Question

The following information relates to two married couples: Begin by computing taxable income for each couple. (Complete all input fields. Enter 0 for accounts with

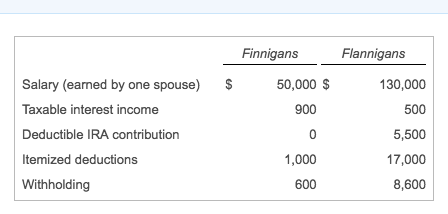

The following information relates to two married couples:

|

| |

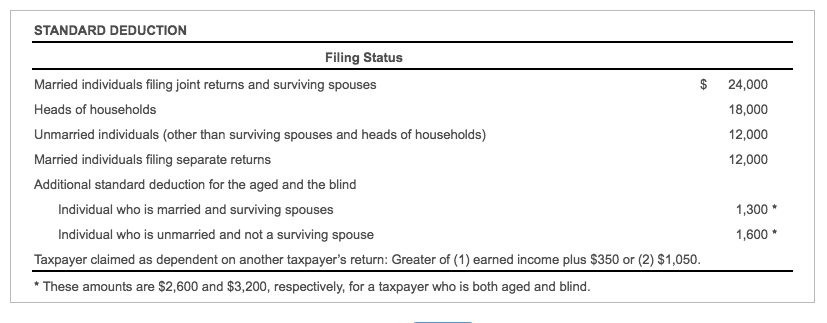

Begin by computing taxable income for each couple. (Complete all input fields. Enter "0" for accounts with a zero balance.)

| Finnigans | Flannigans | |

| Salary | ||

| Taxable interest income | ||

| Gross income | ||

| Minus: | ||

| IRA contribution | ||

| Adjusted gross income | ||

| Minus: | ||

| Itemized deductions | ||

| Taxable income |

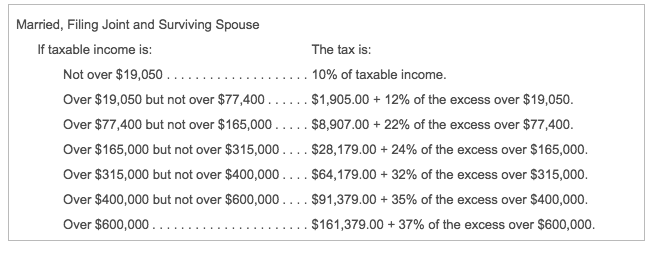

Now calculate the 2018 tax due or refund due for each couple. (Use the 2018 tax rate schedule for all tax calculations. Do not round intermediary calculations. Only round the amount you enter in the input field to the nearest dollar. Use a minus sign or parentheses for a net tax refund.)

| Finnigans | Flannigans | |

| Gross tax | ||

| Minus: | ||

| Withholding | ||

| Tax due (refund) |

Choose from any list or enter any number in the input fields and then continue to the next question.

FinnigansFlannigans Salary (eaned by one spouse) 50,000 $ Taxable interest income Deductible IRA contribution Itemized deductions Withholding 130,000 500 5,500 17,000 8,600 900 1,000 600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started