Answered step by step

Verified Expert Solution

Question

1 Approved Answer

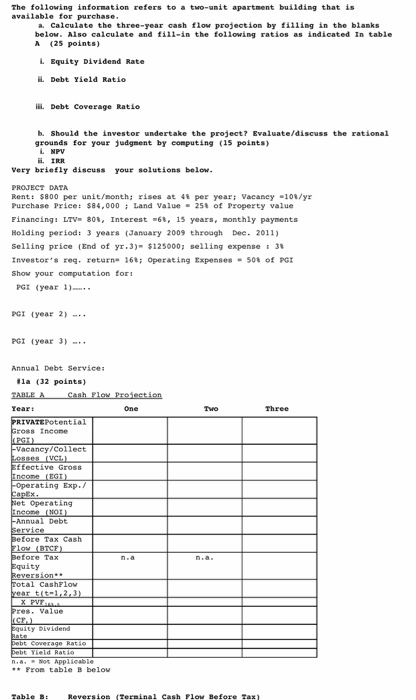

The following information refers to a two-unit apartment building that is available for purchase. Calculate the three-year cash flow projection by filling in the blanks

The following information refers to a two-unit apartment building that is available for purchase.

Calculate the three-year cash flow projection by filling in the blanks below. Also calculate and fill-in the following ratios as indicated In table A (25 points)

Equity Dividend Rate

Debt Yield Ratio

Debt Coverage Ratio

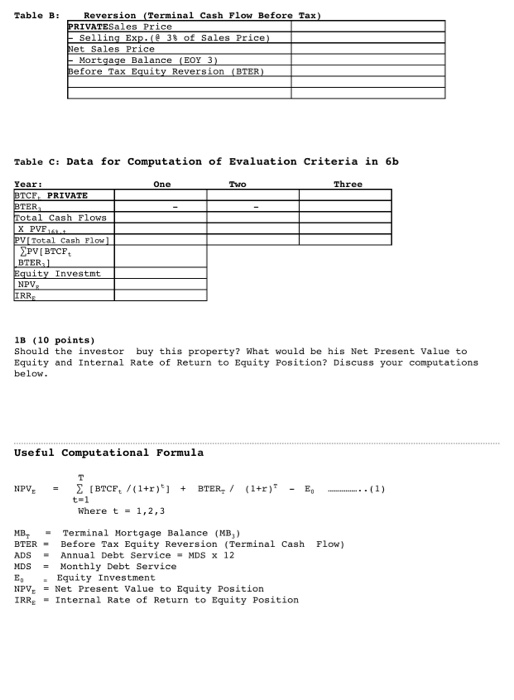

Should the investor undertake the project? Evaluate/discuss the rational grounds for your judgment by computing (15 points)

NPV

IRR

Very briefly discuss your solutions below.

PROJECT DATA

Rent: $800 per unit/month; rises at 4% per year; Vacancy =10%/yr

Purchase Price: $84,000 ; Land Value = 25% of Property valueFinancing: LTV= 80%, Interest =6%, 15 years, monthly payments Holding period: 3 years (January 2009 through Dec. 2011) Selling price (End of yr.3)= $125000; selling expense : 3%Investors req. return= 16%; Operating Expenses = 50% of PGI Show your computation for:

PGI (year 1)..

PGI (year 2) ..

PGI (year 3) ..

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started