Answered step by step

Verified Expert Solution

Question

1 Approved Answer

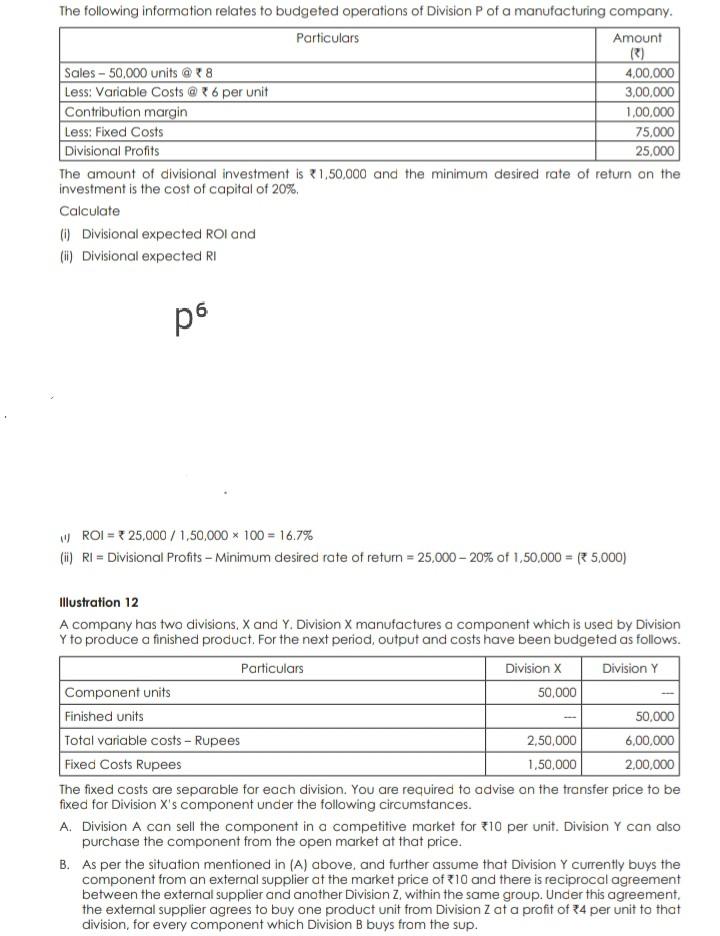

The following information relates to budgeted operations of Division P of a manufacturing company. Particulars Amount R] Sales - 50,000 units @ 8 4,00.000 Less:

The following information relates to budgeted operations of Division P of a manufacturing company. Particulars Amount R] Sales - 50,000 units @ 8 4,00.000 Less: Variable Costs @ +6 per unit 3,00,000 Contribution margin 1,00,000 Less: Fixed Costs 75,000 Divisional Profits 25,000 The amount of divisional investment is 1.50,000 and the minimum desired rate of return on the investment is the cost of capital of 20% Calculate (0) Divisional expected ROI and (H) Divisional expected RI + W ROI = 25,000/1,50,000 x 100 = 16.7% (ii) RI = Divisional Profits - Minimum desired rate of return = 25,000 - 20% of 1,50.000 = 25,000) Illustration 12 A company has two divisions, X and Y. Division X manufactures a component which is used by Division Y to produce a finished product. For the next period output and costs have been budgeted as follows. Particulars Division X Division Y Component units 50,000 Finished units 50,000 Total variable costs - Rupees 2,50,000 6,00,000 Fixed Costs Rupees 1.50,000 2,00,000 The fixed costs are separable for each division. You are required to advise on the transfer price to be fixed for Division X's component under the following circumstances. A. Division A can sell the component in a competitive market for $10 per unit. Division Y can also purchase the component from the open market at that price. B. As per the situation mentioned in (A) above, and further assume that Division Y currently buys the component from an external supplier of the market price of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started