Answered step by step

Verified Expert Solution

Question

1 Approved Answer

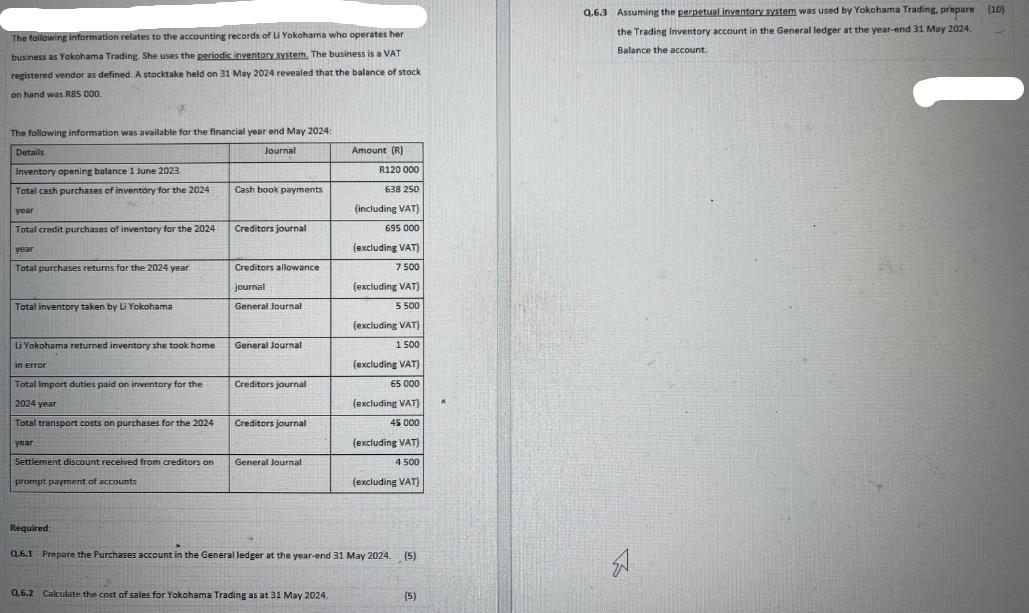

The following information relates to the accounting records of Li Yokohama who operates her business as Yokohama Trading. She uses the periodic inventory system.

The following information relates to the accounting records of Li Yokohama who operates her business as Yokohama Trading. She uses the periodic inventory system. The business is a VAT registered vendor as defined. A stocktake held on 31 May 2024 revealed that the balance of stock on hand was RBS 000. The following information was available for the financial year end May 2024: Details Inventory opening balance 1 June 2023 Journal Amount (R) R120 000 Total cash purchases of inventory for the 2024 Cash book payments 638 250 year (including VAT) Total credit purchases of inventory for the 2024 year Creditors journal Total purchases returns for the 2024 year Creditors allowance journal Total inventory taken by Li Yokohama General Journal 695 000 (excluding VAT) 7 500 (excluding VAT) 5 500 Li Yokohama returned inventory she took home General Journal in error Total Import duties paid on inventory for the 2024 year Creditors journal (excluding VAT) 1500 (excluding VAT) 65 000 (excluding VAT) Total transport costs on purchases for the 2024 year Creditors journal 45 000 Settlement discount received from creditors on prompt payment of accounts General Journali (excluding VAT) 4 500 (excluding VAT) Required: Q.6.1 Prepare the Purchases account in the General ledger at the year-end 31 May 2024. (5) Q.6.2 Calculate the cost of sales for Yokohama Trading as at 31 May 2024. Q.6.3 Assuming the perpetual inventory system was used by Yokohama Trading, prepare (10) the Trading Inventory account in the General ledger at the year-end 31 May 2024. Balance the account. (5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started