The following information relates to Baskin Ltd for the year ended 30 June 2021. The company accountant has prepared the drafts of the financial

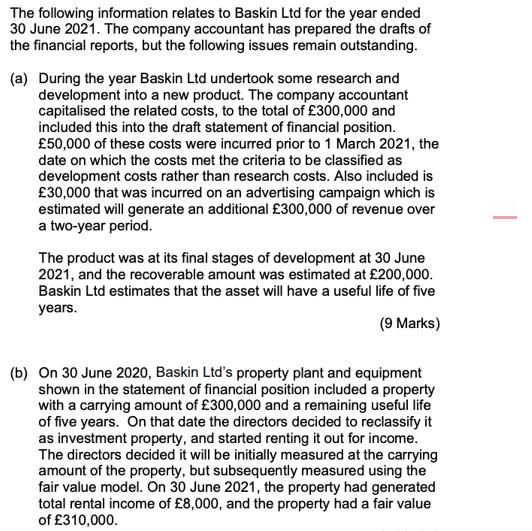

The following information relates to Baskin Ltd for the year ended 30 June 2021. The company accountant has prepared the drafts of the financial reports, but the following issues remain outstanding. (a) During the year Baskin Ltd undertook some research and development into a new product. The company accountant capitalised the related costs, to the total of 300,000 and included this into the draft statement of financial position. 50,000 of these costs were incurred prior to 1 March 2021, the date on which the costs met the criteria to be classified as development costs rather than research costs. Also included is 30,000 that was incurred on an advertising campaign which is estimated will generate an additional 300,000 of revenue over a two-year period. The product was at its final stages of development at 30 June 2021, and the recoverable amount was estimated at 200,000. Baskin Ltd estimates that the asset will have a useful life of five years. (9 Marks) (b) On 30 June 2020, Baskin Ltd's property plant and equipment shown in the statement of financial position included a property with a carrying amount of 300,000 and a remaining useful life of five years. On that date the directors decided to reclassify it as investment property, and started renting it out for income. The directors decided it will be initially measured at the carrying amount of the property, but subsequently measured using the fair value model. On 30 June 2021, the property had generated total rental income of 8,000, and the property had a fair value of 310,000. (c) At the beginning of the financial year Baskin Ltd began the construction of Asset A. The asset was not ready for use at year end. The following payments are related to it: Site preparation Materials used 50,000 245,000 75,000 2,000 300,000 Labour costs Professional fees Overheads The cost of materials used includes material that had cost 25,000 that was ruined when the warehouse housing supplies of the material was flooded. Overheads comprise overheads of 120,000 related to the construction of the asset and overheads of 180,000 that are general to the business as a whole. The above costs have all been included in the figures for Property, plant and equipment. (8 Marks) (Relevant standards: IAS 16, IAS 38, and IAS 40) Required: Explain the required IFRS financial reporting treatment of Issues (a) to (c) above in Baskin Ltd's financial statements for the year ended 30 June 2021, preparing all relevant calculations. (Total 25 marks)

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Que2A Recognition of Asset An Intangible asset shall be recognised only if as per Ind As 38 1 It satisfies the criteria of recognition ie it is Identi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started