Answered step by step

Verified Expert Solution

Question

1 Approved Answer

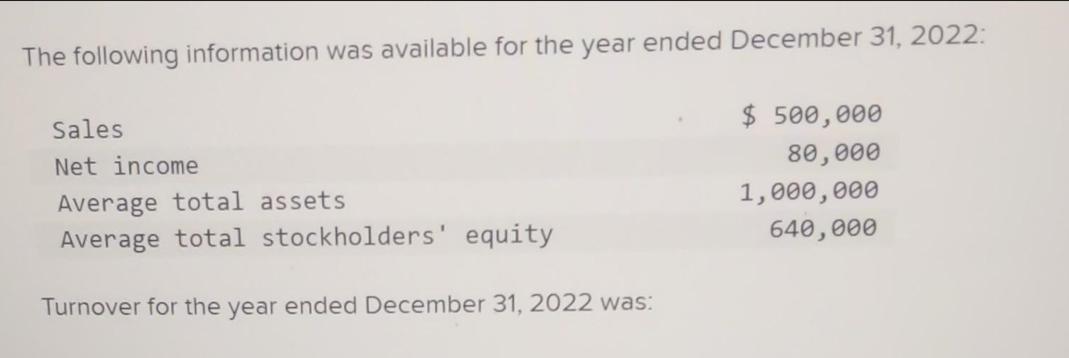

The following information was available for the year ended December 31, 2022: Sales Net income Average total assets Average total stockholders' equity Turnover for

