Answered step by step

Verified Expert Solution

Question

1 Approved Answer

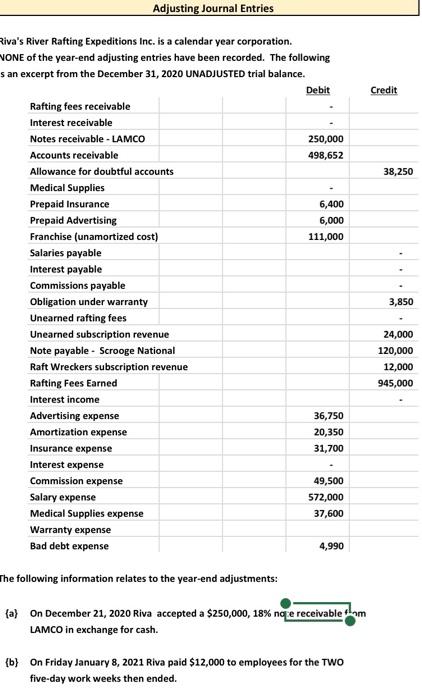

The following information relates to the year-end adjustments: {a} On December 21, 2020 Riva accepted a $250,000, 18% note receivable from LAMCO in exchange for

The following information relates to the year-end adjustments:

{a} On December 21, 2020 Riva accepted a $250,000, 18% note receivable from

LAMCO in exchange for cash.

{b} On Friday January 8, 2021 Riva paid $12,000 to employees for the TWO

five-day work weeks then ended.

{c} During December 2020 Riva offered "Whitewater Wild Weekends in the Drink"

to companies that were required to pay $ 9,200 for all reserved weekends in advance.

Riva estimates that $3,700 of these advance payments remain unearned at

December 31, 2020.

{d} Riva employs marketing personnel who are compensated with base pay plus

commissions. In January 2021 the company paid sales commissions of $4,100

to salespeople for Rafting Adventures occurring in December 2020.

{e} Riva paid $9,600 on October 1, 2020 for insurance coverage covering the

period October 1, 2020 through March 31, 2021. All other insurance costs

had expired as of December 31, 2020.

{f} Riva keeps an ample inventory medical supplies as rafters are frequently

thrown from their river rafts onto jagged rocks. A physical count of medical

supplies revealed that the company had $2,960 of supplies were on hand

as of December 31, 2020.

{g} On August 1, 2020 Riva accepted $36,000 for annual subscriptions to her wildly

popular "Capsized and Wrecked Raft" videos. Each month beginning in August 2020

Riva sent the latest DVDs capturing the most recent raft wrecks to subscribers.

{h} A review of billings revealed that $5,300 of raft adventures had been provided in

December 2020 but were NOT yet billed as of December 31, 2020.

{i} On November 1, 2020 Riva paid $7,500 to WFAN for radio advertisements to be aired

from November 1, 2020 through March 31, 2021. All other advertising costs had been

consumed as of December 31, 2020.

{j} On Dec. 2, 2020 Riva issued a $120,000, 6%, 120-day note payable to Scrooge Natl. Bank

{k} Riva uses the 0.75% percent of sales mathod to estimate bad debts.

The sales for December 2020 amounted to $108,000

{l} Amortization of Franchise costs for the monrth was $ 1,850

{m} Riva's estimated future costs, relative to her wet suit warranty, to be $5,950

Instructions: Riva N. sole shareholder of the company has requested that

you prepare the appropriate year-end adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started