Answered step by step

Verified Expert Solution

Question

1 Approved Answer

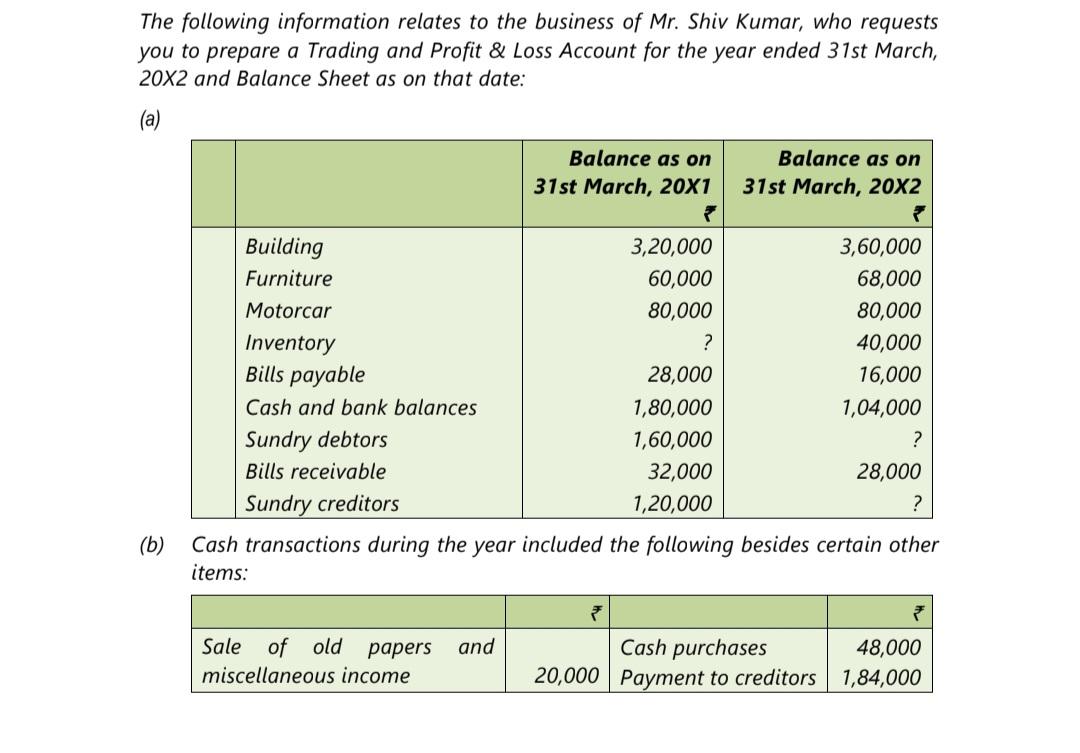

The following information relates to the business of Mr. Shiv Kumar, who requests you to prepare a Trading and Profit & Loss Account for

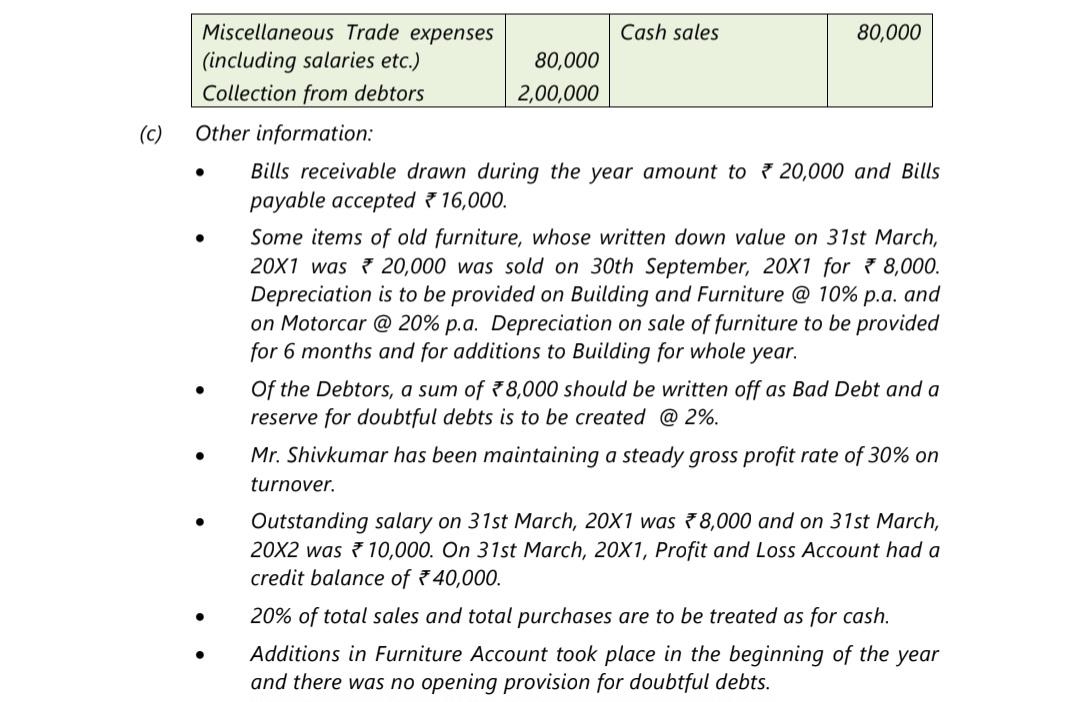

The following information relates to the business of Mr. Shiv Kumar, who requests you to prepare a Trading and Profit & Loss Account for the year ended 31st March, 20X2 and Balance Sheet as on that date: (a) Building Furniture Motorcar Inventory Bills payable Cash and bank balances Sundry debtors Bills receivable Sundry creditors Balance as on 31st March, 20X1 Sale of old papers and miscellaneous income 3,20,000 60,000 80,000 ? 28,000 1,80,000 1,60,000 32,000 1,20,000 Balance as on 31st March, 20X2 3,60,000 68,000 80,000 40,000 16,000 1,04,000 (b) Cash transactions during the year included the following besides certain other items: Cash purchases 20,000 Payment to creditors ? 28,000 ? 48,000 1,84,000 (c) Miscellaneous Trade expenses (including salaries etc.) Collection from debtors Other information: 80,000 2,00,000 Cash sales 80,000 Bills receivable drawn during the year amount to 20,000 and Bills payable accepted 16,000. Some items of old furniture, whose written down value on 31st March, 20X1 was 20,000 was sold on 30th September, 20X1 for 8,000. Depreciation is to be provided on Building and Furniture @ 10% p.a. and on Motorcar @ 20% p.a. Depreciation on sale of furniture to be provided for 6 months and for additions to Building for whole year. Of the Debtors, a sum of 8,000 should be written off as Bad Debt and a reserve for doubtful debts is to be created @ 2%. Mr. Shivkumar has been maintaining a steady gross profit rate of 30% on turnover. Outstanding salary on 31st March, 20X1 was 8,000 and on 31st March, 20X2 was 10,000. On 31st March, 20X1, Profit and Loss Account had a credit balance of 40,000. 20% of total sales and total purchases are to be treated as for cash. Additions in Furniture Account took place in the beginning of the year and there was no opening provision for doubtful debts.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started