Answered step by step

Verified Expert Solution

Question

1 Approved Answer

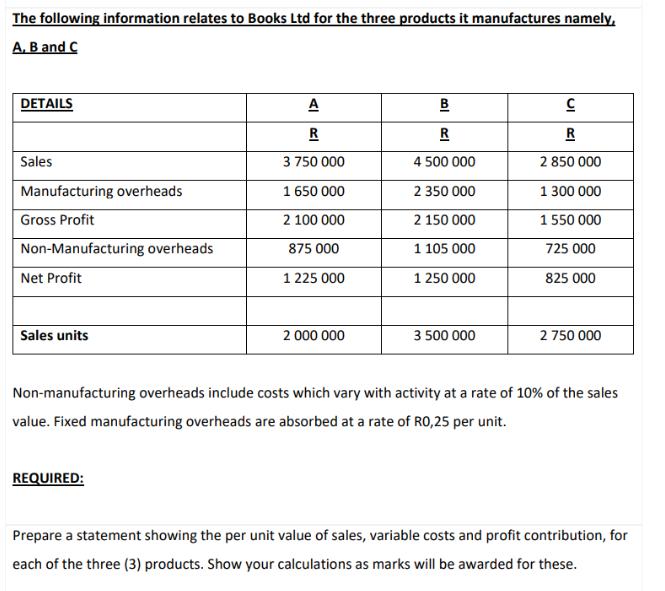

The following information relates to Books Ltd for the three products it manufactures namely, A, B and C DETAILS Sales Manufacturing overheads Gross Profit

The following information relates to Books Ltd for the three products it manufactures namely, A, B and C DETAILS Sales Manufacturing overheads Gross Profit Non-Manufacturing overheads Net Profit Sales units A R 3 750 000 1 650 000 2 100 000 875 000 REQUIRED: 1 225 000 2 000 000 B R 4 500 000 2 350 000 2 150 000 1 105 000 1 250 000 3 500 000 C R 2 850 000 1 300 000 1 550 000 725 000 825 000 2 750 000 Non-manufacturing overheads include costs which vary with activity at a rate of 10% of the sales value. Fixed manufacturing overheads are absorbed at a rate of R0,25 per unit. Prepare a statement showing the per unit value of sales, variable costs and profit contribution, for each of the three (3) products. Show your calculations as marks will be awarded for these.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the per unit value of sales variable costs and profit contribution for each of the three products A B and C we will use the provided info...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started