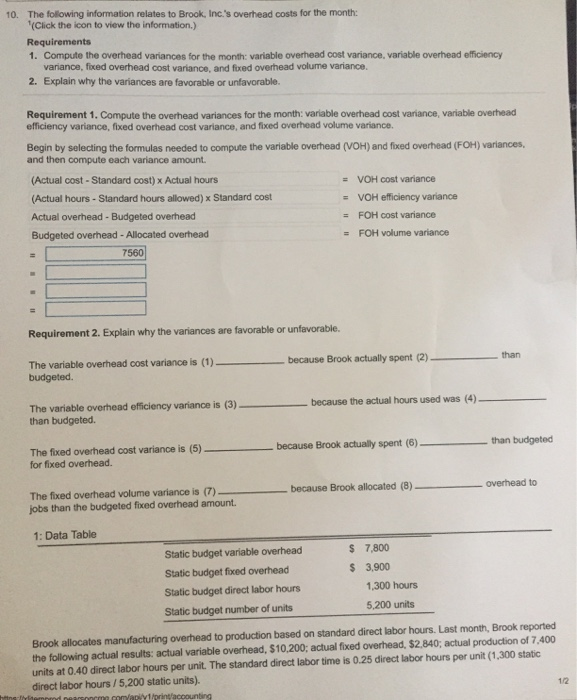

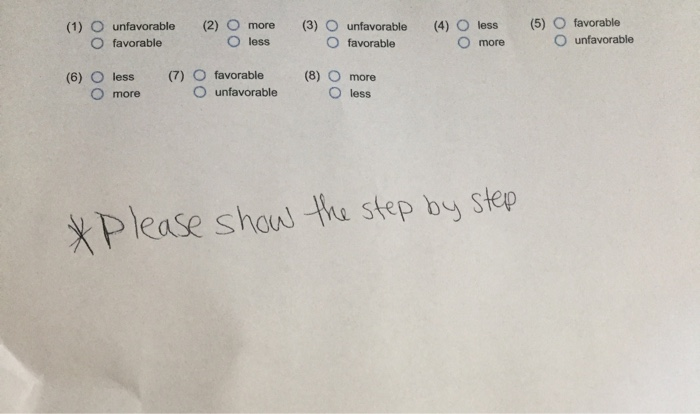

The following information relates to Brook, Inc.'s overhead costs for the month: (Click the icon to view the information.) 10. Requirements 1. Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. 2. Explain why the variances are favorable or unfavorable. Requirement 1, Compute the overhead variances for the month: variable overhead cost variance, variable overhead efficiency variance, fixed overhead cost variance, and fixed overhead volume variance. Begin by selecting the formulas needed to compute the variable overhead (VOH) and fixed overhead (FOH) variances, and then compute each variance amount. VOH cost variance (Actual cost- Standard cost) x Actual hours VOH efficiency variance (Actual hours Standard hours allowed) x Standard cost FOH cost variance Actual overhead - Budgeted overhead - FOH volume variance Budgeted overhead - Allocated overhead 7560 Requirement 2. Explain why the variances are favorable or unfavorable. than because Brook actually spent (2) The variable overhead cost variance is (1) budgeted. because the actual hours used was (4) The variable overhead efficiency variance is (3) than budgeted than budgeted because Brook actually spent (6) The fixed overhead cost variance is (5) for fixed overhead. overhead to because Brook allocated (8) The fixed overhead volume variance is (7) jobs than the budgeted fixed overhead amount. 1: Data Table $ 7,800 Static budget variable overhead $ 3,900 Static budget fixed overhead 1,300 hours Static budget direct labor hours 5,200 units Static budget number of units Brook allocates manufacturing overhead to production based on standard direct labor hours. Last month, Brook reported the following actual results:: actual variable overhead, $10,200; actual fixed overhead, $2.840; actual production of 7,400 units at 0.40 direct labor hours per unit. The standard direct labor time is 0.25 direct labor hours per unit (1,300 static direct labor hours/5,200 static units). https firlitemprd nearsoncmo com/apiy1/printfaccounting 1/2 (5) O favorable O unfavorable (2) (3) (1) O unfavorable (4) O less unfavorable more less favorable favorable more (7) O favorable (8) Omore (6) O less unfavorable less more Please show the step by step 121 E