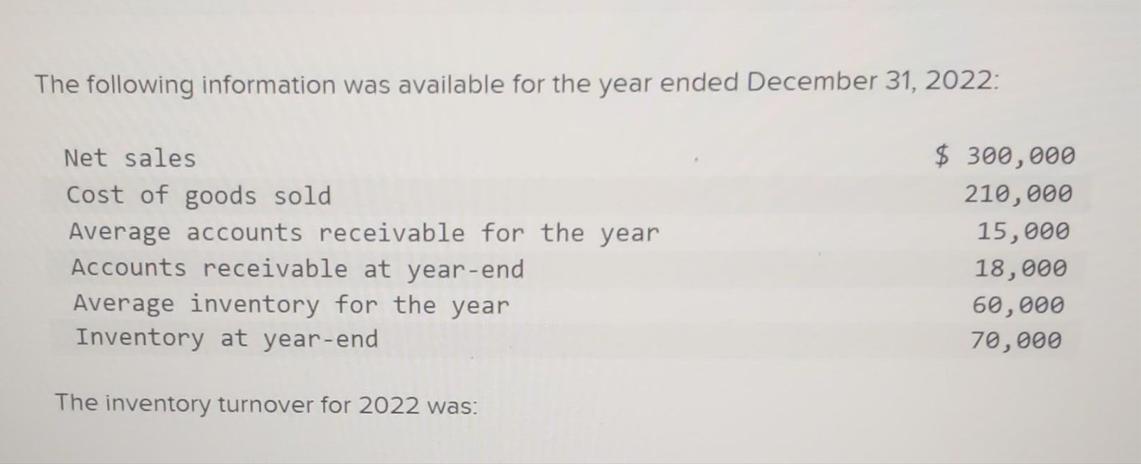

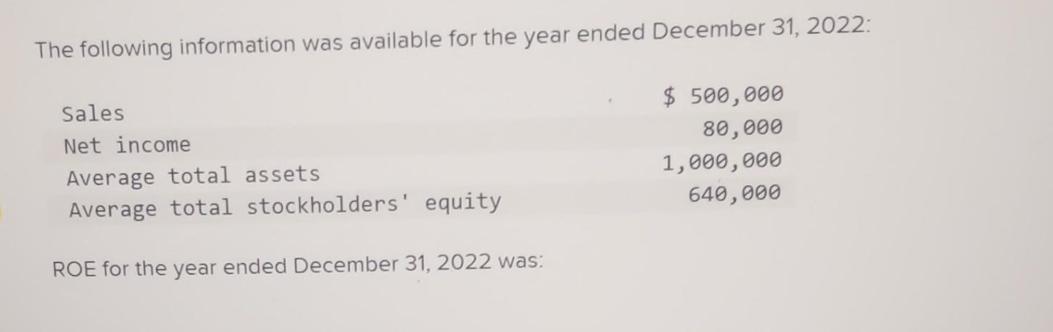

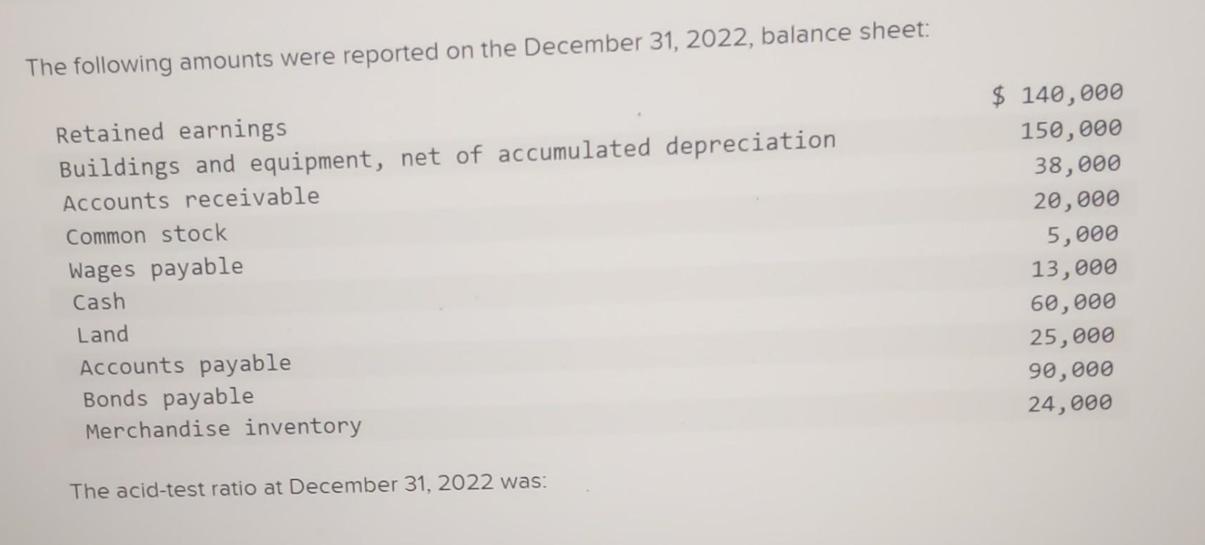

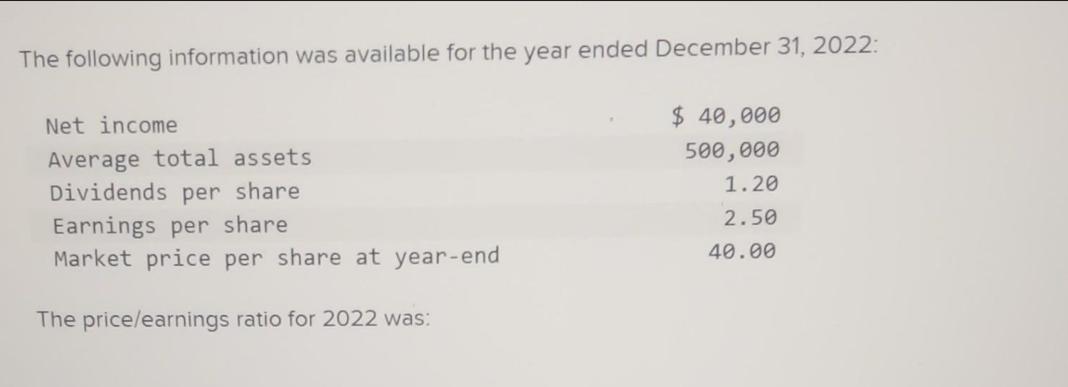

The following information was available for the year ended December 31, 2022: Sales Net income Average total assets Average total stockholders' equity Turnover for the year ended December 31, 2022 was: $ 300,000 50,000 750,000 500,000 The following information was available for the year ended December 31, 2022: Net sales Cost of goods sold Average accounts receivable for the year Accounts receivable at year-end Average inventory for the year Inventory at year-end The inventory turnover for 2022 was: 240,000 160,000 10,000 12,000 40,000 50,000 The following information was available for the year ended December 31, 2022: Net sales Cost of goods sold Average accounts receivable for the year Accounts receivable at year-end Average inventory for the year Inventory at year-end The inventory turnover for 2022 was: $ 300,000 210,000 15,000 18,000 60,000 70,000 The following amounts were reported on the December 31, 2022, balance sheet: Retained earnings Buildings and equipment, net of accumulated depreciation Accounts receivable Common stock Wages payable Cash Land Accounts payable Bonds payable Merchandise inventory The current ratio at December 31, 2022 was: $ 140,000 150,000 38,000 20,000 5,000 13,000 60,000 25,000 90,000 24,000 The following information was available for the year ended December 31, 2022: Net sales Cost of goods sold Average accounts receivable for the year Accounts receivable at year-end Average inventory for the year Inventory at year-end The accounts receivable turnover for 2022 was: $ 300,000 210,000 15,000 18,000 60,000 70,000 The following information was available for the year ended December 31, 2022: Sales Net income Average total assets Average total stockholders' equity ROE for the year ended December 31, 2022 was: $ 500,000 80,000 1,000,000 640,000 The following amounts were reported on the December 31, 2022, balance sheet: Retained earnings Buildings and equipment, net of accumulated depreciation Accounts receivable Common stock Wages payable Cash Land Accounts payable Bonds payable Merchandise inventory The acid-test ratio at December 31, 2022 was: $ 140,000 150,000 38,000 20,000 5,000 13,000 60,000 25,000 90,000 24,000 The following information was available for the year ended December 31, 2022: Net income Average total assets Dividends per share Earnings per share Market price per share at year-end The price/earnings ratio for 2022 was: $ 40,000 500,000 1.20 2.50 40.00 The following information was available for the year ended December 31, 2022: Sales Net income Average total assets Average total stockholders' equity ROI for the year ended December 31, 2022 was: $ 500,000 80,000 1,000,000 640,000 The following information was available for the year ended December 31, 2022: Sales Net income Average total assets Average total stockholders' equity Turnover for the year ended December 31, 2022 was: $ 500,000 80,000 1,000,000 640,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started