Answered step by step

Verified Expert Solution

Question

1 Approved Answer

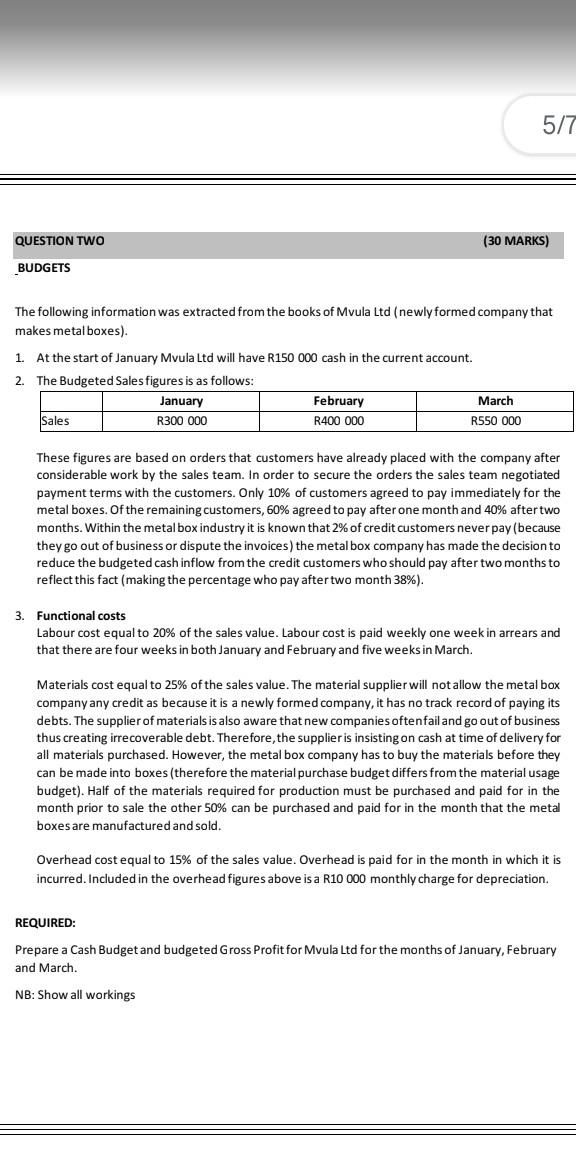

The following information was extracted from the books of Mvula Ltd (newly formed company that makes metal boxes). 1. At the start of January Mvula

The following information was extracted from the books of Mvula Ltd (newly formed company that makes metal boxes). 1. At the start of January Mvula Ltd will have R150 000 cash in the current account. 2. The Budgeted Sales figures is as follows: These figures are based on orders that customers have already placed with the company after considerable work by the sales team. In order to secure the orders the sales team negotiated payment terms with the customers. Only 10% of customers agreed to pay immediately for the metal boxes. Of the remaining customers, 60% agreed to pay after one month and 40% after two months. Within the metal box industry it is known that 2% of credit customers neverpay (because they go out of business or dispute the invoices) the metal box company has made the decision to reduce the budgeted cash inflow from the credit customers who should pay after two months to reflect this fact (making the percentage who pay after two month 38% ). 3. Functional costs Labour cost equal to 20% of the sales value. Labour cost is paid weekly one week in arrears and that there are four weeks in both January and February and five weeks in March. Materials cost equal to 25% of the sales value. The material supplier will not allow the metal box company any credit as because it is a newly formed company, it has no track record of paying its debts. The supplier of materials is also aware that new companies oftenfail and go out of business thus creating irrecoverable debt. Therefore, the supplier is insisting on cash at time of delivery for all materials purchased. However, the metal box company has to buy the materials before they can be made into boxes (therefore the material purchase budget differs from the material usage budget). Half of the materials required for production must be purchased and paid for in the month prior to sale the other 50% can be purchased and paid for in the month that the metal boxes are manufactured and sold. Overhead cost equal to 15% of the sales value. Overhead is paid for in the month in which it is incurred. Included in the overhead figures above is a R10 000 monthly charge for depreciation. REQUIRED: Prepare a Cash Budget and budgeted G ross Profit for Mvula Ltd for the months of January, February and March. NB: Show all workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started