Answered step by step

Verified Expert Solution

Question

1 Approved Answer

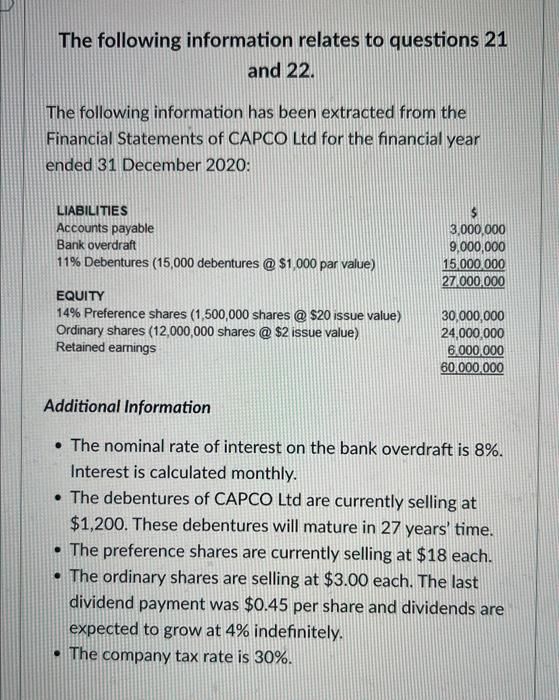

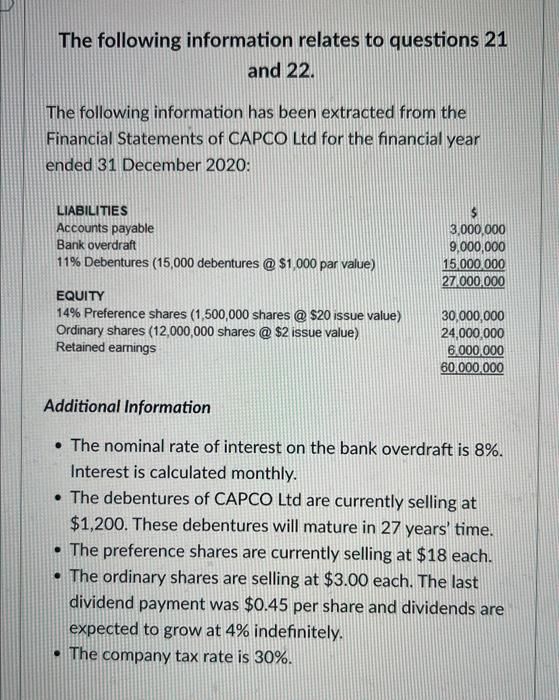

The following information relates to questions 21 and 22. The following information has been extracted from the Financial Statements of CAPCO Ltd for the financial

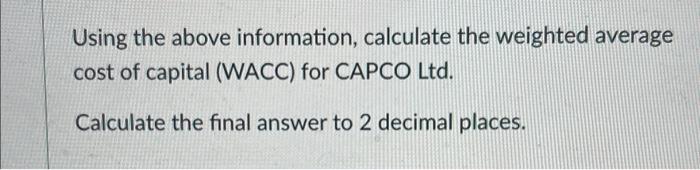

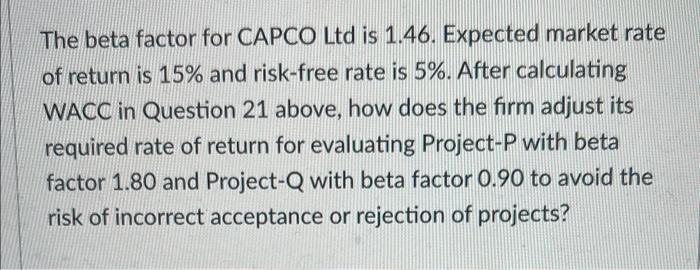

The following information relates to questions 21 and 22. The following information has been extracted from the Financial Statements of CAPCO Ltd for the financial year ended 31 December 2020: Additional Information - The nominal rate of interest on the bank overdraft is 8%. Interest is calculated monthly. - The debentures of CAPCO Ltd are currently selling at $1,200. These debentures will mature in 27 years' time. - The preference shares are currently selling at \$18 each. - The ordinary shares are selling at $3.00 each. The last dividend payment was $0.45 per share and dividends are expected to grow at 4% indefinitely. - The company tax rate is 30%. Using the above information, calculate the weighted average cost of capital (WACC) for CAPCO Ltd. Calculate the final answer to 2 decimal places. The beta factor for CAPCO Ltd is 1.46. Expected market rate of return is 15% and risk-free rate is 5%. After calculating WACC in Question 21 above, how does the firm adjust its required rate of return for evaluating Project-P with beta factor 1.80 and Project-Q with beta factor 0.90 to avoid the risk of incorrect acceptance or rejection of projects

The following information relates to questions 21 and 22. The following information has been extracted from the Financial Statements of CAPCO Ltd for the financial year ended 31 December 2020: Additional Information - The nominal rate of interest on the bank overdraft is 8%. Interest is calculated monthly. - The debentures of CAPCO Ltd are currently selling at $1,200. These debentures will mature in 27 years' time. - The preference shares are currently selling at \$18 each. - The ordinary shares are selling at $3.00 each. The last dividend payment was $0.45 per share and dividends are expected to grow at 4% indefinitely. - The company tax rate is 30%. Using the above information, calculate the weighted average cost of capital (WACC) for CAPCO Ltd. Calculate the final answer to 2 decimal places. The beta factor for CAPCO Ltd is 1.46. Expected market rate of return is 15% and risk-free rate is 5%. After calculating WACC in Question 21 above, how does the firm adjust its required rate of return for evaluating Project-P with beta factor 1.80 and Project-Q with beta factor 0.90 to avoid the risk of incorrect acceptance or rejection of projects

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started