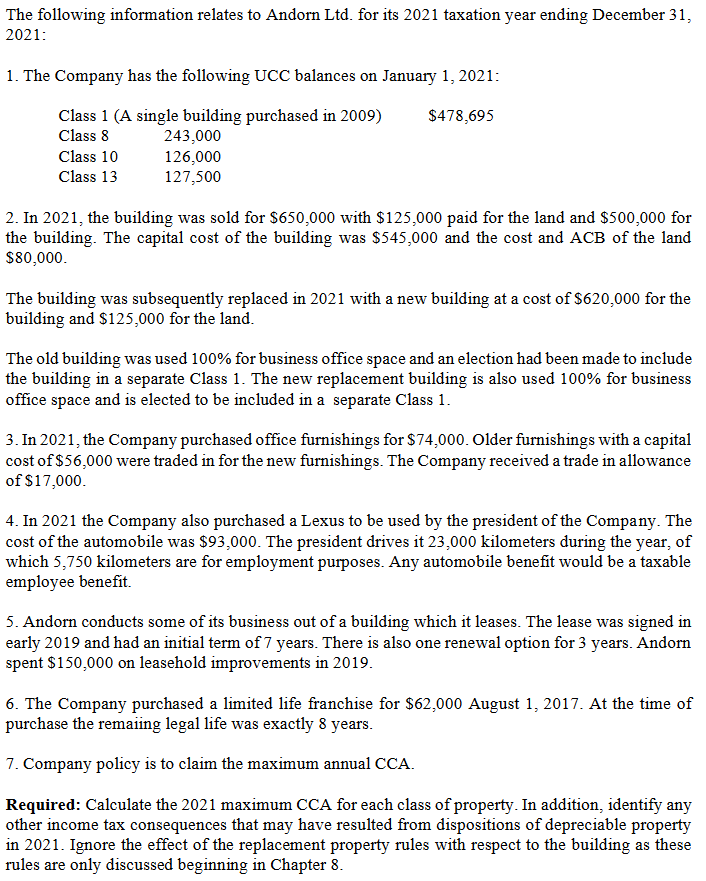

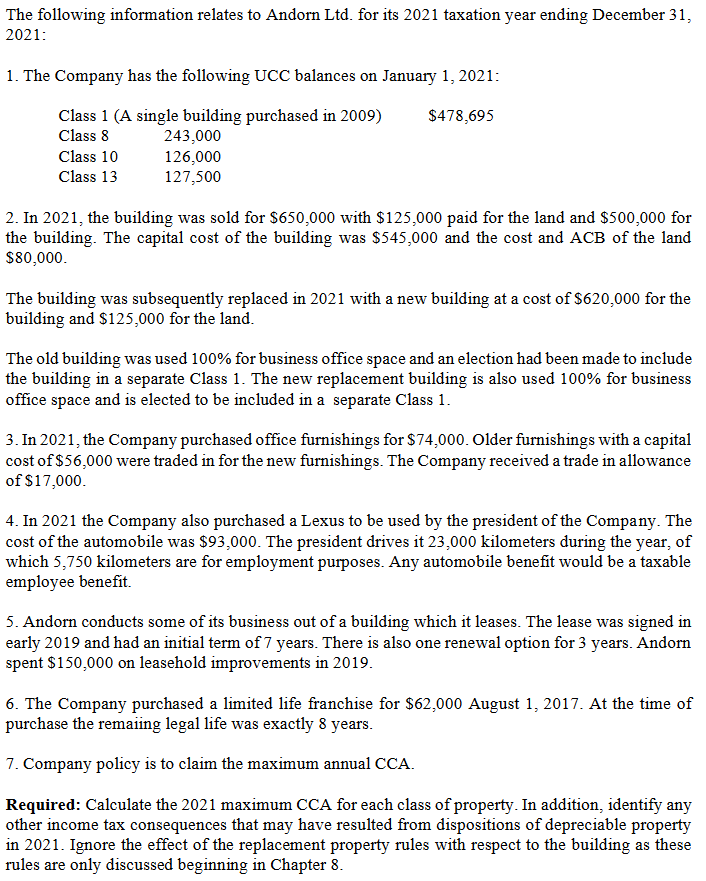

The following information relates to Andorn Ltd. for its 2021 taxation year ending December 31, 2021: 1. The Company has the following UCC balances on January 1, 2021: $478,695 Class 1 (A single building purchased in 2009) Class 8 243,000 Class 10 126,000 Class 13 127,500 2. In 2021, the building was sold for $650,000 with $125,000 paid for the land and $500,000 for the building. The capital cost of the building was $545,000 and the cost and ACB of the land $80,000 The building was subsequently replaced in 2021 with a new building at a cost of $620,000 for the building and $125,000 for the land. The old building was used 100% for business office space and an election had been made to include the building in a separate Class 1. The new replacement building is also used 100% for business office space and is elected to be included in a separate Class 1. 3. In 2021, the Company purchased office furnishings for $74,000. Older furnishings with a capital cost of $56,000 were traded in for the new furnishings. The Company received a trade in allowance of $17,000. 4. In 2021 the Company also purchased a Lexus to be used by the president of the Company. The cost of the automobile was $93,000. The president drives it 23,000 kilometers during the year, of which 5,750 kilometers are for employment purposes. Any automobile benefit would be a taxable employee benefit. 5. Andorn conducts some of its business out of a building which it leases. The lease was signed in early 2019 and had an initial term of 7 years. There is also one renewal option for 3 years. Andorn spent $150,000 on leasehold improvements in 2019. 6. The Company purchased a limited life franchise for $62,000 August 1, 2017. At the time of purchase the remaiing legal life was exactly 8 years. 7. Company policy is to claim the maximum annual CCA. Required: Calculate the 2021 maximum CCA for each class of property. In addition, identify any other income tax consequences that may have resulted from dispositions of depreciable property in 2021. Ignore the effect of the replacement property rules with respect to the building as these rules