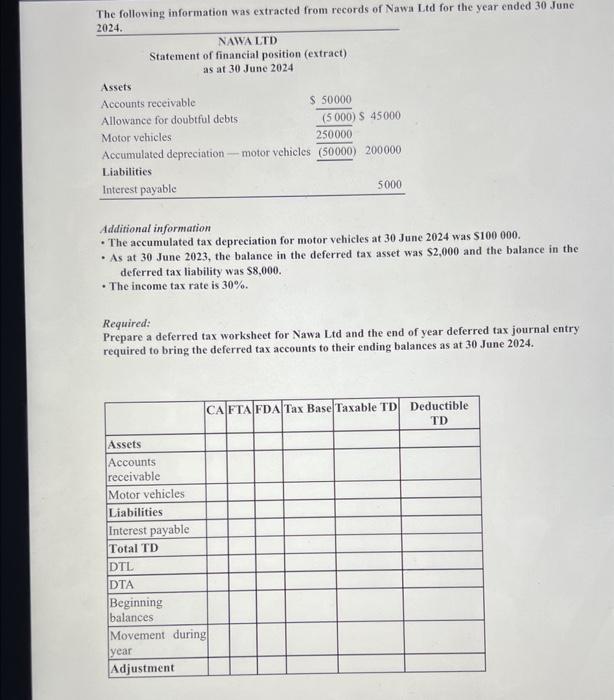

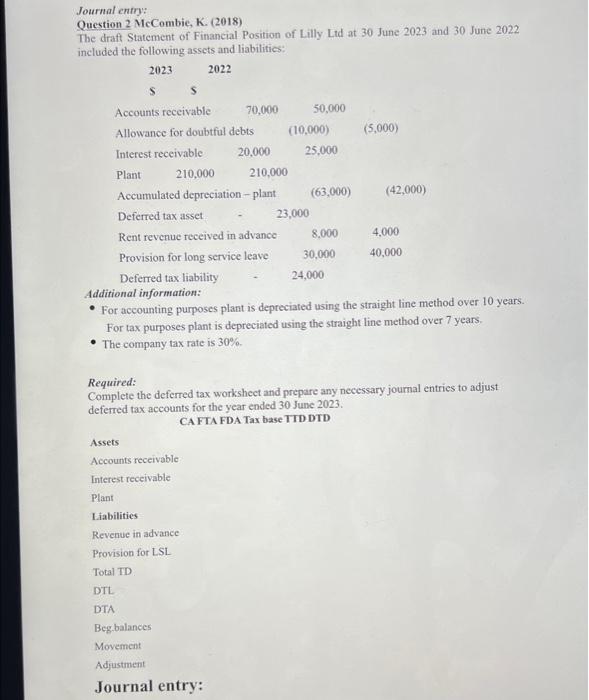

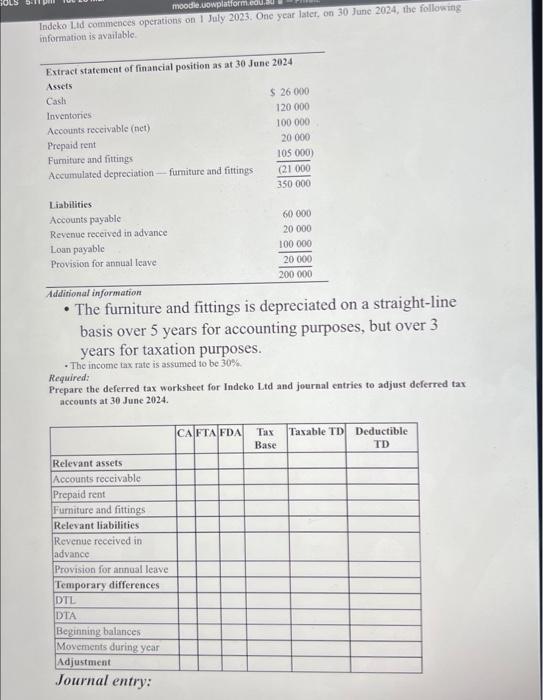

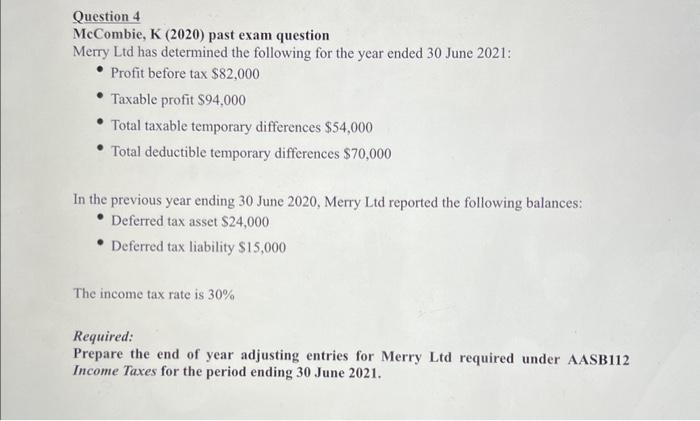

The following information was extracted from records of Nawa Ltd for the year ended 30 June 2024. NAWA LTD Statement of financial position (extract) as at 30.J. une 2024 Additional information - The accumulated tax depreciation for motor vehicles at 30 June 2024 was $100000. - As at 30 June 2023 , the balance in the deferred tax asset was $2,000 and the balance in the deferred tax liability was $8,000. - The income tax rate is 30%. Required: Prepare a deferred tax worksheet for Nawa Ltd and the end of year deferred tax journal entry required to bring the deferred tax accounts to their ending balances as at 30 June 2024 . Journal entry: Question 2 McCombie, K. (2018) Question 2 McCombic, K. (2018) The draft Statement of Financial Position of Lilly Ltd at 30 June 2023 and 30 June 2022 included the following assets and liabilitics: Ad - For accounting purposes plant is depreciated using the straight line method over 10 years. For tax purposes plant is depreciated using the straight line method over 7 years. - The company tax rate is 30%. Required: Complete the deferred tax worksheet and prepare any necessary journal entries to adjust deferred tax accounts for the year ended 30 June 2023. CA FTA FDA Tax base TTD DTD Assets Accounts receivable Interest receivable Plant Liabilities Revenue in advance Provision for LSL Total TD DTL DTA Beg.balances Movement Adjustment Journal entry: Indeko Lidd commences operations on I July 2023. One yeat later, on 30 June 2024, the following information is available. Additional information - The furniture and fittings is depreciated on a straight-line basis over 5 years for accounting purposes, but over 3 years for taxation purposes. - The income tax rate is assumed to be 30% Required: Prepare the deferred tax worksheet for Indeko Ltd and journal entries to adjust deferred tax accounts at 30 June 2024. McCombie, K (2020) past exam question Merry Ltd has determined the following for the year ended 30 June 2021: - Profit before tax $82,000 - Taxable profit $94,000 - Total taxable temporary differences $54,000 - Total deductible temporary differences $70,000 In the previous year ending 30 June 2020 , Merry Ltd reported the following balances: - Deferred tax asset $24,000 - Deferred tax liability $15,000 The income tax rate is 30% Required: Prepare the end of year adjusting entries for Merry Ltd required under AASB112 Income Taxes for the period ending 30 June 2021