Answered step by step

Verified Expert Solution

Question

1 Approved Answer

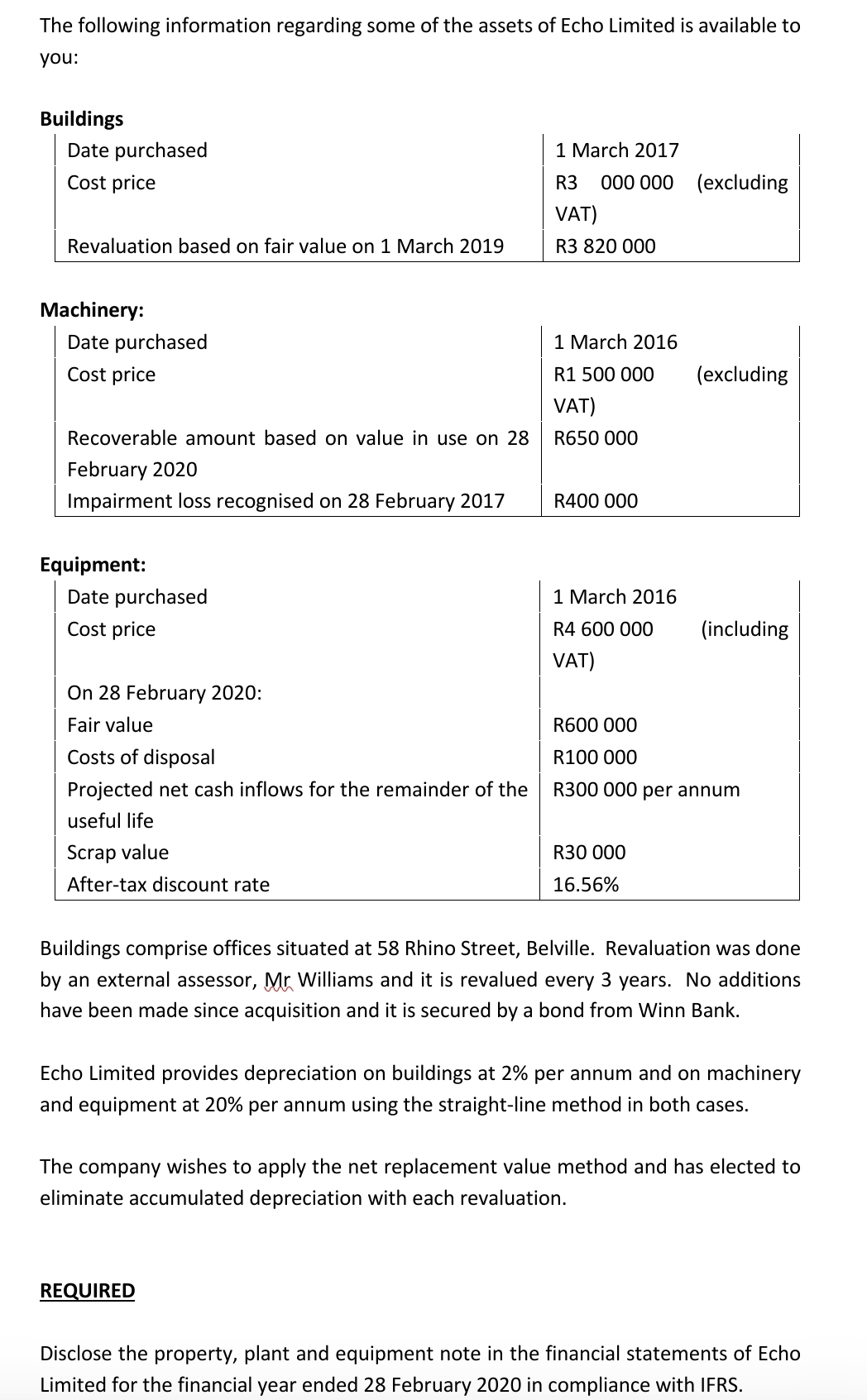

The following information regarding some of the assets of Echo Limited is available to you: Buildings Date purchased Cost price Revaluation based on fair

The following information regarding some of the assets of Echo Limited is available to you: Buildings Date purchased Cost price Revaluation based on fair value on 1 March 2019 1 March 2017 R3 000 000 (excluding VAT) R3 820 000 Machinery: Date purchased Cost price Recoverable amount based on value in use on 28 February 2020 Impairment loss recognised on 28 February 2017 Equipment: Date purchased Cost price On 28 February 2020: Fair value Costs of disposal Projected net cash inflows for the remainder of the useful life Scrap value After-tax discount rate 1 March 2016 R1 500 000 VAT) R650 000 R400 000 1 March 2016 R4 600 000 VAT) (excluding (including R600 000 R100 000 R300 000 per annum R30 000 16.56% Buildings comprise offices situated at 58 Rhino Street, Belville. Revaluation was done by an external assessor, Mr Williams and it is revalued every 3 years. No additions have been made since acquisition and it is secured by a bond from Winn Bank. Echo Limited provides depreciation on buildings at 2% per annum and on machinery and equipment at 20% per annum using the straight-line method in both cases. The company wishes to apply the net replacement value method and has elected to eliminate accumulated depreciation with each revaluation. REQUIRED Disclose the property, plant and equipment note in the financial statements of Echo Limited for the financial year ended 28 February 2020 in compliance with IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started