Answered step by step

Verified Expert Solution

Question

1 Approved Answer

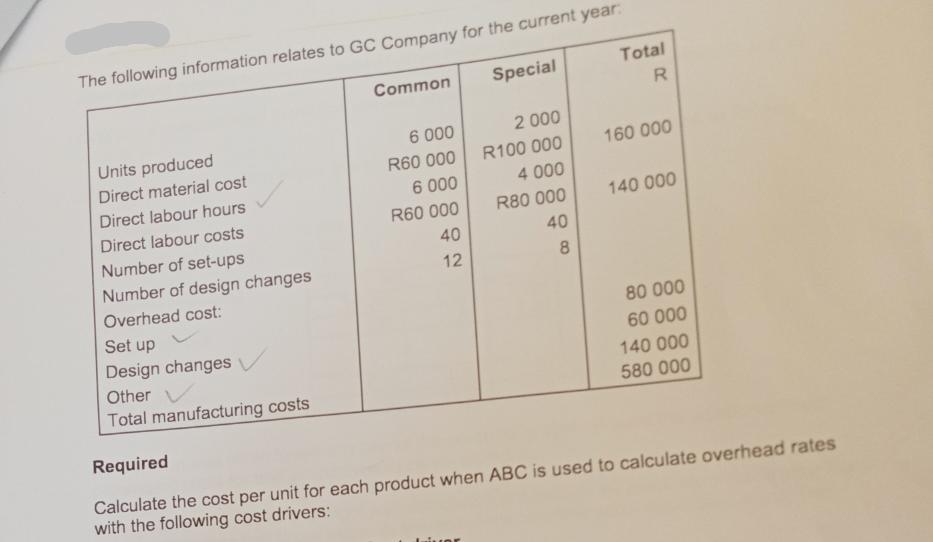

The following information relates to GC Company for the current year. Special Units produced Direct material cost Direct labour hours Direct labour costs Number

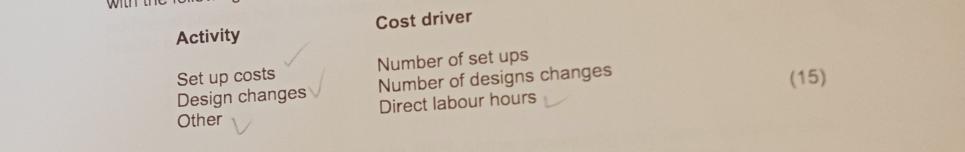

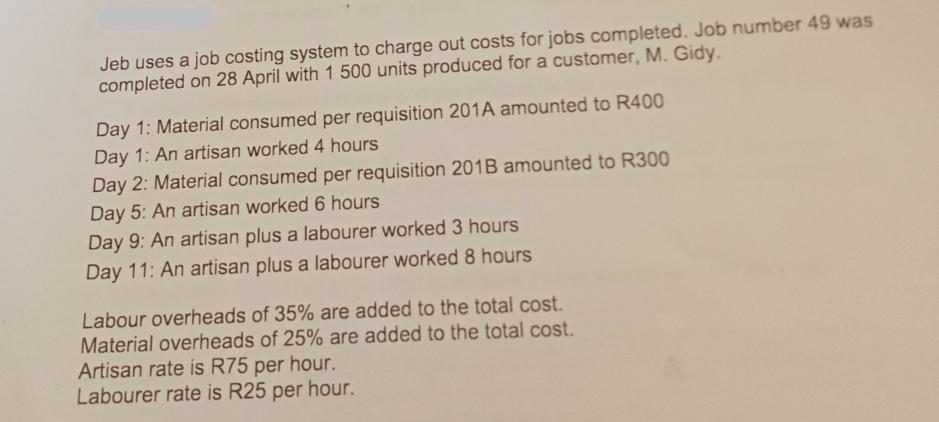

The following information relates to GC Company for the current year. Special Units produced Direct material cost Direct labour hours Direct labour costs Number of set-ups Number of design changes Overhead cost: Set up Design changes V Other Total manufacturing costs Common 6 000 R60 000 6 000 R60 000 40 12 2 000 R100 000 4 000 R80 000 40 Total R 8 160 000 140 000 80 000 60 000 140 000 580 000 Required Calculate the cost per unit for each product when ABC is used to calculate overhead rates with the following cost drivers: WILL Activity Set up costs Design changes Other V Cost driver Number of set ups Number of designs changes Direct labour hours (15) Jeb uses a job costing system to charge out costs for jobs completed. Job number 49 was completed on 28 April with 1 500 units produced for a customer, M. Gidy. Day 1: Material consumed per requisition 201A amounted to R400 Day 1: An artisan worked 4 hours Day 2: Material consumed per requisition 201B amounted to R300 Day 5: An artisan worked 6 hours Day 9: An artisan plus a labourer worked 3 hours Day 11: An artisan plus a labourer worked 8 hours Labour overheads of 35% are added to the total cost. Material overheads of 25% are added to the total cost. Artisan rate is R75 per hour. Labourer rate is R25 per hour. Required Calculate the total job cost and the cost per unit. Present your answer in column form.(20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part A Calculate the cost per unit for each product when ABC is used to calculate overhead rates with the following cost drivers Set up costs Overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started