Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to Perry Somer s financial affairs in 2 0 2 3 . Perry is employed as a salesperson and is remunerated

The following information relates to Perry Somers financial affairs in

Perry is employed as a salesperson and is remunerated by commissions. He must pay all of his own expenses. During the year, he earned commissions of $ His employer withheld income tax, EI and CPP contributions including CPP enhanced contributions of $ His expenses were as follows.

Automobile operating costs $

Entertainment meals

Convention related to his employment

Donations

Cell phone basic plan related to his employment

The personaluse portion of his automobile expense is The UCC of his automobile at the end of the previous year was $

He made the following capital transactions.

Gain loss

Shares of public corporation A $

Shares of public corporation B

Shares of Canadiancontrolled private corporation C

a small business corporation

In Perry acquired the following two residential rental properties.

Property X Property Y

Land $ $

Building

Maximum capital cost allowance was claimed in In the city expropriated property Y for $land $ building $ Perry was pleased because property Y was vacant for part of the year after a tenant vacated unexpectedly. In net rental income from both properties after all expenses but before capital cost allowance was $

Perrys other income and expenses are as follows.

Income:

Dividends Canadian public corporations $

Interest on foreign bonds net of withholding tax

Expenses:

Interest on a loan used to acquire the foreign bonds

Investment counsel fee

During the year, Perry contributed to a registered pension plan, which was matched by his employer. In addition, he contributed $ to his RRSP

Required:

Calculate Perrys minimum net income in accordance with the aggregating formula for determining net income for tax purposes.does not indicate completion.

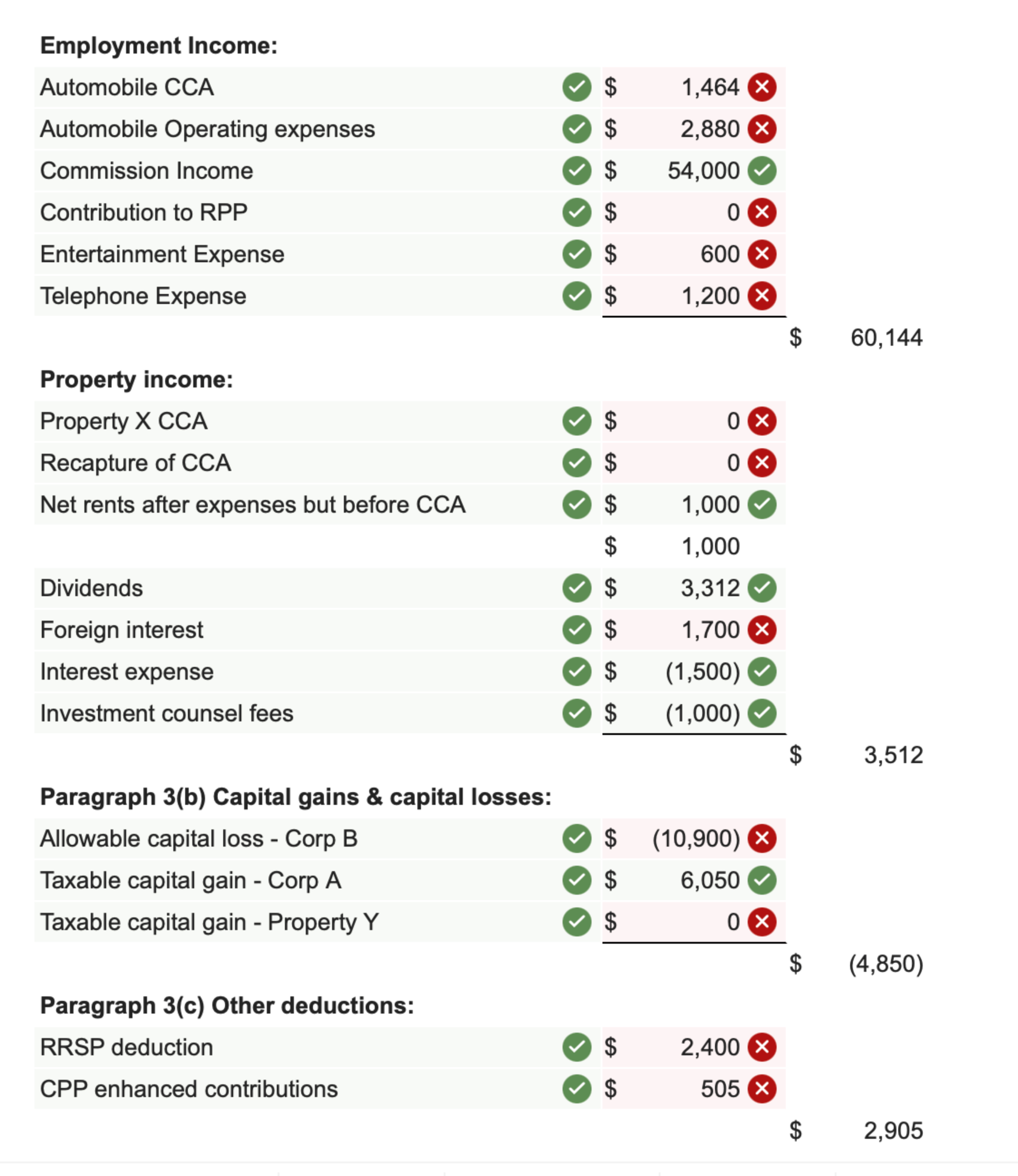

Employment Income:

Automobile CCA

Automobile Operating expenses

Commission Income

Contribution to RPP

Entertainment Expense

Telephone Expense

Property income:

Property X CCA

Recapture of CCA

Net rents after expenses but before CCA

Dividends

Foreign interest

Interest expense

Investment counsel fees

Paragraph b Capital gains & capital losses:

Allowable capital loss Corp B

Taxable capital gain Corp A

Taxable capital gain Property Y

Paragraph c Other deductions:

RRSP deduction

CPP enhanced contributions

$

$

$

$ Employment Income:

Paragraph b Capital gains & capital losses:

Allowable capital loss Corp B

Taxable capital gain Corp A

table$times $times $times

Taxable capital gain Property

Paragraph c Other deductions:

RRSP deduction

CPP enhanced contributions

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started