Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to Ballard Company for there year ended December 31, 2019. For 2019, Ballard reported pre-tax financial income of $250,000. The

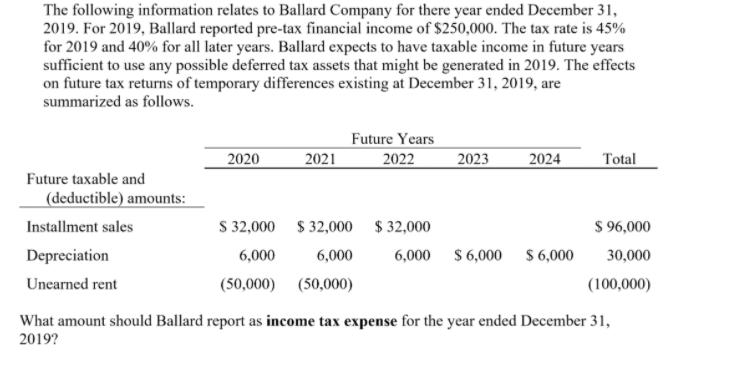

The following information relates to Ballard Company for there year ended December 31, 2019. For 2019, Ballard reported pre-tax financial income of $250,000. The tax rate is 45% for 2019 and 40% for all later years. Ballard expects to have taxable income in future years sufficient to use any possible deferred tax assets that might be generated in 2019. The effects on future tax returns of temporary differences existing at December 31, 2019, are summarized as follows. Future taxable and (deductible) amounts: Installment sales Depreciation Unearned rent 2020 2021 Future Years 2022 $ 32,000 $32,000 6,000 6,000 (50,000) (50,000) $32,000 2023 2024 6,000 $ 6,000 $ 6,000 Total $ 96,000 30,000 (100,000) What amount should Ballard report as income tax expense for the year ended December 31, 2019?

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer5 Income tax expense for December 312019 Calculation Pretax fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started