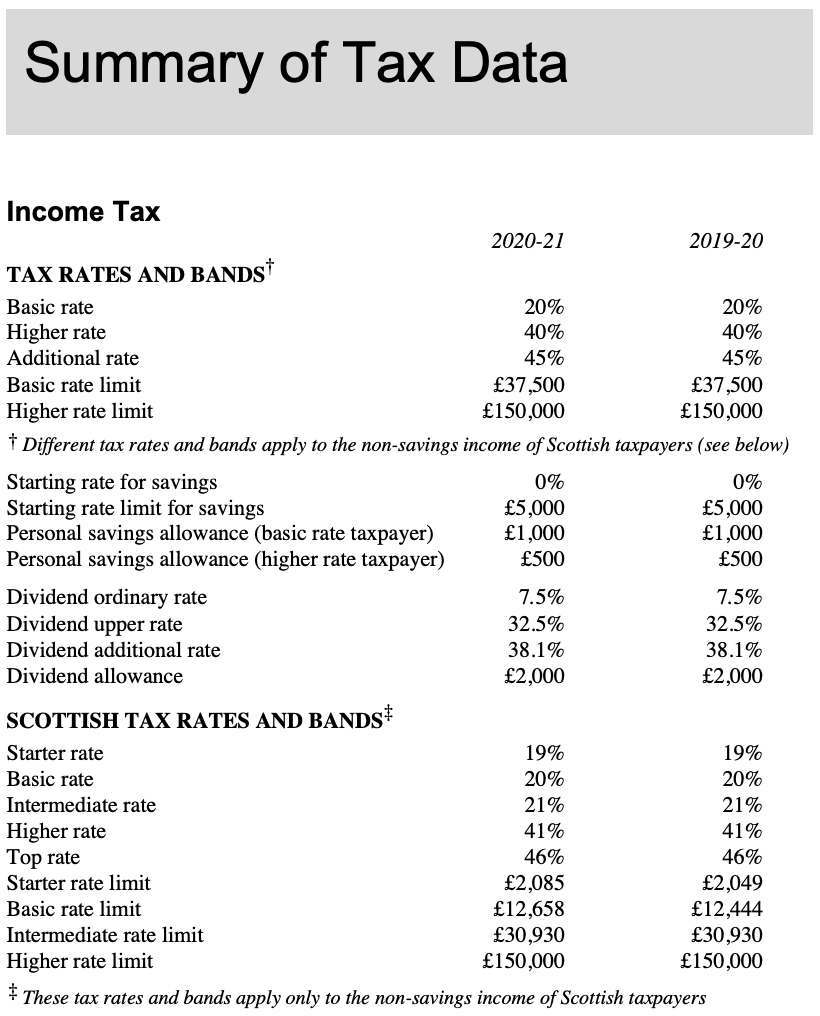

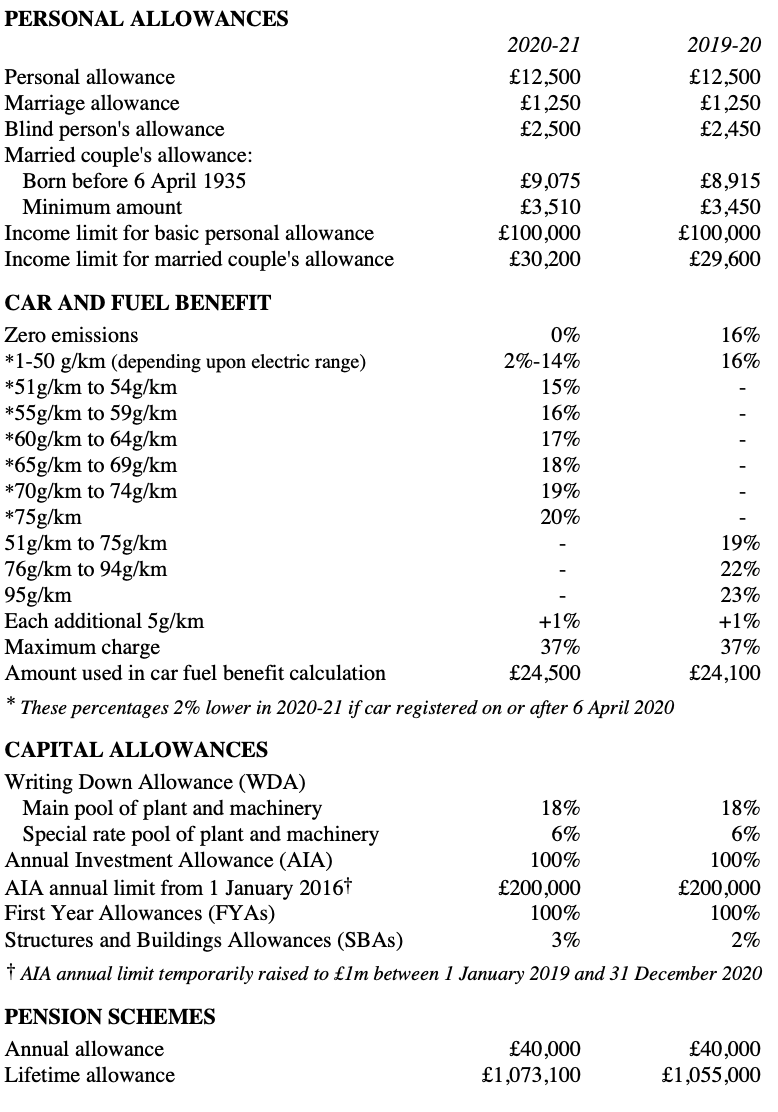

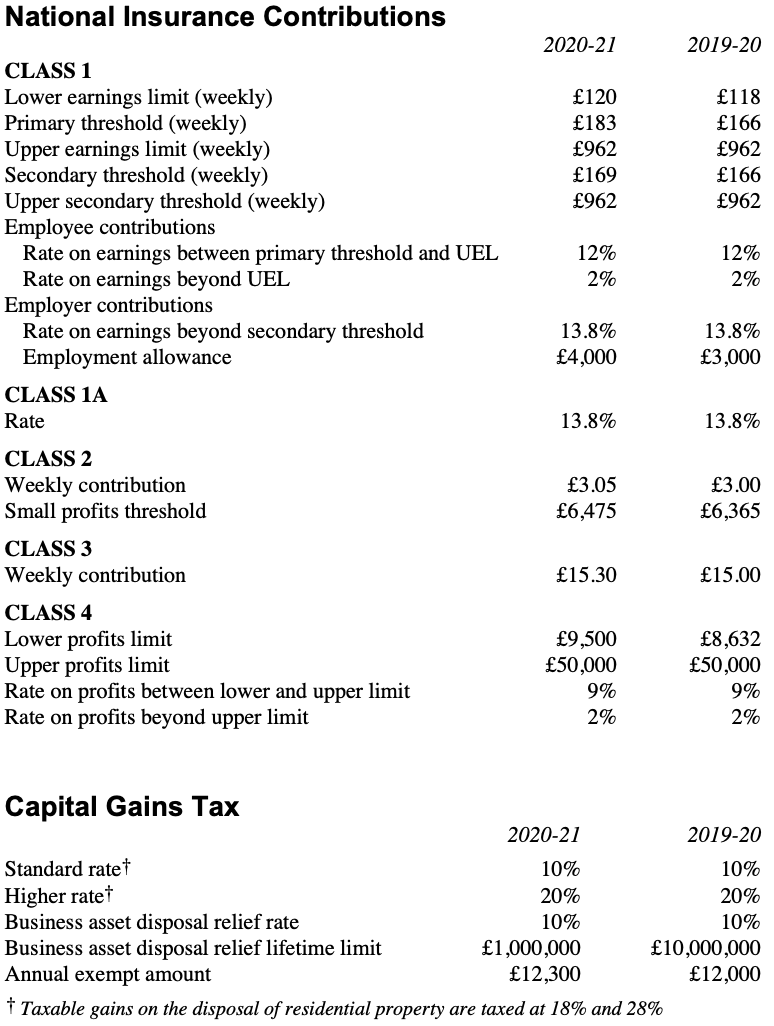

IF NEEDED, below is tax rate and allowances information:

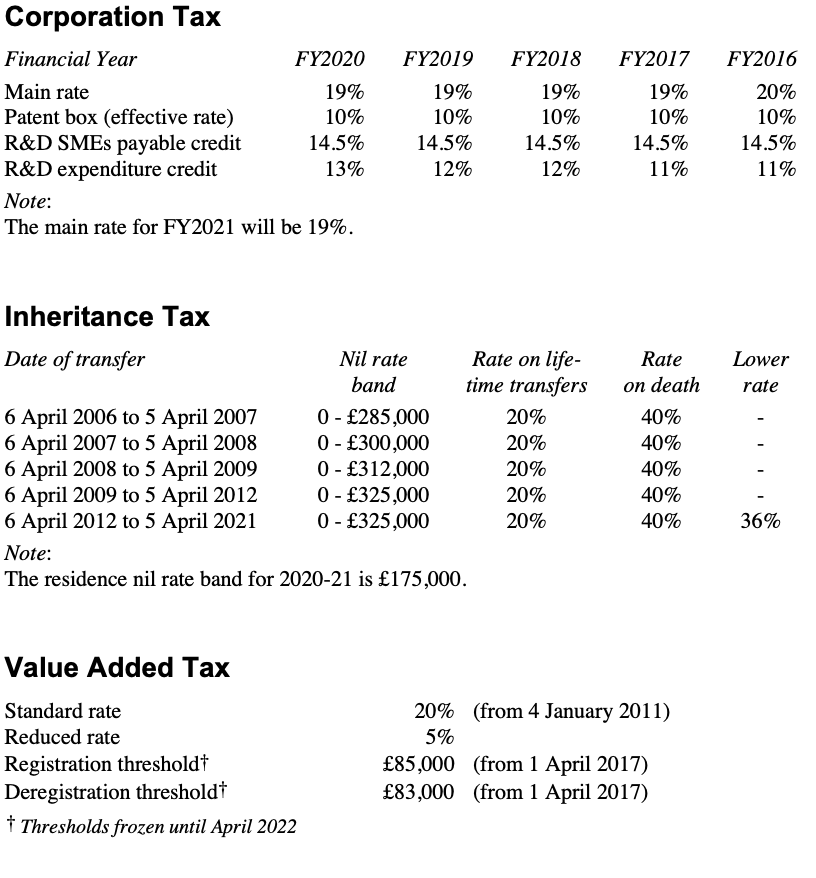

Summary of Tax Data Income Tax 2020-21 2019-20 TAX RATES AND BANDS Basic rate 20% 20% Higher rate 40% 40% Additional rate 45% 45% Basic rate limit 37,500 37,500 Higher rate limit 150,000 150,000 + Different tax rates and bands apply to the non-savings income of Scottish taxpayers (see below) 0% Starting rate for savings Starting rate limit for savings Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) 5,000 1,000 500 0% 5,000 1,000 500 7.5% 7.5% 32.5% 32.5% Dividend ordinary rate Dividend upper rate Dividend additional rate Dividend allowance 38.1% 2,000 38.1% 2,000 SCOTTISH TAX RATES AND BANDS Starter rate 19% 19% Basic rate 20% 20% Intermediate rate 21% 21% Higher rate 41% 41% Top rate 46% 46% Starter rate limit 2,085 2,049 Basic rate limit 12,658 12,444 Intermediate rate limit 30,930 30,930 Higher rate limit 150,000 150,000 These tax rates and bands apply only to the non-savings income of Scottish taxpayers PERSONAL ALLOWANCES 2020-21 2019-20 12,500 1,250 2,500 12,500 1,250 2,450 Personal allowance Marriage allowance Blind person's allowance Married couple's allowance: Born before 6 April 1935 Minimum amount Income limit for basic personal allowance Income limit for married couple's allowance 9,075 3,510 100,000 30,200 8,915 3,450 100,000 29,600 CAR AND FUEL BENEFIT 16% 16% Zero emissions 0% *1-50 g/km (depending upon electric range) 2%-14% *51g/km to 54g/km 15% *55g/km to 59g/km 16% *60g/km to 64g/km 17% *65g/km to 69g/km 18% *70g/km to 74g/km 19% *75g/km 20% 51g/km to 75g/km 