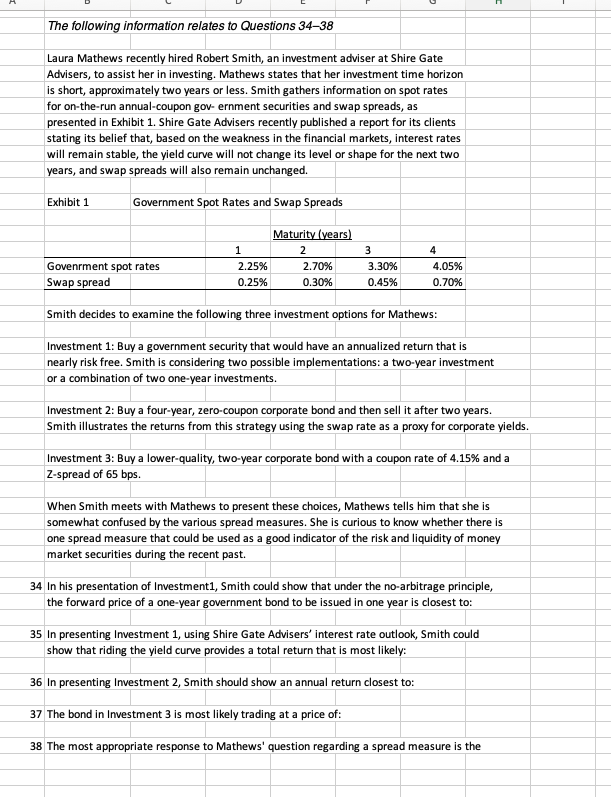

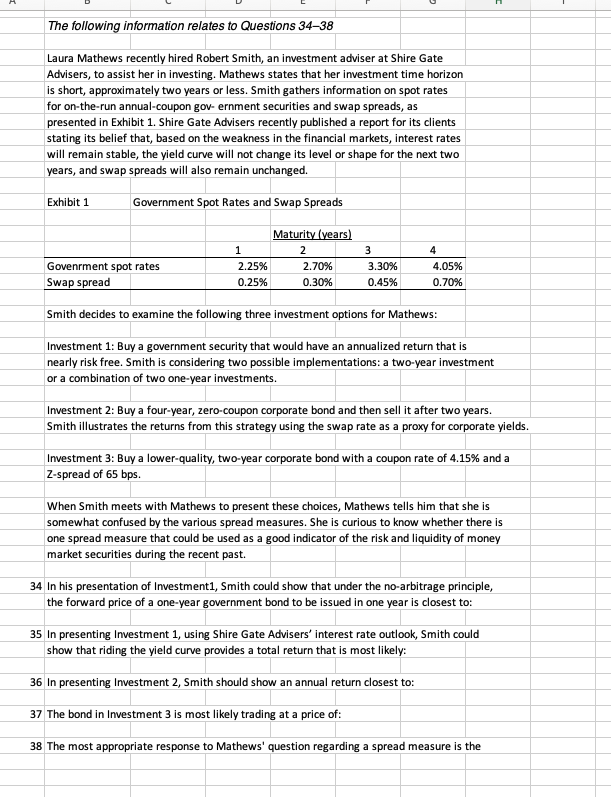

The following information relates to Questions 34-38 Laura Mathews recently hired Robert Smith, an investment adviser at Shire Gate Advisers, to assist her in investing. Mathews states that her investment time horizon is short, approximately two years or less. Smith gathers information on spot rates for on-the-run annual-coupon gov- ernment securities and swap spreads, as presented in Exhibit 1. Shire Gate Advisers recently published a report for its clients stating its belief that, based on the weakness in the financial markets, interest rates will remain stable, the yield curve will not change its level or shape for the next two years, and swap spreads will also remain unchanged. Exhibit 1 Government Spot Rates and Swap Spreads \begin{tabular}{|l|l|l|l|l|} \hline & \multicolumn{3}{|c|}{ Maturity (vears) } & \\ \hline & 1 & 2 & 3 & 4 \\ \hline Govenrment spot rates & 2.25% & 2.70% & 3.30% & 4.05% \\ \hline Swap spread & 0.25% & 0.30% & 0.45% & 0.70% \\ \hline \end{tabular} Smith decides to examine the following three investment options for Mathews: Investment 1: Buy a government security that would have an annualized return that is nearly risk free. Smith is considering two possible implementations: a two-year investment or a combination of two one-year investments. Investment 2: Buy a four-year, zero-coupon corporate bond and then sell it after two years. Smith illustrates the returns from this strategy using the swap rate as a proxy for corporate yields. Investment 3: Buy a lower-quality, two-year corporate bond with a coupon rate of 4.15% and a Z-spread of 65 bps. When Smith meets with Mathews to present these choices, Mathews tells him that she is somewhat confused by the various spread measures. She is curious to know whether there is one spread measure that could be used as a good indicator of the risk and liquidity of money market securities during the recent past. 34 In his presentation of Investment1, Smith could show that under the no-arbitrage principle, the forward price of a one-year government bond to be issued in one year is closest to: 35 In presenting Investment 1, using Shire Gate Advisers' interest rate outlook, Smith could show that riding the yield curve provides a total return that is most likely: 36 In presenting Investment 2, Smith should show an annual return closest to: 37 The bond in Investment 3 is most likely trading at a price of: 38 The most appropriate response to Mathews' question regarding a spread measure is the