Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to questions 13 to 15. The directors of SUPERFAST Ltd are interested in a new type of racing boat that ejects

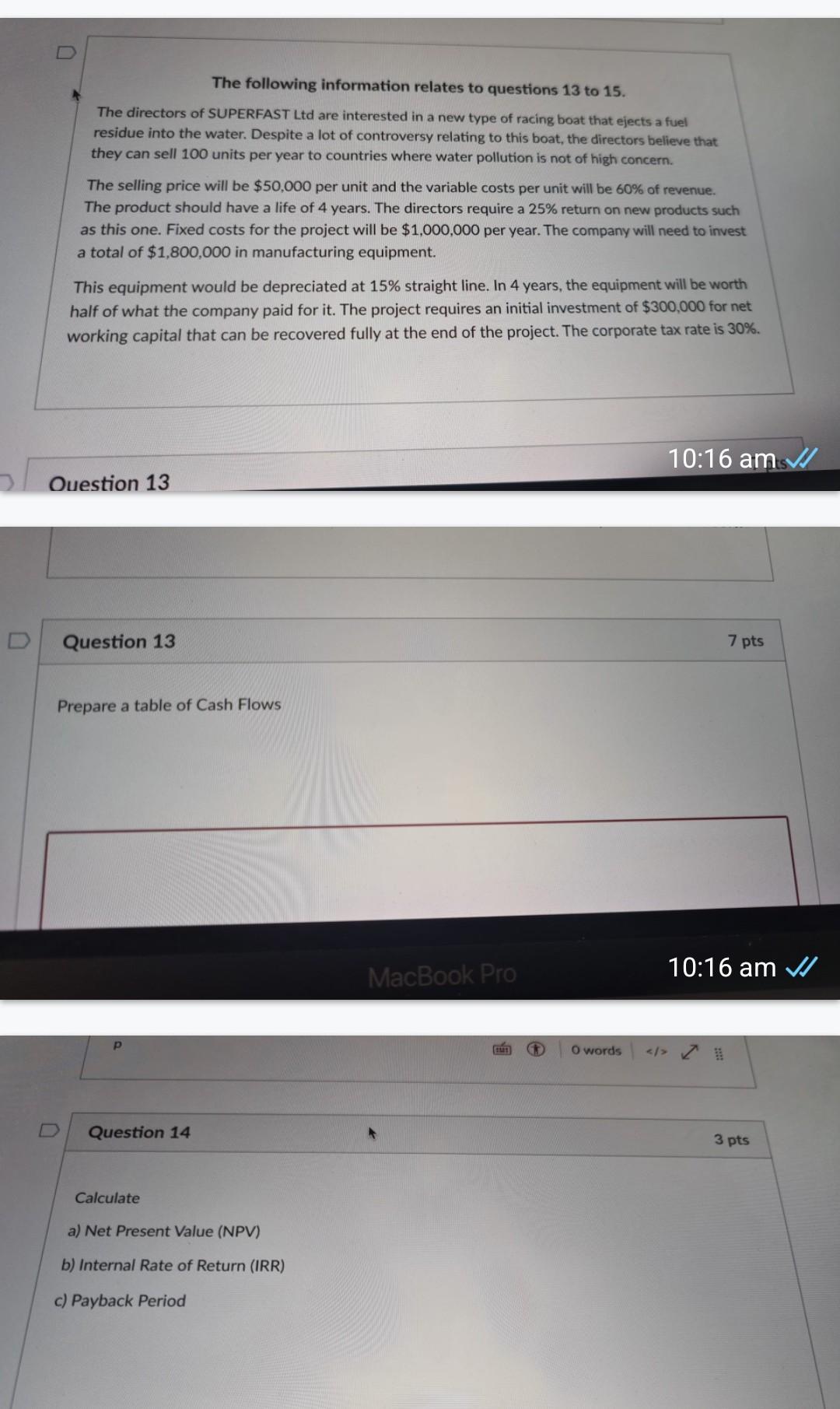

The following information relates to questions 13 to 15. The directors of SUPERFAST Ltd are interested in a new type of racing boat that ejects a fuel residue into the water. Despite a lot of controversy relating to this boat, the directors believe that they can sell 100 units per year to countries where water pollution is not of high concern. The selling price will be $50,000 per unit and the variable costs per unit will be 60% of revenue. The product should have a life of 4 years. The directors require a 25% return on new products such as this one. Fixed costs for the project will be $1,000,000 per year. The company will need to invest a total of $1,800,000 in manufacturing equipment. This equipment would be depreciated at 15% straight line. In 4 years, the equipment will be worth half of what the company paid for it. The project requires an initial investment of $300,000 for net working capital that can be recovered fully at the end of the project. The corporate tax rate is 30%. Ouestion 13 Question 13 10:16 am Prepare a table of Cash Flows Question 14 10:16 am Calculate a) Net Present Value (NPV) b) Internal Rate of Return (IRR) c) Payback Period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started