The following information regarding two shares- the Erongo Ltd equity share and Cunene Ltd's equity share. State of the economy Probability Recession Moderate Expansionary

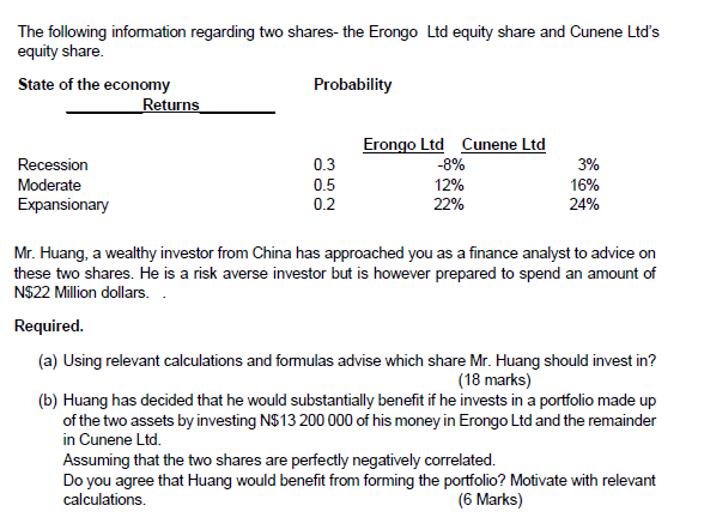

The following information regarding two shares- the Erongo Ltd equity share and Cunene Ltd's equity share. State of the economy Probability Recession Moderate Expansionary Returns Erongo Ltd Cunene Ltd 0.3 -8% 3% 0.5 12% 16% 0.2 22% 24% Mr. Huang, a wealthy investor from China has approached you as a finance analyst to advice on these two shares. He is a risk averse investor but is however prepared to spend an amount of N$22 Million dollars.. Required. (a) Using relevant calculations and formulas advise which share Mr. Huang should invest in? (18 marks) (b) Huang has decided that he would substantially benefit if he invests in a portfolio made up of the two assets by investing N$13 200 000 of his money in Erongo Ltd and the remainder in Cunene Ltd. Assuming that the two shares are perfectly negatively correlated. Do you agree that Huang would benefit from forming the portfolio? Motivate with relevant calculations. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started