76g/km to 94g/km 95g/km Each additional 5g/km +1% Maximum charge 37% Amount used in car fuel benefit calculation 24,500 * These percentages 2% lower in 2020-21 if car registered on or after 6 April 2020 19% 22% 23% +1% 37% 24,100 CAPITAL ALLOWANCES Writing Down Allowance (WDA) Main pool of plant and machinery 18% 18% Special rate pool of plant and machinery 6% 6% Annual Investment Allowance (AIA) 100% 100% AIA annual limit from 1 January 20167 200,000 200,000 First Year Allowances (FYAs) 100% 100% Structures and Buildings Allowances (SBAs) 3% 2% AIA annual limit temporarily raised to lm between 1 January 2019 and 31 December 2020 PENSION SCHEMES Annual allowance 40,000 1,073,100 40,000 1,055,000 Lifetime allowance National Insurance Contributions 2020-21 2019-20 120 183 118 166 962 166 962 169 962 962 CLASS 1 Lower earnings limit (weekly) Primary threshold (weekly) Upper earnings limit (weekly) Secondary threshold (weekly) Upper secondary threshold (weekly) Employee contributions Rate on earnings between primary threshold and UEL Rate on earnings beyond UEL Employer contributions Rate on earnings beyond secondary threshold Employment allowance 12% 2% 12% 2% 13.8% 13.8% 4,000 3,000 CLASS 1A Rate 13.8% 13.8% CLASS 2 Weekly contribution Small profits threshold 3.00 3.05 6,475 6,365 CLASS 3 Weekly contribution 15.30 15.00 CLASS 4 Lower profits limit Upper profits limit Rate on profits between lower and upper limit Rate on profits beyond upper limit 9,500 50,000 9% 2% 8,632 50,000 9% 2% Capital Gains Tax 2020-21 2019-20 Standard ratet 10% 10% Higher ratet 20% 20% Business asset disposal relief rate 10% 10% Business asset disposal relief lifetime limit 1,000,000 10,000,000 Annual exempt amount 12,300 12,000 