Question

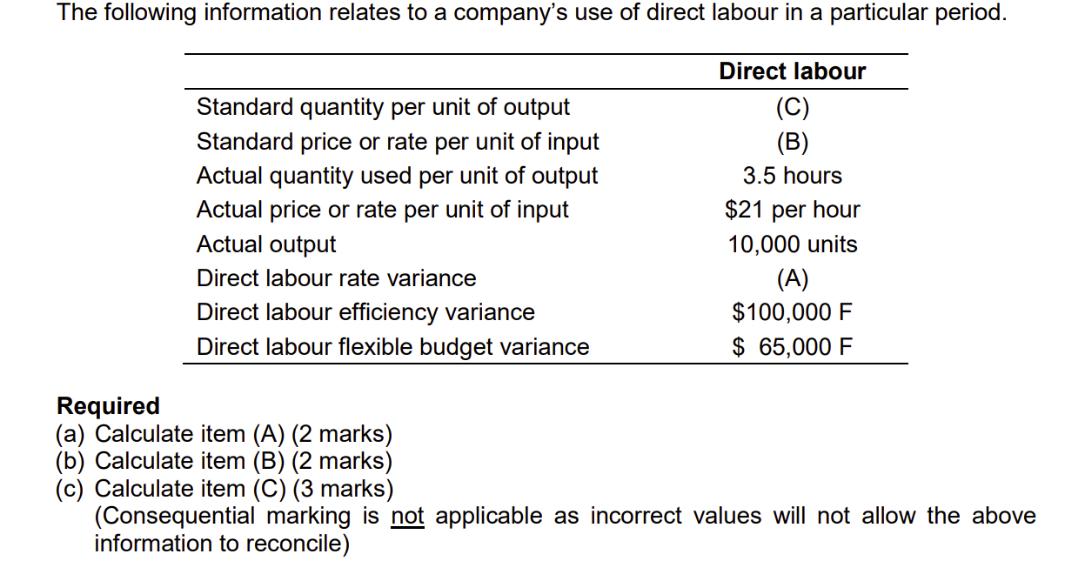

The following information relates to a company's use of direct labour in a particular period. Direct labour (C) (B) 3.5 hours $21 per hour

The following information relates to a company's use of direct labour in a particular period. Direct labour (C) (B) 3.5 hours $21 per hour 10,000 units Standard quantity per unit of output Standard price or rate per unit of input Actual quantity used per unit of output Actual price or rate per unit of input Actual output Direct labour rate variance Direct labour efficiency variance Direct labour flexible budget variance Required (a) Calculate item (A) (2 marks) (b) Calculate item (2 marks) (A) $100,000 F $ 65,000 F (c) Calculate item (C) (3 marks) (Consequential marking is not applicable as incorrect values will not allow the above information to reconcile)

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate item A Direct labor rate variance The direct labor rate variance measures the difference ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Kim Langfield Smith, Helen Thorne, David Alan Smith, Ronald W. Hilton

7th Edition

978-1760421144, 1760421146

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App