The following information relates to Gilla Plc, a commercial property development company listed on the UK stock exchange. Current share price of Gilla Number

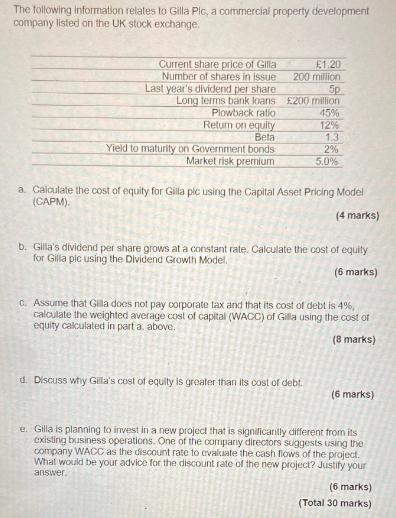

The following information relates to Gilla Plc, a commercial property development company listed on the UK stock exchange. Current share price of Gilla Number of shares in issue Last year's dividend per share Long terms bank loans Plowback ratio Return on equity Beta Yield to maturity on Government bonds Market risk premium 1.20 200 million 5p 200 million 45% 12% 1.3. 2% 5.0% a. Calculate the cost of equity for Gilla pic using the Capital Asset Pricing Model (CAPM). (4 marks) b. Gilla's dividend per share grows at a constant rate. Calculate the cost of equity for Gilla plc using the Dividend Growth Model. (6 marks) d. Discuss why Gilla's cost of equity is greater than its cost of debt. c. Assume that Gila does not pay corporate tax and that its cost of debt is 4%, calculate the weighted average cost of capital (WACC) of Gilla using the cost of equity calculated in part a. above. (8 marks) (6 marks) e. Gilla is planning to invest in a new project that is significantly different from its existing business operations. One of the company directors suggests using the company WACC as the discount rate to evaluate the cash flows of the project. What would be your advice for the discount rate of the new project? Justify your answer. (6 marks) (Total 30 marks)

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of Equity using CAPM Cost of Equity RiskFree Rate Beta Market Risk Premium Cost of Equity 2 1...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started