Taxable gains on the disposal of residential property are taxed at 18% and 28% Corporation Tax Financial Year FY2020 FY2019 FY2018 FY2017 FY2016 19% 10% 14.5% 12% Main rate 19% Patent box (effective rate) 10% R&D SMEs payable credit 14.5% R&D expenditure credit 13% Note: The main rate for FY2021 will be 19%. 19% 10% 14.5% 12% 19% 10% 14.5% 20% 10% 14.5% 11% 11% Inheritance Tax Lower Rate on death rate 40% Date of transfer Nil rate Rate on life- band time transfers 6 April 2006 to 5 April 2007 0 - 285,000 20% 6 April 2007 to 5 April 2008 0 - 300,000 20% 6 April 2008 to 5 April 2009 0 - 312,000 20% 6 April 2009 to 5 April 2012 0 - 325,000 20% 6 April 2012 to 5 April 2021 0 - 325,000 20% Note: The residence nil rate band for 2020-21 is 175,000. 40% 40% 40% 40% 36% Value Added Tax Standard rate Reduced rate Registration thresholdt Deregistration thresholdt Thresholds frozen until April 2022 20% (from 4 January 2011) 5% 85,000 (from 1 April 2017) 83,000 (from 1 April 2017) Summary of Tax Data Income Tax 2020-21 2019-20 TAX RATES AND BANDS Basic rate 20% 20% Higher rate 40% 40% Additional rate 45% 45% Basic rate limit 37,500 37,500 Higher rate limit 150,000 150,000 + Different tax rates and bands apply to the non-savings income of Scottish taxpayers (see below) 0% Starting rate for savings Starting rate limit for savings Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) 5,000 1,000 500 0% 5,000 1,000 500 7.5% 7.5% 32.5% 32.5% Dividend ordinary rate Dividend upper rate Dividend additional rate Dividend allowance 38.1% 2,000 38.1% 2,000 SCOTTISH TAX RATES AND BANDS Starter rate 19% 19% Basic rate 20% 20% Intermediate rate 21% 21% Higher rate 41% 41% Top rate 46% 46% Starter rate limit 2,085 2,049 Basic rate limit 