Answered step by step

Verified Expert Solution

Question

1 Approved Answer

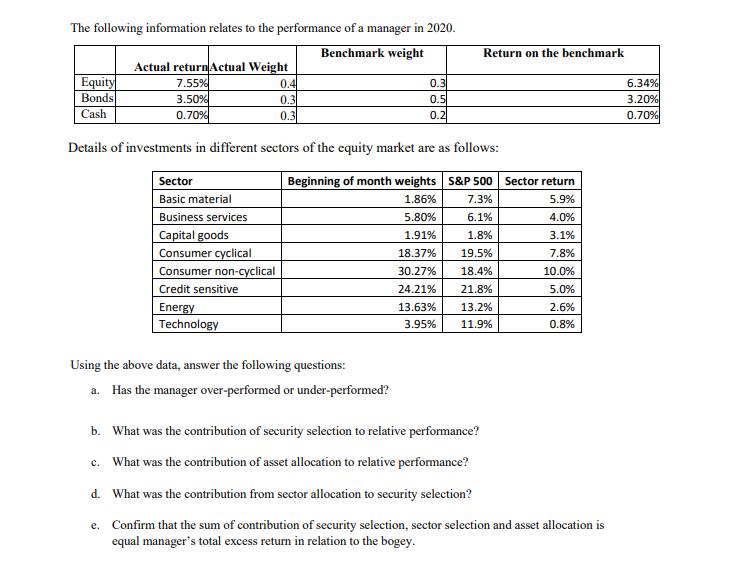

The following information relates to the performance of a manager in 2020. Benchmark weight Equity Bonds Cash Actual returnActual Weight 7.55% 0.4 3.50% 0.3

The following information relates to the performance of a manager in 2020. Benchmark weight Equity Bonds Cash Actual returnActual Weight 7.55% 0.4 3.50% 0.3 0.70% 0.3 Sector Basic material Details of investments in different sectors of the equity market are as follows: Business services Capital goods Consumer cyclical Consumer non-cyclical Credit sensitive Energy Technology 0.3 0.5 0.2 Return on the benchmark Using the above data, answer the following questions: a. Has the manager over-performed or under-performed? Beginning of month weights S&P 500 Sector return 1.86% 7.3% 5.9% 5.80% 6.1% 4.0% 1.91% 1.8% 3.1% 18.37% 19.5% 7.8% 30.27% 18.4% 10.0% 24.21% 21.8% 5.0% 13.63% 13.2% 2.6% 3.95% 11.9% 0.8% b. What was the contribution of security selection to relative performance? c. What was the contribution of asset allocation to relative performance? d. What was the contribution from sector allocation to security selection? e. Confirm that the sum of contribution of security selection, sector selection and asset allocation is equal manager's total excess return in relation to the bogey. 6.34% 3.20% 0.70%

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Equity Bond Cash Equity Bond Cash b Actual Return 728 C Benchmark Return Benchmark Weghts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started