Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to next year's projected operating results of the Housewares Division of Nolan Enterprises: Contribution margin Fixed expenses $ 2,450,000.00 $

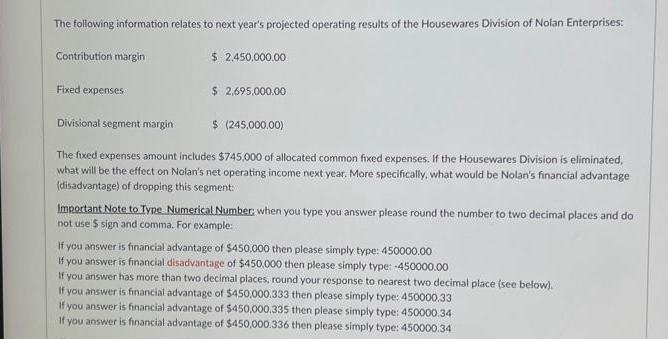

The following information relates to next year's projected operating results of the Housewares Division of Nolan Enterprises: Contribution margin Fixed expenses $ 2,450,000.00 $ 2,695,000.00 Divisional segment margin $ (245,000.00) The fixed expenses amount includes $745,000 of allocated common fixed expenses. If the Housewares Division is eliminated, what will be the effect on Nolan's net operating income next year. More specifically, what would be Nolan's financial advantage (disadvantage) of dropping this segment: Important Note to Type Numerical Number; when you type you answer please round the number to two decimal places and do not use $ sign and comma. For example: If you answer is financial advantage of $450,000 then please simply type: 450000.00 If you answer is financial disadvantage of $450,000 then please simply type: -450000.00 If you answer has more than two decimal places, round your response to nearest two decimal place (see below). If you answer is financial advantage of $450,000.333 then please simply type: 450000.33 If you answer is financial advantage of $450,000.335 then please simply type: 450000.34 If you answer is financial advantage of $450,000.336 then please simply type: 450000.34

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Nolans financial advantage disadvantage of dropping the Housewares Division we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started