12,658 12,444 Intermediate rate limit 30,930 30,930 Higher rate limit 150,000 150,000 These tax rates and bands apply only to the non-savings income of Scottish taxpayers PERSONAL ALLOWANCES 2020-21 2019-20 12,500 1,250 2,500 12,500 1,250 2,450 Personal allowance Marriage allowance Blind person's allowance Married couple's allowance: Born before 6 April 1935 Minimum amount Income limit for basic personal allowance Income limit for married couple's allowance 9,075 3,510 100,000 30,200 8,915 3,450 100,000 29,600 CAR AND FUEL BENEFIT 16% 16% Zero emissions 0% *1-50 g/km (depending upon electric range) 2%-14% *51g/km to 54g/km 15% *55g/km to 59g/km 16% *60g/km to 64g/km 17% *65g/km to 69g/km 18% *70g/km to 74g/km 19% *75g/km 20% 51g/km to 75g/km 76g/km to 94g/km 95g/km Each additional 5g/km +1% Maximum charge 37% Amount used in car fuel benefit calculation 24,500 * These percentages 2% lower in 2020-21 if car registered on or after 6 April 2020 19% 22% 23% +1% 37% 24,100 CAPITAL ALLOWANCES Writing Down Allowance (WDA) Main pool of plant and machinery 18% 18% Special rate pool of plant and machinery 6% 6% Annual Investment Allowance (AIA) 100% 100% AIA annual limit from 1 January 20167 200,000 200,000 First Year Allowances (FYAs) 100% 100% Structures and Buildings Allowances (SBAs) 3% 2% AIA annual limit temporarily raised to lm between 1 January 2019 and 31 December 2020 PENSION SCHEMES Annual allowance 40,000 1,073,100 40,000 1,055,000 Lifetime allowance National Insurance Contributions 2020-21 2019-20 120 183 118 166 962 166 962 169 962 962 CLASS 1 Lower earnings limit (weekly) Primary threshold (weekly) Upper earnings limit (weekly) Secondary threshold (weekly) Upper secondary threshold (weekly) Employee