are only discussed beginning in Chapter 8. The following information relates to Andorn Ltd. for its 2021 taxation year ending December 31, 2021: 1. The Company has the following UCC balances on January 1, 2021: $478,695 Class 1 (A single building purchased in 2009) Class 8 243,000 Class 10 126,000 Class 13 127,500 2. In 2021, the building was sold for $650,000 with $125,000 paid for the land and $500,000 for the building. The capital cost of the building was $545,000 and the cost and ACB of the land $80,000 The building was subsequently replaced in 2021 with a new building at a cost of $620,000 for the building and $125,000 for the land. The old building was used 100% for business office space and an election had been made to include the building in a separate Class 1. The new replacement building is also used 100% for business office space and is elected to be included in a separate Class 1. 3. In 2021, the Company purchased office furnishings for $74,000. Older furnishings with a capital cost of $56,000 were traded in for the new furnishings. The Company received a trade in allowance of $17,000. 4. In 2021 the Company also purchased a Lexus to be used by the president of the Company. The cost of the automobile was $93,000. The president drives it 23,000 kilometers during the year, of which 5,750 kilometers are for employment purposes. Any automobile benefit would be a taxable employee benefit. 5. Andorn conducts some of its business out of a building which it leases. The lease was signed in early 2019 and had an initial term of 7 years. There is also one renewal option for 3 years. Andorn spent $150,000 on leasehold improvements in 2019. 6. The Company purchased a limited life franchise for $62,000 August 1, 2017. At the time of purchase the remaiing legal life was exactly 8 years. 7. Company policy is to claim the maximum annual CCA. Required: Calculate the 2021 maximum CCA for each class of property. In addition, identify any other income tax consequences that may have resulted from dispositions of depreciable property in 2021. Ignore the effect of the replacement property rules with respect to the building as these rules are only discussed beginning in Chapter 8