Answered step by step

Verified Expert Solution

Question

1 Approved Answer

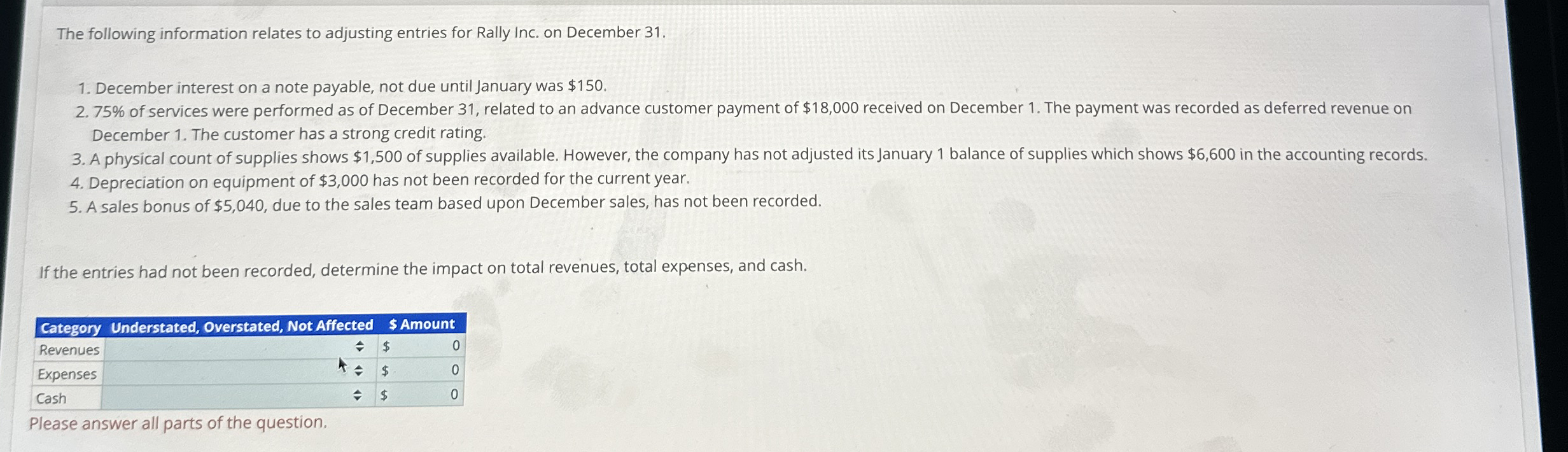

The following information relates to adjusting entries for Rally Inc. on December 3 1 . December interest on a note payable, not due until January

The following information relates to adjusting entries for Rally Inc. on December

December interest on a note payable, not due until January was $

of services were performed as of December related to an advance customer payment of $ received on December The payment was recorded as deferred revenue on

December The customer has a strong credit rating.

A physical count of supplies shows $ of supplies available. However, the company has not adjusted its January balance of supplies which shows $ in the accounting records.

Depreciation on equipment of $ has not been recorded for the current year.

A sales bonus of $ due to the sales team based upon December sales, has not been recorded.

If the entries had not been recorded, determine the impact on total revenues, total expenses, and cash.

Please answer all parts of the question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started