contributions Rate on earnings between primary threshold and UEL Rate on earnings beyond UEL Employer contributions Rate on earnings beyond secondary threshold Employment allowance 12% 2% 12% 2% 13.8% 13.8% 4,000 3,000 CLASS 1A Rate 13.8% 13.8% CLASS 2 Weekly contribution Small profits threshold 3.00 3.05 6,475 6,365 CLASS 3 Weekly contribution 15.30 15.00 CLASS 4 Lower profits limit Upper profits limit Rate on profits between lower and upper limit Rate on profits beyond upper limit 9,500 50,000 9% 2% 8,632 50,000 9% 2% Capital Gains Tax 2020-21 2019-20 Standard ratet 10% 10% Higher ratet 20% 20% Business asset disposal relief rate 10% 10% Business asset disposal relief lifetime limit 1,000,000 10,000,000 Annual exempt amount 12,300 12,000 Taxable gains on the disposal of residential property are taxed at 18% and 28% Corporation Tax Financial Year FY2020 FY2019 FY2018 FY2017 FY2016 19% 10% 14.5% 12% Main rate 19% Patent box (effective rate) 10% R&D SMEs payable credit 14.5% R&D expenditure credit 13% Note: The main rate for FY2021 will be 19%. 19% 10% 14.5% 12% 19% 10% 14.5% 20% 10% 14.5% 11% 11% Inheritance Tax Lower Rate on death rate 40% Date of transfer Nil rate Rate on life- band time transfers 6 April 2006 to 5 April 2007 0 - 285,000 20% 6 April 2007 to 5 April 2008 0 - 300,000 20% 6 April 2008 to 5 April 2009 0 - 312,000 20% 6 April 2009 to 5 April 2012 0 - 325,000 20% 6 April 2012 to 5 April 2021 0 - 325,000 20% Note: The residence nil rate band for 2020-21 is 175,000. 40% 40% 40% 40% 36% Value Added Tax Standard rate Reduced rate Registration thresholdt Deregistration thresholdt Thresholds frozen until April 2022 20% (from 4 January 2011) 5% 85,000 (from 1 April 2017) 83,000 (from 1 April 2017)